Introduction

In a hearing on Tuesday focused on recent failures of regional banks, banking regulators repeated their intention to propose new capital rules for banks who have been a source of strength in recent months, the U.S.-based Global Systemically Important Banks, or GSIBs. These new requirements are expected to significantly increase capital requirements for these banks.

A new report, Basel III Endgame: The next generation of capital requirements, sheds important light on the state of large bank capital in the United States. The findings from PwC, the global audit and consulting firm, are helpful for assessing both the current state of capital at the largest U.S. banks and any potential need for additional capital. In this blog, we provide a brief overview of the PwC report and its key findings. Overall, the report shows that 1) capital and resiliency at the largest U.S. banks is strong, 2) the level of capital maintained by the largest U.S. banks is in line with academic findings on the optimal level of bank capital, 3) increasing capital requirements on this group of banks will impose a direct cost on the economy, and 4) raising bank capital requirements will hasten the migration of activity from the banking sector to the less regulated non-bank sector and impair financial stability. The report and its findings should be seriously reviewed and considered by policymakers as they consider new capital rules for the nation’s largest banks. On balance, the report strongly suggests that any new capital requirements would incur more costs than benefits to the economy.

The Largest U.S. Banks are Well Capitalized and Resilient

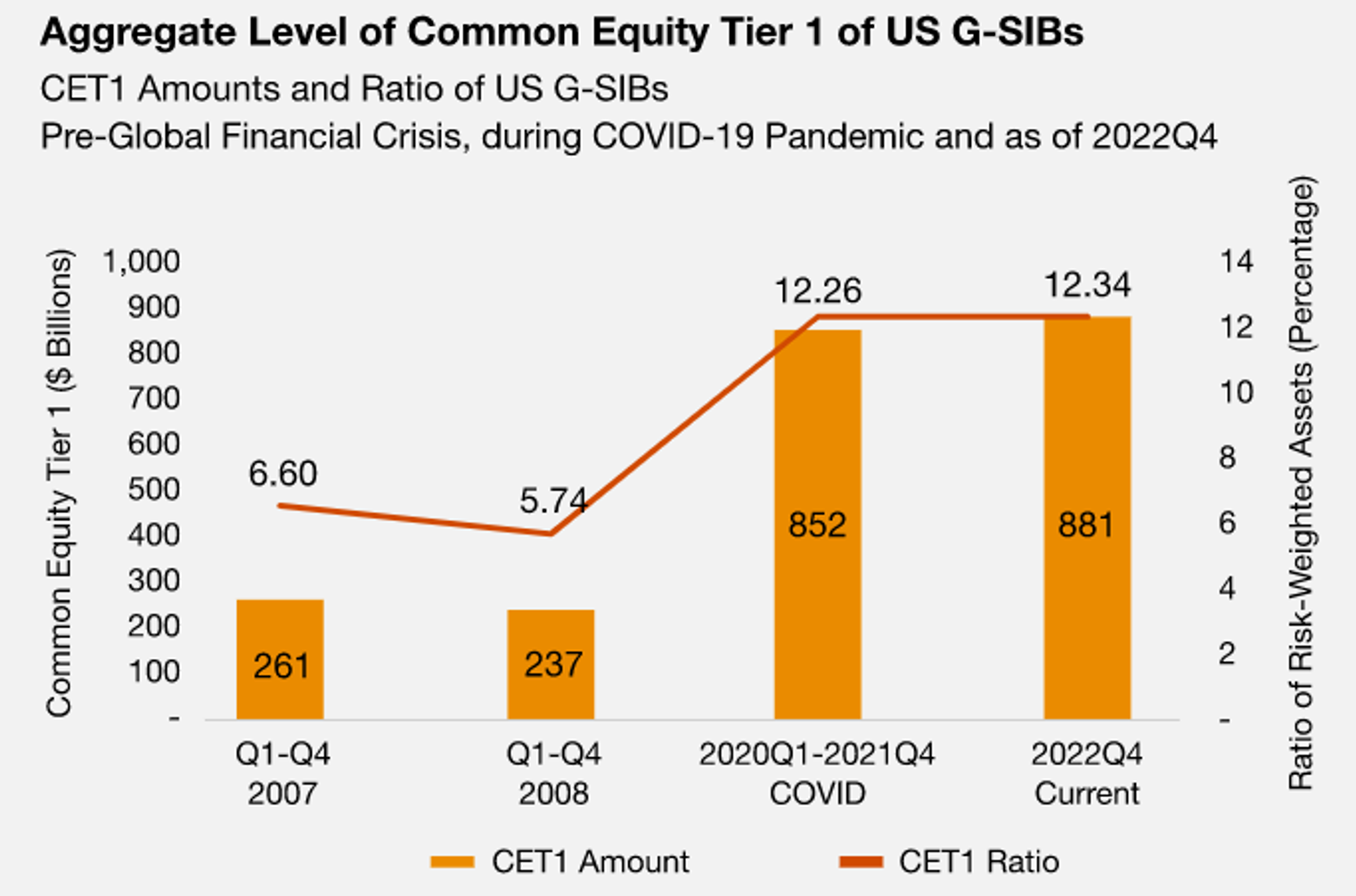

Since the financial crisis, U.S.-based Global Systemically Important Banks (GSIBs), have increased their capital levels substantially. As the report shows in the chart below, common equity tier 1 capital (CET1), the highest quality of regulatory capital, has more than tripled to $881 billion.

Source: Basel III Endgame: The next generation of capital requirements

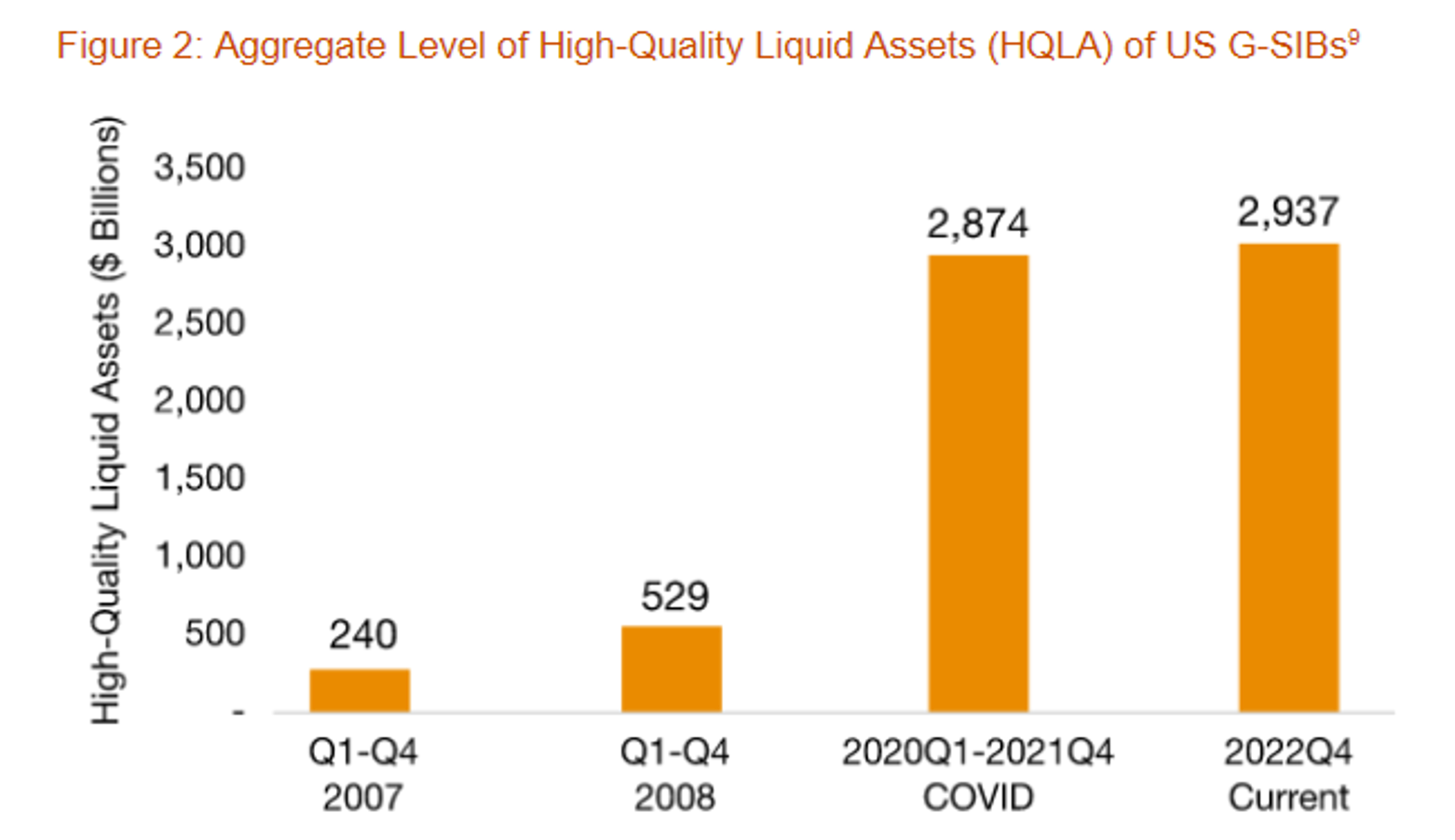

And while the report clearly documents the significant and notable rise in capital at the largest U.S. banks, it also outlines the substantial improvements in resiliency through other, non capital-related initiatives, such as liquidity requirements, total loss absorbing capacity (TLAC) requirements, and a host of other important regulatory initiatives. Importantly, the authors note that understanding and accounting for these additional sources of resiliency are crucial when evaluating the “right” level of capital for the banking system because these other initiatives support and complement capital requirements. As an example, the chart below from PwC clearly demonstrates the large increase in liquidity resources from roughly $500 billion to nearly $3 trillion– or more than a six-fold increase – that supports and buttresses capital requirements.

Source: Basel III Endgame: The next generation of capital requirements

Capital at the Largest Banks Consistent with Academic Research on “Optimal” Levels

The new report also offers an important review of academic studies on the optimal level of capital in the banking system. This is an important part of the report because while documenting the significant increase in capital and resiliency is important, ultimately, we need a coherent analytical framework to assess “how much is enough?”

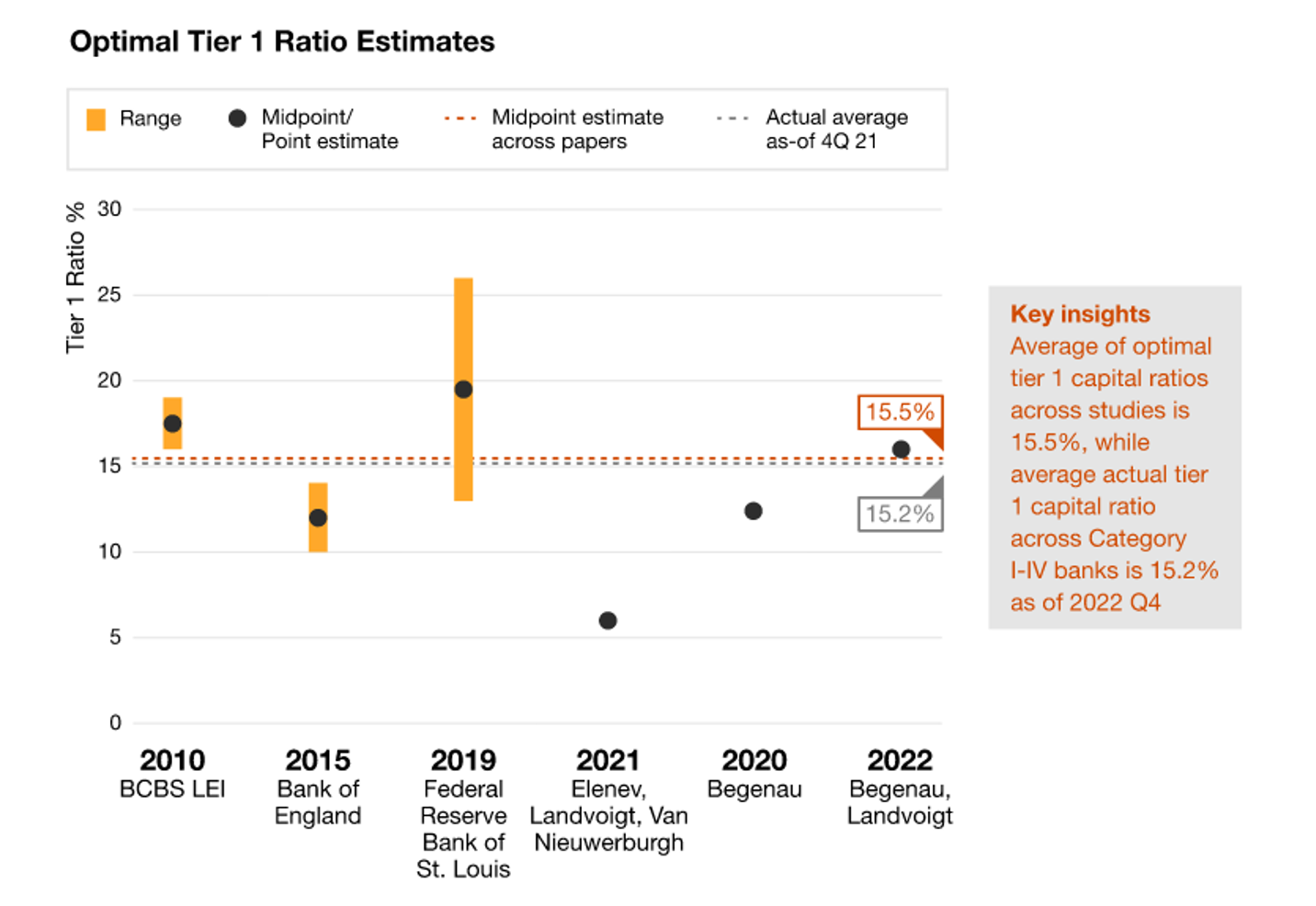

The report reviews a broad range of relatively recent academic research on this topic. And importantly, the report reviews academic studies that consider a “broad range” of post-crisis regulations (e.g., TLAC, liquidity requirements) because of the inherent importance of considering the entire regulatory framework when assessing the optimal level of bank capital. The chart below summarizes the findings.

Source: Basel III Endgame: The next generation of capital requirements

As shown in the chart and stated in the report, “the average optimal capital level that the papers suggest is near current levels at firms expected to be subject to Basel III Endgame capital requirements.” Moreover, it is worth noting that the average optimal capital level is “pushed up” by the results of a study from the Federal Reserve, which finds an optimal ratio of 20 percent, substantially higher than the findings of all other academic studies considered in the report. Accordingly, statements that large bank capital levels are inconsistent with the findings of academic research are simply incorrect.

Increasing Capital at the Largest U.S. Banks will Impose Direct Costs on the Economy, Hasten the Migration of Activity to Non-Banks, and Impair Financial Stability

In addition to documenting the resilience and capital adequacy of the largest U.S. banks, the report also provides important evidence on the impact of increasing capital standards on these institutions. Specifically, the report recognizes two key drawbacks to inappropriately high capital requirements: 1) higher borrowing costs for businesses and consumers, and 2) increased migration of banking activities outside the banking sector.

In terms of the direct costs of increasing capital, the report points to a range of research, finding, “greater capital requirements increase a commercial bank’s funding costs, which increases its lending rates and reduces its loan volumes,” thus reducing economic activity. As an example, one of the papers reviewed in the report finds that increasing the risk-based capital ratio by two percentage points (e.g., increasing the requirement from 10 percent to 12 percent) would increase the cost of borrowing by roughly a quarter percentage point and reduce GDP by roughly a quarter percentage point.

The report also considers the impact on the economy via a migration of activity outside the banking sector. More specifically, the report finds that non-banks may expand as a result of higher bank capital requirements pushing activity outside of the banking sector and may increase the chances of financial crises, “The potential increase in probability of a crisis would be driven by greater leverage in less regulated and less transparent financial intermediaries, and the potential increase in cost would be due to resiliency of the credit supply being reduced.”

Conclusion

PwC’s report on the largest U.S. banks provides a lot of important food for thought for regulators as they consider proposing higher capital requirements for the largest U.S. banks. Overall, the report finds that resiliency at the largest banks has been strengthened considerably and is at levels broadly consistent with recommendations offered by independent research studies. The report also rightly points to the costs of inappropriately increasing capital requirements – both in terms of the direct costs and the financial stability costs of an expanded non-bank sector. The Federal Reserve is conducting a “holistic review” of bank capital. The PwC report serves as an excellent template for such a review. The report is data-based, draws on a broad array of academic research, and, importantly, is fully public and transparent. The data, methods, and analysis contained in the report and its conclusions can be reviewed by anyone. We believe that the Federal Reserve should make its holistic review as open and transparent as the PwC report. Based on the findings, there is no convincing evidence to suggest that the largest U.S. banks are in need of more capital and increasing requirements would come at a cost. If the Federal Reserve holds a different view, it should be willing to provide its findings in a clear, open, and transparent manner before moving ahead with any policy prescriptions.