Introduction

As we navigate the start of 2025, it is a good idea to take stock of the state of large bank capital while also considering what reforms are needed to better align capital standards with economic growth. In this post, we document the significant inflation in large bank capital – in both dollar and percentage terms – since 2018. We close by outlining key capital reforms that are necessary to ensure that large banks can continue to support a robust economy while safeguarding a resilient banking system. Finally, the issues that we discuss below are treated in greater detail in our recent report “Observations and Recommendations for a New Administration and U.S. Economic Growth”, and we refer folks to the report for a deeper dive on these issues.

Large Bank Capital is at All-Time Highs

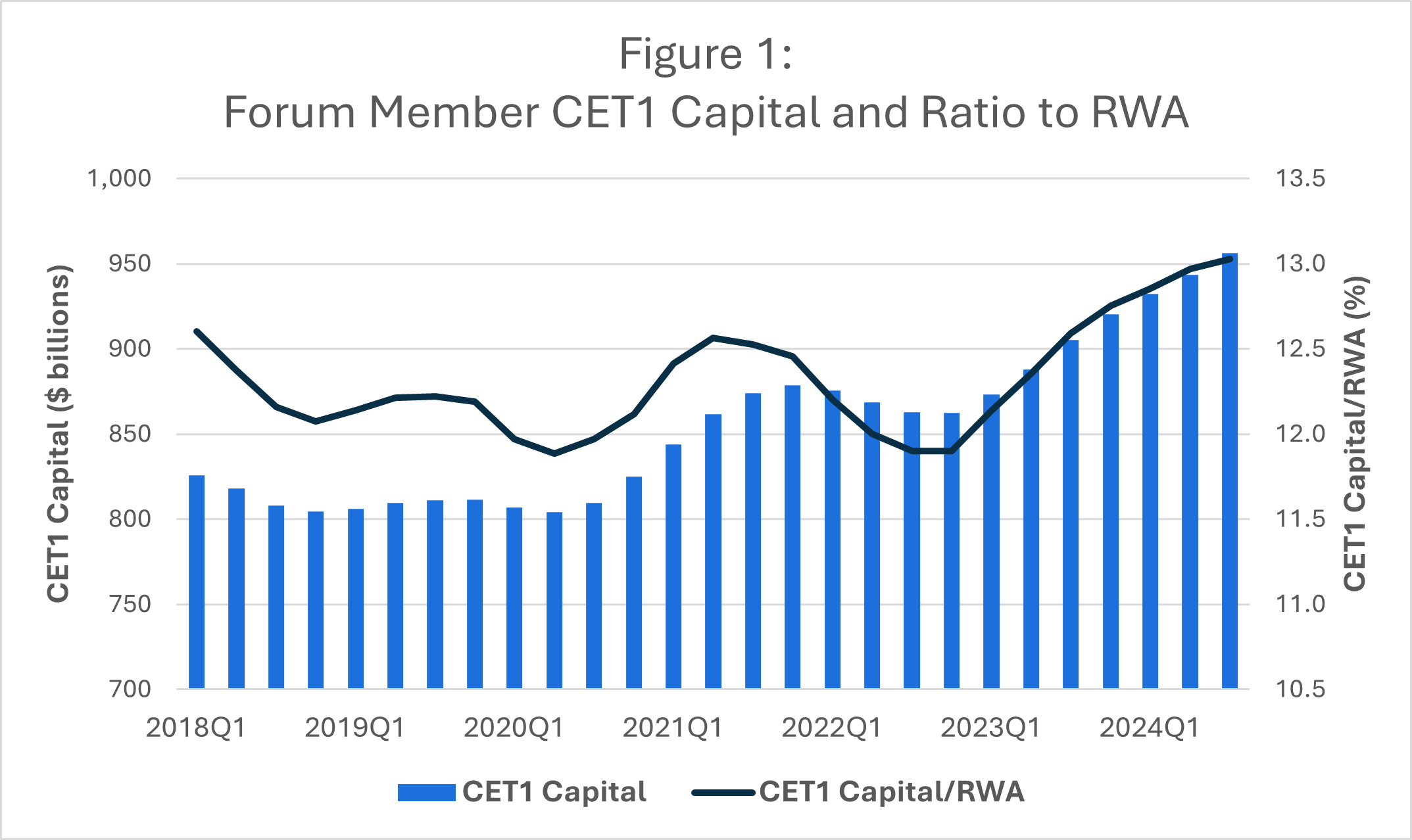

Figure 1 documents the state of bank capital for Forum members. The chart displays a four-quarter average of Forum member aggregate common equity Tier 1 (CET1) capital – the highest quality form of capital. The chart shows both the dollar value of capital maintained by Forum members as well as the aggregate ratio of capital to risk-weighted assets.

The robust level of capital maintained by Forum members has been clearly recognized by regulators. As an example, the Federal Reserve recently pointed to the strong level of large bank capital among Forum members (U.S. GSIBs) in its Financial Stability Report. Specifically, they noted that “CET1 ratios for global systemically important banks (G-SIBs) reached the highest levels recorded in the past decade, while CET1 ratios for large non–G-SIBs and other bank holding companies were close to pre-pandemic levels.”

Large Bank Capital Has Been Inflated by Ever-Rising Regulatory Requirements

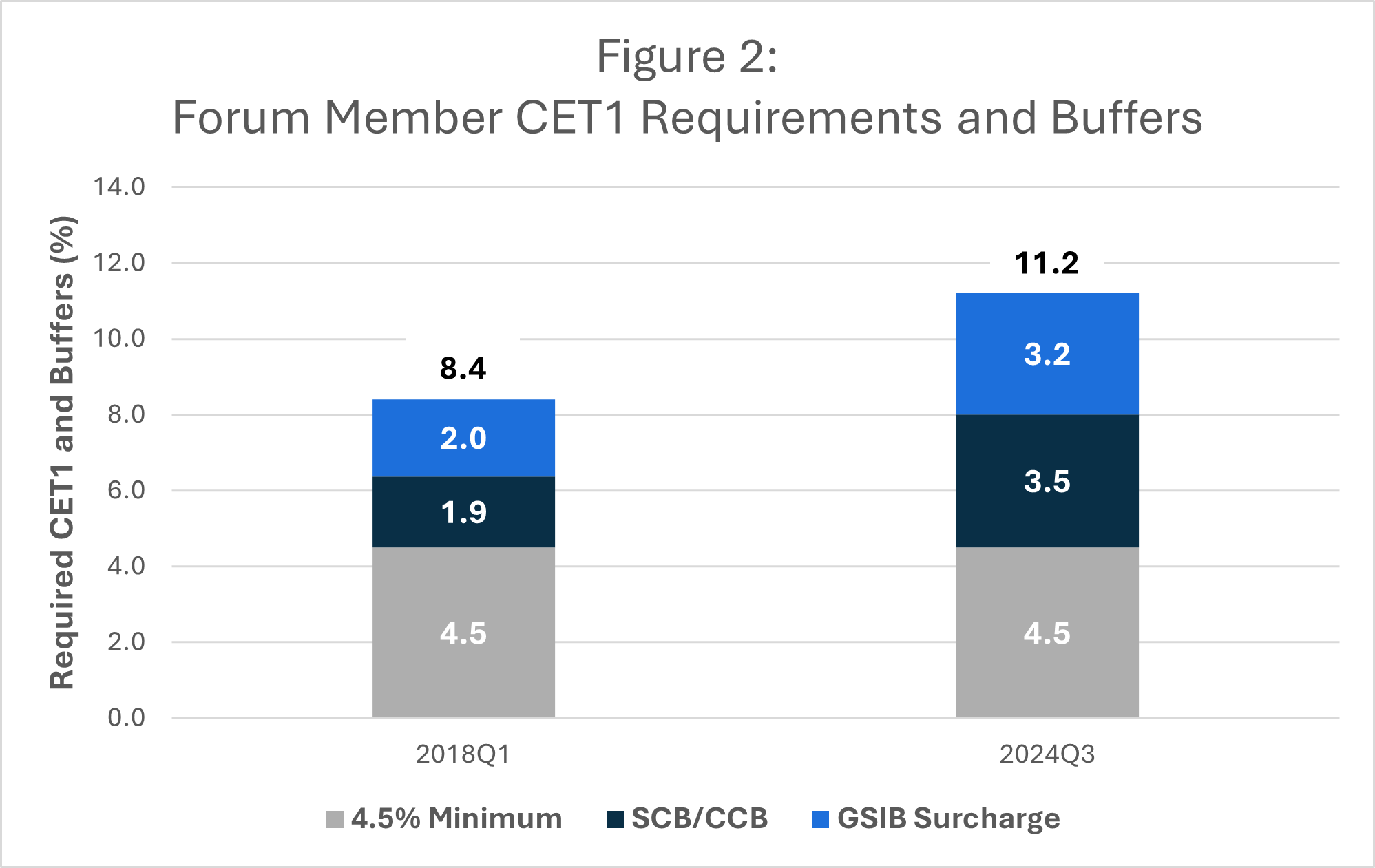

Considering the all-time high levels of bank capital, it is worth exploring the reason for these capital levels. While Forum members are committed to strong capital levels that support a resilient banking sector and robust economy, they are also subject to the requirements of bank regulators. And, indeed, much of the increase in required capital can be traced to inflated regulatory requirements. In Figure 2 below, we document the change in required capital for Forum members in just the past six years.

Source: Federal Reserve Y9-C, FFIEC 101

Source: Federal Reserve Y9-C, FFIEC 101

As shown in Figure 2, CET1 requirements have increased from 8.4 percent to 11.2 percent since 2018. Looking further, the chart shows that the rise in requirements is driven by a significant increase in the stress capital buffer, or “SCB,” (1.9 percent to 3.5 percent) that is a result of the Federal Reserve’s stress testing framework as well as a significant increase in the GSIB surcharge (2.0 percent to 3.2 percent). These increases have occurred despite the fact that the risk profile of Forum members has improved

In the case of the GSIB surcharge, the increase is driven largely by an unwarranted inflation in GSIB surcharges stemming from the massive increase in the Federal Reserve’s balance sheet since 2018. As we have discussed previously, both paradoxically and perversely, the GSIB surcharge for Forum members continues to increase despite the fact that the expansion of the Federal Reserve’s balance sheet increases the supply of safe bank reserves, which lowers systemic risks.

In the case of the stress capital buffer, the increase stems from the replacement of a fixed “capital conservation buffer” with a buffer that increases or decreases based on the potential losses simulated in the annual stress test exercise. This new capital requirement was introduced in 2020.

Finally, while it is not displayed in Figure 2, no discussion of large bank capital requirements is complete without mentioning risk-blind leverage capital requirements. As we have previously discussed, the massive inflation of the Federal Reserve’s balance sheet has made leverage capital requirements increasingly binding and has indirectly led to increased capital levels for large banks.

In sum, a primary driver of increased capital among large banks has been an inexorable and unnecessary inflation of large bank capital requirements, which are not supported by any consistent, well-established analysis. The only common thread tying together these developments has been the loose claim that “more is better.” Of course, this claim is fundamentally incorrect as it ignores the fact that increasing capital has a real economic cost. Like any economic resource, unchecked increases, at some point, become counterproductive.

Capital Reform in 2025

Forum members are strongly committed to robust capital standards that are transparent, risk-sensitive, and strike the right balance between safety and growth. Unfortunately, the last several years have witnessed a variety of capital-related policies that have moved us further away from an appropriate and efficient bank capital regime that supports the U.S. economy. The following capital policy initiatives should be undertaken in 2025 to reform and improve the large bank capital regime.

- Any implementation of Basel III Endgame must be consistent with its original intent, coherent with other capital requirements, and mindful of the robust level of capital maintained by large banks. Basel III Endgame was developed as a means of raising capital standards for non-U.S. banks to closely align with U.S. standards and was not intended to materially increase capital. As described above, U.S. large bank capital is at an all-time high and exceeds the level maintained by foreign peers. Any final implementation of Basel III Endgame in the United States must ensure a level playing field with those of non-U.S. jurisdictions and should not result in any increase in capital for large U.S. banks.

- The GSIB Surcharge must be fundamentally reformed. The U.S. version of the GSIB surcharge is significantly more stringent than the international standard applied to foreign GSIBs. In addition, the U.S. version of the GSIB surcharge mechanically increases for reasons that have nothing at all to do with systemic risk and in some cases increases when systemic risk decreases. The U.S. GSIB Surcharge must be rationalized with the international standard and should not be allowed to increase unabated as the size of the economy or the size of the Federal Reserve’s balance sheet increases.

- Leverage capital requirements must be reformed so that they are appropriate for the current size of the Federal Reserve’s balance sheet. It is well documented and understood that current leverage capital requirements are undermining the market for U.S. Treasuries and other low-risk assets. Indeed, the G30 publicly called upon the Federal Reserve to reform leverage requirements for this reason. Back in 2021, the Federal Reserve publicly committed to “soon” reconsider leverage capital requirements, but has not done so. Leverage capital requirements must be reformed so as not to serve as the binding capital constraint and to restore incentives to provide much-needed liquidity to the U.S. Treasury market.

- The stress tests must be reformed to provide transparency and reduce volatility in the annual resetting of the SCB. Recently, the Federal Reserve announced that it will undertake serious reform of the stress testing regime to improve transparency and reduce unwarranted volatility. We support these efforts and will engage further as they unfold in 2025.

Conclusion

Capital levels among Forum members are at an all-time high. Forum members support robust capital standards that support a resilient banking sector and a robust economy. Much of the observed increase in capital over the past several years has been the result of unchecked and inflated regulatory standards that have been allowed to increase without being tethered to any analysis or serious consideration of the appropriate path forward. The reforms described above would improve the effectiveness and efficiency of the large bank capital regime, improve international consistency and competitiveness, and support a strong U.S. economy while maintaining a highly resilient banking system.