Introduction

During the pandemic, Financial Services Forum members displayed significant strength and provided support to the economy by providing much-needed lending to businesses and households, helping firms raise capital through public securities offerings, and providing consumers with a place to keep their money safe during a period of heightened uncertainty. In looking back at the pandemic, some have argued that given broad government support for the economy, COVID was not a true test of the banking system’s resiliency. In this post, we analyze the impact that counterfactually high COVID losses absent government intervention would have had on Forum members. The analysis shows that even in the face of counterfactually high hypothetical losses Forum capital levels would have remained robust, allowing them to support the economy during the pandemic.

The Calm Before the Storm: Large Bank Capital on the Eve of the Pandemic

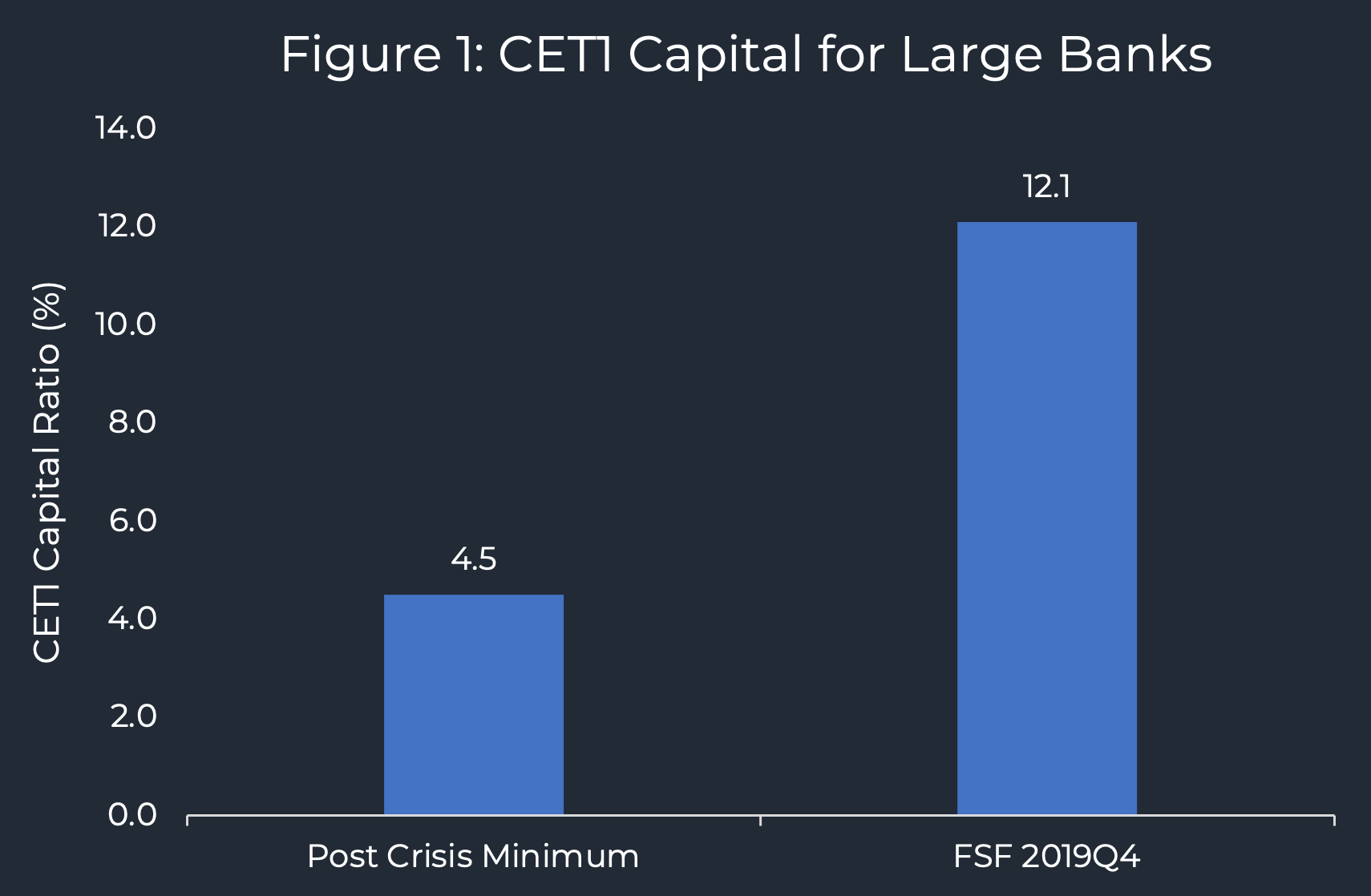

On the eve of the COVID pandemic, the fourth quarter of 2019, Financial Services Forum members maintained an aggregate common equity Tier 1 capital ratio of 12.1 percent. Before discussing the events of the pandemic, it is instructive to assess the significance and robustness of that level of capital. In particular, Forum capital levels reflected a 4.5 percent minimum requirement that was established after the financial crisis as well as a variety of capital buffers relating to the Federal Reserve’s stress tests and other regulatory requirements, such as the GSIB capital surcharge, that are

intended to ensure that Forum members maintain capital well beyond the amount needed to operate during both normal and stressed economic conditions. These capital buffers are intended to flexibly expand and contract in response to underlying economic conditions and are not rigid requirements that are fixed for all time.

In Figure 1, we display the required regulatory minimum and pre-COVID capital levels to visually demonstrate the strong and robust level of capital maintained by Forum members before the onset of the pandemic. The figure clearly demonstrates that Forum members were well positioned to support the economy despite the unanticipated economic turmoil stemming from the pandemic.

As COVID shut down the U.S. economy in the first quarter of 2020, banks suffered losses and their balance sheets expanded as they absorbed deposits and extended credit to support the economy. As a result, bank capital ratios declined from 12.1% to 11.4% – the low point of Forum member capital during the pandemic. While this decline represents an economic loss, large banks exhibited double digit capital levels, reaffirming their resiliency. Indeed, the reduction in capital simply reflected a modest compression of the ample capital buffers that were established after the financial crisis.

Some have argued that these losses do not represent the “true” economic losses attributable to the pandemic because of government support. While banks received no direct government support during the pandemic, some have argued that broad support provided throughout the economy – extended unemployment benefits, CARES act stimulus, and the like – buoyed household finances and forestalled loan defaults that would have otherwise hit the banking sector.

In order to seriously consider these claims, one needs to provide a specific and quantitative estimate of those counterfactual losses. Such counterfactuals are, by their very nature, hard to assess. How can anyone validate a loss estimate that never occurred based on assumptions that were not realized? Conceptual difficulties aside, it is instructive to consider some estimates of counterfactual losses to see what impact they would have had on large bank capital levels.

One analysis conducted by the Federal Reserve Bank of Minneapolis suggests that banking industry losses would have been $100 billion to $300 billion higher in the absence of government support. Our use of these estimates is intended to be instructive but is not intended to convey agreement with the findings.

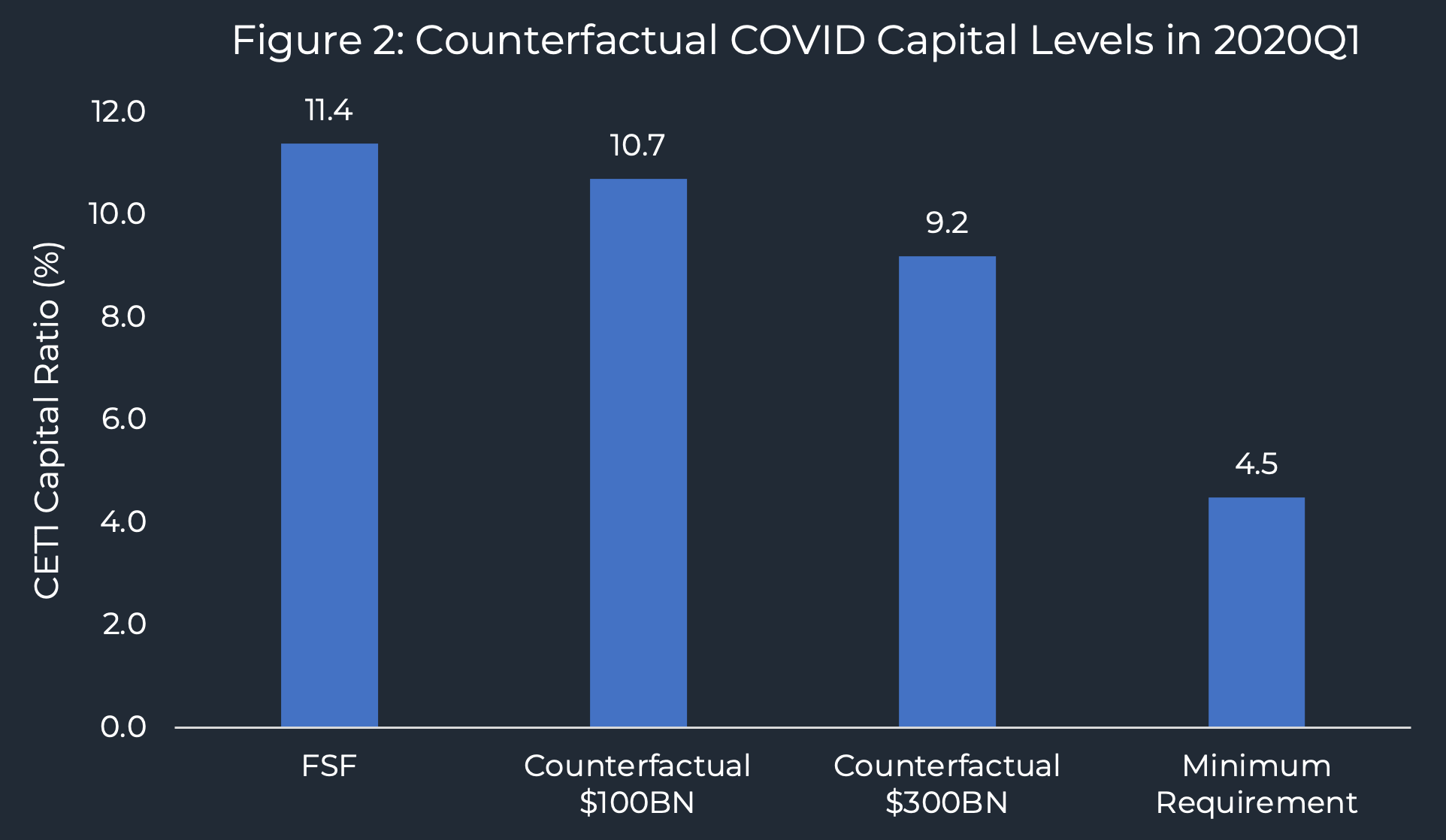

In Figure 2 below, we show the aggregate Forum member capital ratio that would have been realized had these counterfactual losses – either $100 billion or $300 billion scaled to reflect the size of Forum members relative to the entire industry – occurred in the first quarter of 2020. This calculation is highly conservative because we are assuming that all of the losses would have been realized in a single quarter, and we are also assuming that the losses would have occurred when Forum member capital was at its lowest point during the pandemic (Q1 of 2020). Had those counterfactual losses occurred more smoothly over the course of 2020, the impact on capital would be significantly smaller.

As shown in Figure 2, these counterfactual losses would have reduced Forum member aggregate capital from 11.4% to between 10.7% ($100 billion) and 9.2% ($300 billion). This level of capital is still quite robust, being more than twice the post-crisis regulatory minimum of 4.5%. It is reasonable to assume that banks need to maintain capital above the regulatory minimum requirement. It is clear, however, that operating with a level of capital that is more than twice the post-crisis regulatory minimum would be sufficient to continue operating soundly while maintaining public confidence. While higher COVID economic losses would have resulted in lower capital levels, and may have required some amount of capital to be rebuilt over time, the resulting counterfactual capital levels are not anywhere near a level that could be reasonably described as problematic or distressed.

This point has also been publicly made by Federal Reserve Chair Jerome Powell. Specifically, during a Senate hearing in 2021, Chair Powell disputed an assertion that banks would have been materially weakened by an additional $300 billion in COVID losses. Chair Powell responded: “which they would have met. Which they would have been able to absorb without difficulty.” (emphasis added)

Addressing the Cassandras – Root Risk Analysis in Reality

The analysis above and the statements of Chair Powell clearly document that Forum members would have remained resilient during the pandemic even if bank losses were unrealistically elevated relative to actual experience. But what if losses were $600 billion or $900 billion or even $1 trillion? What if the elevated losses carried into 2021, and 2022, and 2023 as well? What if the virus had become significantly more virulent and resulted in multiyear and economically devastating lockdowns?

As a matter of basic arithmetic, it is always possible to dream up an implausibly extreme, counterfactual scenario that would substantially weaken bank capital to unstable levels. But that exercise tests nothing except one’s ability to count. Rigorous and informative risk analysis demands that the scenario be within the bounds of reason given the prevailing economic context. Counterfactually high pandemic losses would have reduced capital levels, but capital would have remained sufficiently strong to avoid any significant financial distress. Of course, one should “never say never” when it comes to risk. But simply asserting that losses could have reached a level that would have destabilized the banking system is a tautology with no empirical content that says nothing about the safety and soundness of large banks.

Conclusion

Forum members steadfastly supported the economy during the depths of the COVID pandemic. Their ability to support our economy stems from their strong capital position. No large banks received direct government assistance during the pandemic. An analysis of counterfactually high COVID losses clearly shows that Forum members would have maintained sufficient capital to continue supporting the economy.