Last week, the Federal Reserve released its Fall 2021 Financial Stability Report. The report does an excellent job of highlighting how banks, and Forum members in particular, have actively contributed to U.S. financial stability.

Specifically, the report finds that “banks continued to be profitable and strongly capitalized.” This is an important statement about the condition of the banking sector. But it is particularly important with respect to the largest institutions, specifically Forum members, whose diversified nature is a source of strength. Forum members serve the economy and their customers in a variety of ways depending on the needs of individual customers, companies and other financial institutions. For example, the report notes the significance of capital markets activity during the pandemic – such as underwriting – which has supported industries looking to raise capital and the provision of liquidity to financial markets, both of which directly support the economy. This activity and an improving economy drove performance that enhanced the strength of banks and supported overall financial stability. In effect, consistent and robust profitability is a source of safety and soundness.

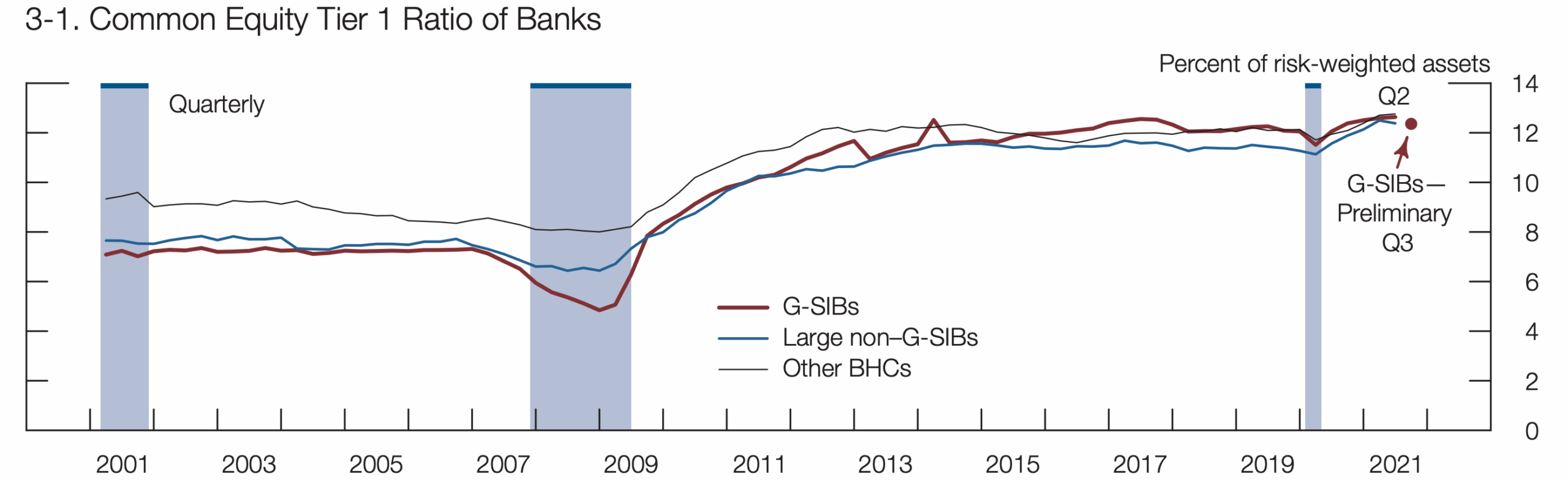

In terms of overall capital levels, the report clearly documents the strong capital position of Forum members, all global systemically important banks (GSIBs). The chart below, taken directly from the report, clearly shows that current capital levels exceed pre-pandemic levels and also exceed those of large, non-GSIB peer banks. The higher capital levels of Forum members speak directly to the fact that they are subject to the most stringent regulatory capital standards.

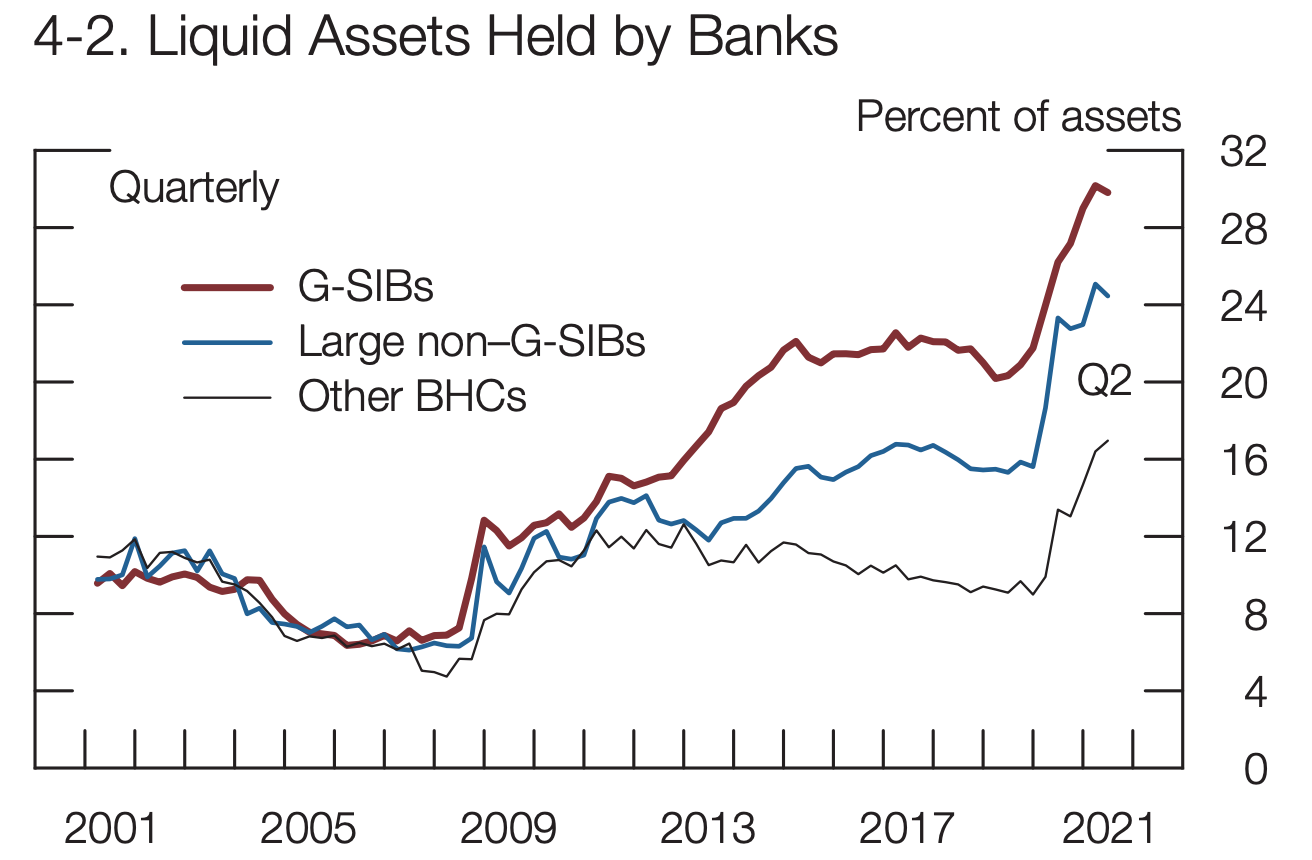

The report also documents the high degree of liquidity maintained by Forum members. The chart below, taken from the report, documents the high level of liquidity on Forum member balance sheets relative to other banks. The data clearly show that Forum members maintain the highest proportion of liquid assets, which supports their resiliency as liquid assets can be quickly and easily monetized in times of stress.

Notably, the recent Financial Stability Report identifies several near-term financial stability risks worth monitoring, such as increased leverage at certain non-banks, the prospects for sustained inflation, and a worsening of the public health situation. Importantly, the banking sector has acted as a source of strength and resiliency that contributes to financial stability. Forum members will continue to responsibly support the strength of our financial system and the overall economy.