Introduction

Nearly one and half years ago, at the beginning of the worldwide COVID-19 pandemic, local and federal governments instituted shutdowns, mandating the closure of some businesses in order to slow the spread of the virus. As part of government efforts to help prevent the mass unemployment and economic crisis that would naturally arise from such a measure, the Paycheck Protection Program (PPP) was implemented to support small businesses. Through this program, existing banks are utilized to supply forgivable government loans to affected businesses, allowing these businesses to continue to pay their employees and make good on other financial commitments during the pandemic. In the previous BankNotes blogs, “Supporting Small Businesses Through PPP” and “Large Banks Support Small Businesses Across a Range of Industries Through the PPP,” Dr. Sean Campbell showed how the data on loan sizes and jobs supported by PPP in 2020 reflect the commitment of Forum members to prioritize lending to small businesses. Recently, the Small Business Administration (SBA) released new data concerning PPP lending, showing that Forum members continued to focus on providing loans to small businesses as the program extended into 2021.

Forum Members Primarily Supported Small Businesses Through Their Lending

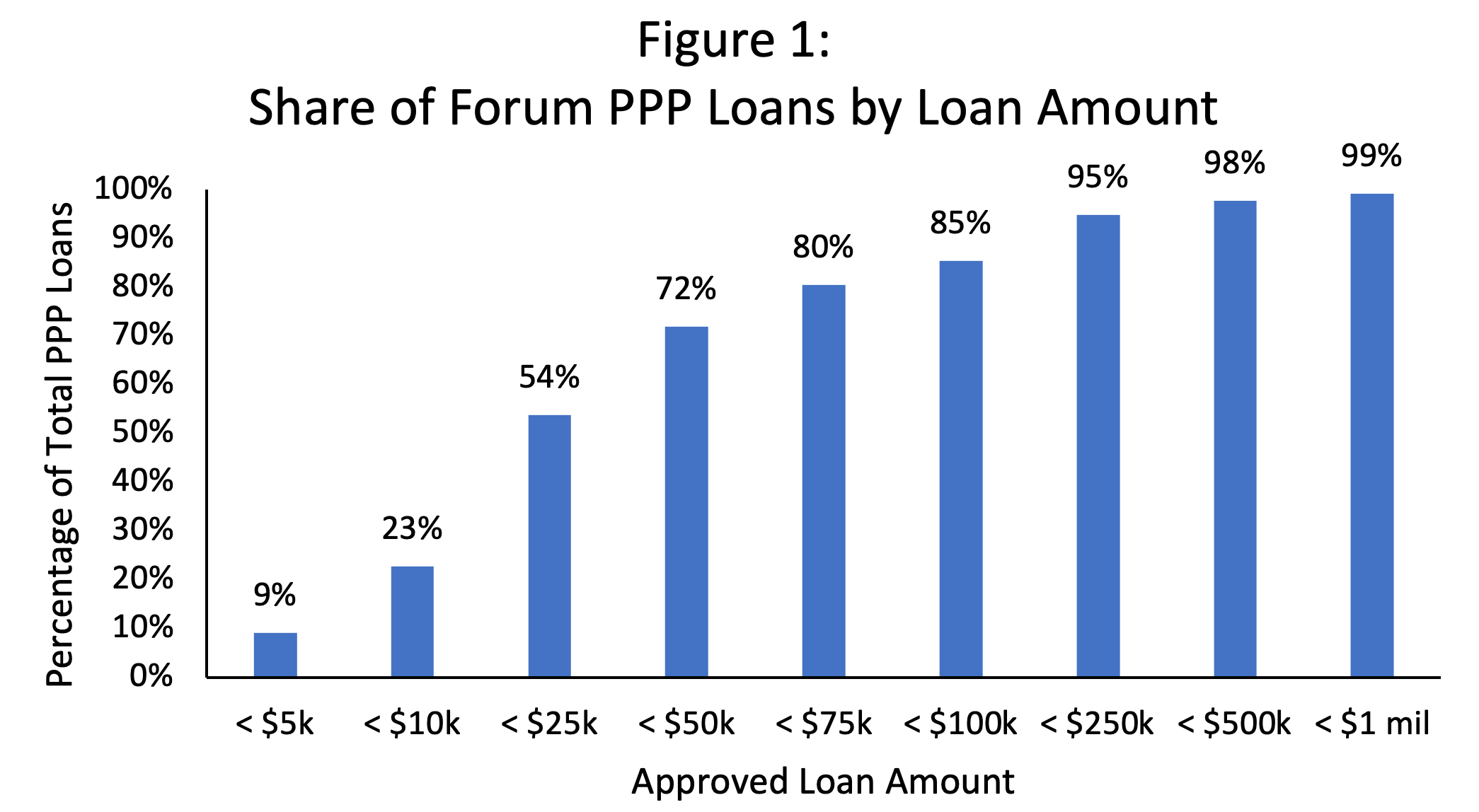

One year and four months after the beginning of the Paycheck Protection Program (PPP), Forum members have extended PPP loans to 1.25 million businesses with a median loan amount of $21,572. These loans have been organized by loan size in Figure 1 below. Eighty percent of the loans (over 1 million) were under $75,000 and 54 percent were under $25,000, showing that our members have prioritized small businesses for relief. One quarter of all loans were just over $10,000. All in all, Forum members have facilitated the transfer of $94 billion to primarily small businesses during the pandemic.

Jobs Supported by the Forum

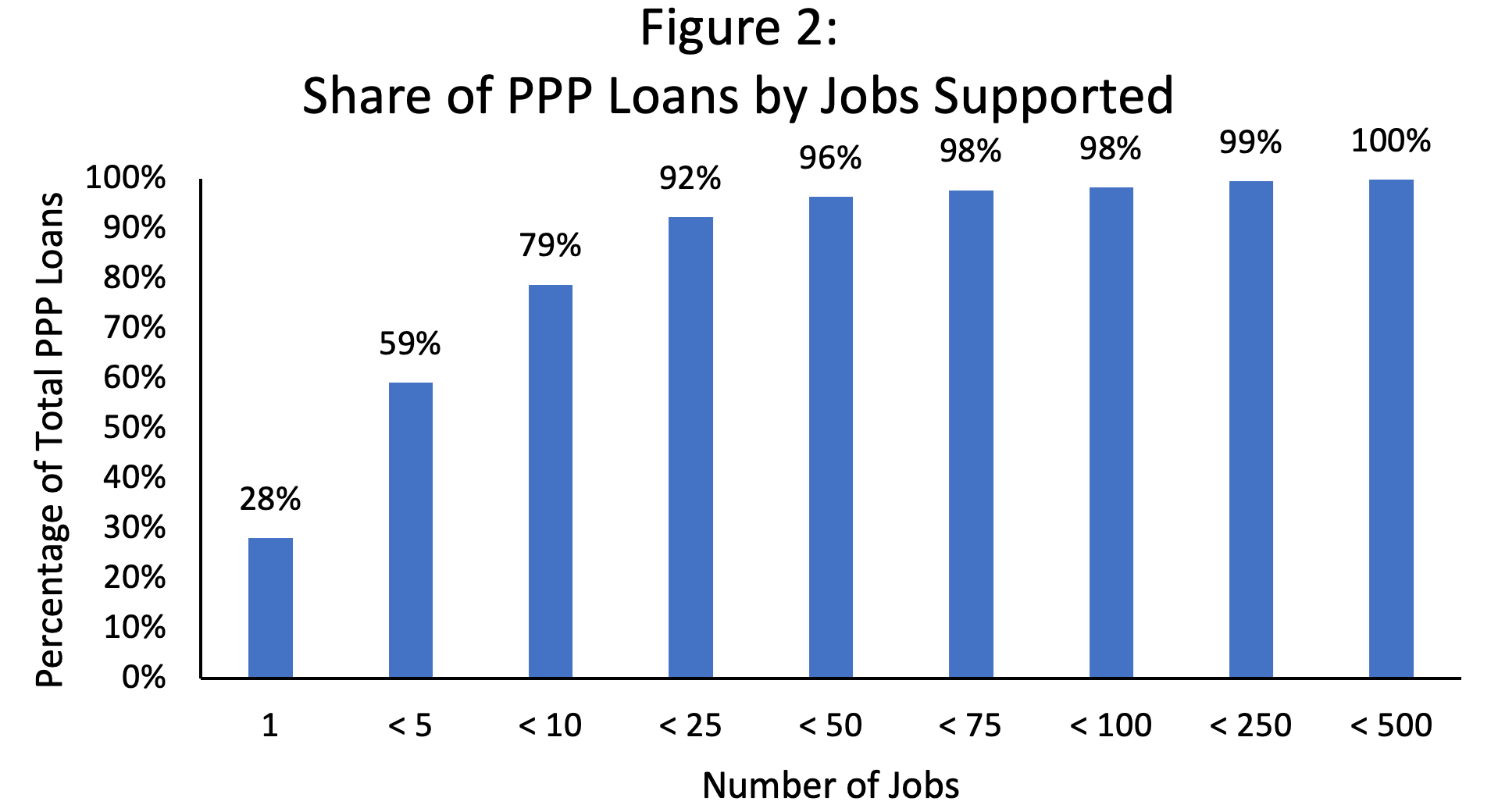

The goal of the PPP initiative was to keep businesses afloat during the pandemic and provide paychecks for the employees of those businesses. The number of jobs supported by each PPP loan is recorded in the SBA data. Using these data, Figure 2 displays the share of Forum PPP loans that went to businesses with different numbers of employees. Almost 60 percent of the loans went to businesses with fewer than 5 employees. Nearly 80 percent went to businesses with fewer than 10. Ninety-eight percent of the Forum members’ PPP loans were extended to businesses with fewer than 50 employees, highlighting the efforts of the Forum members to prioritize small businesses. In total, through these 1.25 million loans, our member banks supported over 13 million jobs.

Conclusion

Sixteen months after the inception of the Paycheck Protection Program, our members have extended loans to 1.25 million businesses, supporting more than 13 million jobs. Half of all loans extended were for less than $22,000 and half of all businesses supported by the Forum members had three employees or less. These data show that our member banks are focused on providing support where it is most-needed, i.e., small businesses. Throughout the pandemic, Forum members have shown their ability and willingness to help the American people through supporting American business, and they will continue to extend that help into the future.