Dear reader,

We’re back by popular demand—and just in time for a busy June in Washington. With longer days and growing policy momentum, there’s plenty to cover. In this issue, we highlight Wells Fargo’s new small business initiative, look at how changes to bank rules could help support the U.S. Treasury market and American economy, and share how Forum members are driving innovation, and community growth nationwide.

Thanks for keeping up with us.

Kevin Fromer, President and CEO, Financial Services Forum

Penny For Your Thoughts

Kimelyn Harris, head of Small Business Growth Philanthropy for Wells Fargo

What is Wells Fargo’s Open for Business Growth program?

This new $20 million Open for Business Growth program is designed to support the growth potential of small businesses in the “missing middle”– those that are in-between most capital solutions. During the pandemic, Wells Fargo created its Open for Business Fund, a $420 million national small business recovery effort. Through this fund, Wells Fargo collaborated with community organizations to benefit roughly 336,000 small businesses and enable them to keep or maintain 461,000 jobs nationwide. Open for Business Growth builds on that momentum and Wells Fargo’s focus on small business growth.

What do small businesses need to be successful?

Access to capital is the number one need we hear from small businesses. Often these businesses need a little bit more than a microloan but are not ready for traditional financing. Open for Business Growth allows our nonprofit grantees to develop products and services and coaching that embrace growth-stage small businesses so they can reach the next level of success.

How will the Open for Business Growth program be deployed? Which cities?

Our first grant recipient, Allies for Community Business, focuses on growing the construction industry around Chicago and helping businesses that have fluctuating revenue flow, like restaurants and retail. With grant funding, Allies for Community Business is deploying creative capital and flexible financing options that give businesses the leap they need to expand. We’re excited to announce grants in additional markets across the U.S. through end of the year.

Can you explain more what you mean by “missing middle” for small businesses?

Across the country, millions of small businesses serve as the backbone of America’s economy. They provide vital services and goods, as well as jobs for local communities. But there’s a “missing middle” of small businesses ready for expansion but not able to find the flexible capital solutions they need to grow. These small businesses are on the brink of expansion, poised to make an even greater impact in creating jobs, increasing services, and strengthening the economy. They need more than a microloan, but are not yet large enough for traditional financing.

Value Add

Supporting Small Businesses Recovering from the L.A. Wildfires

Wells Fargo is working across the bank to support small business growth. Through Beyond Open for Business initiatives, Wells Fargo is expanding support services to include resources, knowledge and networking opportunities for businesses owners, which is also imperative to their growth. In the Greater Los Angeles area, many local businesses are trying to recover from the devastating wildfires. There Wells Fargo is collaborating with Operation HOPE to extend financial coaching services to small business owners at several Wells Fargo branches as part of the Project Restore HOPE Los Angeles initiative. The five-year effort helps those affected by wildfires with immediate and long-term financial recovery by helping them with FEMA applications, SBA loans, insurance claims, working with creditors, building a recovery budget, and much more. Additionally, Wells Fargo donated $2 million to local nonprofits to support ongoing relief efforts for small businesses and individuals.

Wells Fargo believes philanthropy can be a catalyst for lasting impact and collaboration as key to moving the needle, listening to what communities need and co-designing with them. Small businesses are an important path to economic opportunity and wealth-building. Our country needs small businesses as a driver of the U.S economy.

Capital Gains

What we’re doing in Washington

The Forum continues to advocate for common sense policies that allow our members to best serve their customers and the U.S. economy. Recently, Forum President and CEO Kevin Fromer issued a statement after the House Financial Services Committee voted to advance measures to improve bank supervision. “The FIRM Act, the FAIR Exams Act, and the HUMPS Act represent important steps toward a supervisory system that is consistent and transparent,” Fromer said.

Additionally, the Forum, along with fellow trade associations, urged the Federal Reserve to take prompt, interim steps to clarify the 2025 stress test cycle to avoid unnecessary uncertainty.

Finally, the Forum applauded the Senate Banking Committee’s vote to advance Federal Reserve Governor Michelle Bowman for Federal Reserve Vice Chair for Supervision and urged swift Senate confirmation. “This role is critical to implementing appropriate regulation and effective supervision that promotes economic growth,” Fromer said.

Our Two Cents

Research from the Forum

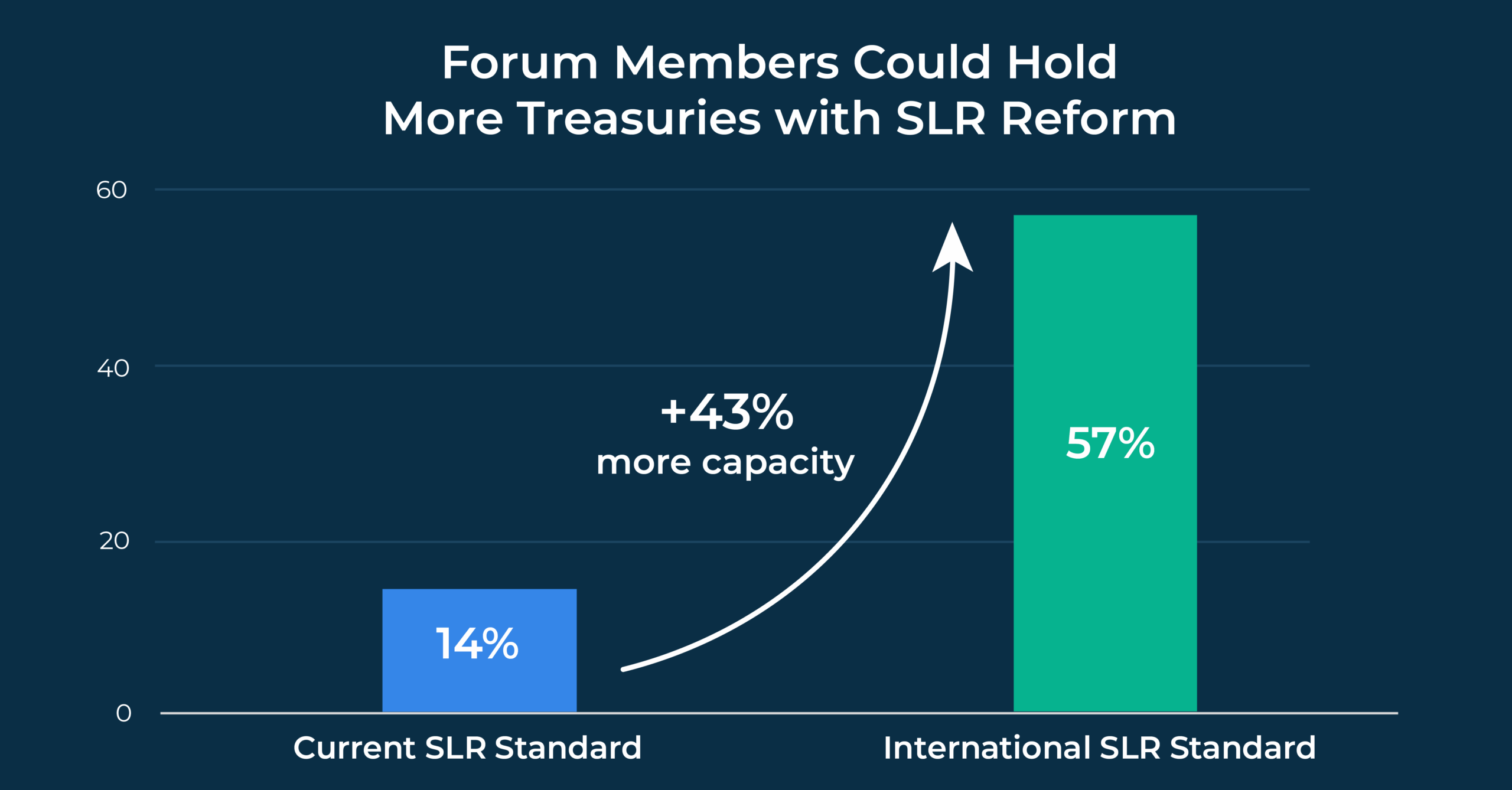

The following chart shows how changing the Supplementary Leverage Ratio (SLR) could help large banks buy and hold more U.S. Treasuries. The chart compares the current capacity of the Forum members to hold Treasuries and the additional capacity that would be available under a more flexible standard

In the latest edition of the BankNotes Blog, Forum Chief Economist Sean Campbell addresses key misrepresentations about leverage capital requirements and discusses why the economy needs change. “Outmoded and arbitrary leverage capital regulations have been backfiring on the U.S. economy for years and are in serious need of reform,” said Dr. Campbell.

Checking the Balance

Members in the news

Bank of America announced plans to open over 150 financial centers across 60 markets by the end of 2027, expanding access to banking services nationwide.

BNY expanded its digital asset platform offering with a new data insights product that securely and efficiently deliver both on- and off-chain data across blockchain networks.

Citi celebrated the 20th anniversary of Global Community Day, its annual tradition of global volunteerism and community impact.

In April, Goldman Sachs 10,000 Small Businesses announced its 1,000th graduate in Salt Lake City, as the firm celebrates 25 years in the city. Goldman Sachs 10,000 Small Businesses also opened applications across Utah as part of its $100 million Investment in Rural Communities, an initiative that launched in 2023 and equips rural entrepreneurs with results-oriented training to help grow their businesses and expand access to capital and to personalized support services.

JPMorganChase committed $14.5 million in philanthropic funding to improve access to workplace and public benefits for low- to moderate-income individuals.

Morgan Stanley celebrated the 5th anniversary of its Alliance for Children’s Mental Health, reaffirming its $50 million commitment to youth mental health solutions by making multi-year grants to nonprofit members and expanding its Innovation Awards program to include younger leaders.

State Street highlighted key insights into evolving market dynamics and shared its outlook for the second quarter of 2025.

Wells Fargo partnered with Operation HOPE to expand access to financial education workshops and personalized coaching for small business owners.