Bank capital requirements have a direct impact on lending decisions by banks. In turn, these lending decisions determine whether households and businesses obtain credit that supports and grows the economy. In this post, we profile new research from the Federal Reserve Bank of New York (FRBNY) that provides important evidence showing the important linkage between bank capital requirements and lending decisions. Specifically, the recent blog post Bank Capital, Loan Liquidity, and Credit Standards since the Global Financial Crisis investigates how post-crisis banking regulations have affected commercial credit standards. The researchers find that bank capital considerations have increased in importance in driving changes in commercial credit standards over the past decade. Accordingly, their results show that the level of bank capital is an important determinant of bank lending decisions that affect economic growth. These findings add to a large body of mainstream economic research that convincingly shows that bank capital regulation has important consequences for the real economy.

Senior Loan Officer Opinion Survey

The FRBNY blog post uses data from the Federal Reserve’s Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS). The SLOOS has been conducted by the Federal Reserve since 1964 and has been referenced in a wide array of economic research. The survey is conducted across 80 banks in the U.S. with broad geographic coverage as well as coverage across large and small banks. The survey asks respondent banks for their views on whether bank credit standards have tightened (has become more difficult to obtain a loan) or loosened (has become easier to obtain a loan) as well as why standards have tightened or loosened.

Bank Credit Standards and Bank Capital

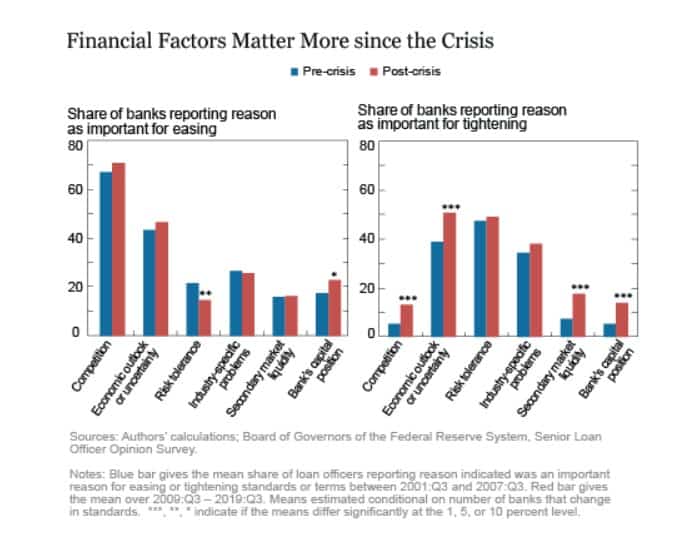

A key piece of evidence cited by the FRBNY researchers is the increase in the number of times “bank’s capital position” is cited by banks as a reason for changing (loosening or tightening) credit standards. As shown in the figure below, which is reproduced from the blog post, there has been a clear increase in the degree to which “bank’s capital position” is cited as a reason for changing credit standards by banks responding to the SLOOS over the past decade. In particular, the dots above the red bar over “bank’s capital position” indicate that the increase is statistically significant. This is noteworthy as “bank’s capital position” is the only factor that exhibits a statistically significant increase in the context of both tightening and easing credit standards over the past decade.

Conclusion

Banks must maintain robust levels of capital to remain safe and strong so that they can support the economy. Indeed, Financial Services Forum members have increased their capital levels as requirements have risen from just over four percent to over ten percent in the past few years. Today, Forum members maintain $832 billion in high-quality capital, which is $146 billion over their regulatory capital requirements. At the same time, regulators, policymakers and the public should recognize that bank capital requirements have direct implications for lending and economic growth. Moreover, recent research shows that bank capital has become more important as a determinant of bank lending decisions over the past decade. This is likely due to the fact that bank capital requirements have increased so much over the past decade and therefore have become a more significant driver of bank business decisions.