Introduction

Recently, policymakers have considered significantly raising the amount of FDIC deposit insurance for smaller and mid-sized banks. Some proposals have suggested increasing the deposit insurance limit from the current $250,000 to as much as $20 million. An increase of this magnitude to the FDIC deposit insurance program would represent a massive change in public policy that should receive careful and exacting scrutiny. In this blog, we review the history and economics of deposit insurance and explain why a massive increase in deposit insurance coverage would increase financial risk and repeat a past policy mistake that resulted in one of the worst banking crises in modern memory. While it is reasonable to periodically adjust FDIC insurance limits for inflation and economic growth, a massive expansion in FDIC insurance is unwarranted and would do little to improve the fundamental determinants of bank safety and resilience.

The Origins and Rationale for Deposit Insurance

Federal deposit insurance for bank accounts was introduced in response to the wave of bank failures that unfolded during the Great Depression. During the Depression, people who became concerned about the financial condition of their local banks resorted to withdrawing their deposits for fear that their bank might fail and their deposits would be lost. The resulting wave of local bank failures was an important factor in prolonging the length and depth of the Depression.

Anyone who has seen Mary Poppins can understand the dynamic. Someone, somewhere, hears a rumor about bad times at the bank and decides to close their account. The rumor spreads. Others quickly follow suit. Once everyone decides en masse to withdraw their deposits, no bank – no matter how healthy – can continue to operate. A classic bank run ensues, and the economy suffers as credit creation comes to a screeching halt.

The defining characteristic of a bank run is a widespread and indiscriminate pullback from small depositors who are acting out of fear rather than an informed view of the bank’s financial condition. These depositors are driven by fear rather than information because they lack the financial means and sophistication to prudently assess risk. The FDIC deposit insurance program that was erected after the Great Depression has been a great success in improving banking sector stability precisely because households and small businesses that spend their time earning a living and raising their family rather than scrutinizing their bank’s finances can rest assured that their hard-earned money will be protected. As a result, households and small businesses don’t have an incentive to run at the first whiff of perceived trouble at a bank and the destabilizing dynamic of a bank run never takes root. Today, according to the FDIC, over 99 percent of deposit accounts are covered by the current $250,000 insurance limit.

Deposit insurance is not targeted at larger, sophisticated depositors who have the financial acumen and wherewithal to assess risk. Financially sophisticated depositors are needed to monitor bank risk taking and apply market discipline, which contributes to and complements a bank’s overall risk-management strategy. A large deposit insurance limit erodes the incentives of financially sophisticated depositors to monitor and manage risk and creates a real moral hazard problem for banks that increases risk. Why should a large depositor spend time monitoring a bank and imposing discipline if its deposit is fully insured?

This concern is more than conceptual. Recent history provides a stark example of what can go wrong when market discipline gives way to moral hazard.

Deposit Insurance and the S&L Crisis of the 1980s

During the 1980s, the U.S. experienced a wave of bank failures – commonly known as the S&L Crisis – that resulted in the closing of over 700 banks and cost the economy $300 billion (in 2025 dollars). The causes of the crisis were many, but one clear driver was a massive expansion in deposit insurance that eroded incentives for larger, and financially sophisticated depositors to monitor the risks that their banks were taking.

In 1980, Congress authorized an increase in FDIC deposit insurance from $40,000 to $100,000. This was a large expansion in the coverage of FDIC deposit insurance at the time. Prior to the 1980 increase, FDIC insurance limit increases were considerably smaller and infrequent.

This large increase in deposit insurance dramatically eroded private incentives for large, sophisticated depositors to monitor risk and led to significant increases in the risk profile of many banks across the country. Later, a downturn in the real estate market revealed heightened risks in the banking sector that abruptly resulted in a large wave of bank failures.

The role played by the massive increase in FDIC deposit insurance in precipitating the S&L Crisis is not unappreciated or controversial. In a report assessing the causes of the crisis, the National Commission on Financial Institution Reform, Recovery, and Enforcement wrote that “combining insured deposits with risky activities of the institutions offering them courted disaster because it robbed the system of the market discipline needed to control risk.”

The lesson of the S&L Crisis is hard to overstate. Massive increases in FDIC deposit insurance eroded the incentives for sophisticated depositors to apply market discipline and support prudent risk management. The aftermath of the S&L Crisis took a heavy toll on our nation’s banking system, hitting smaller banks particularly hard. According to the FDIC, the median failed bank during the S&L Crisis had total assets of only $150 million at a time when more than 60 percent of banks had total assets of more than $1 billion. This historical episode clearly demonstrates that large-scale increases in deposit insurance that may be aimed at helping smaller banks can have exactly the opposite impact.

Of course, the 1980s was not the only time that deposit insurance limits have increased. After the financial crisis of 2008 there was a similarly sized increase in deposit insurance. The economic circumstances surrounding that increase, however, were quite different. Specifically, bank capital, liquidity, and oversight expanded dramatically during this time, which counterbalanced the incentive effects created by the increase in deposit insurance.

Repeating Past Mistakes…and Then Some?

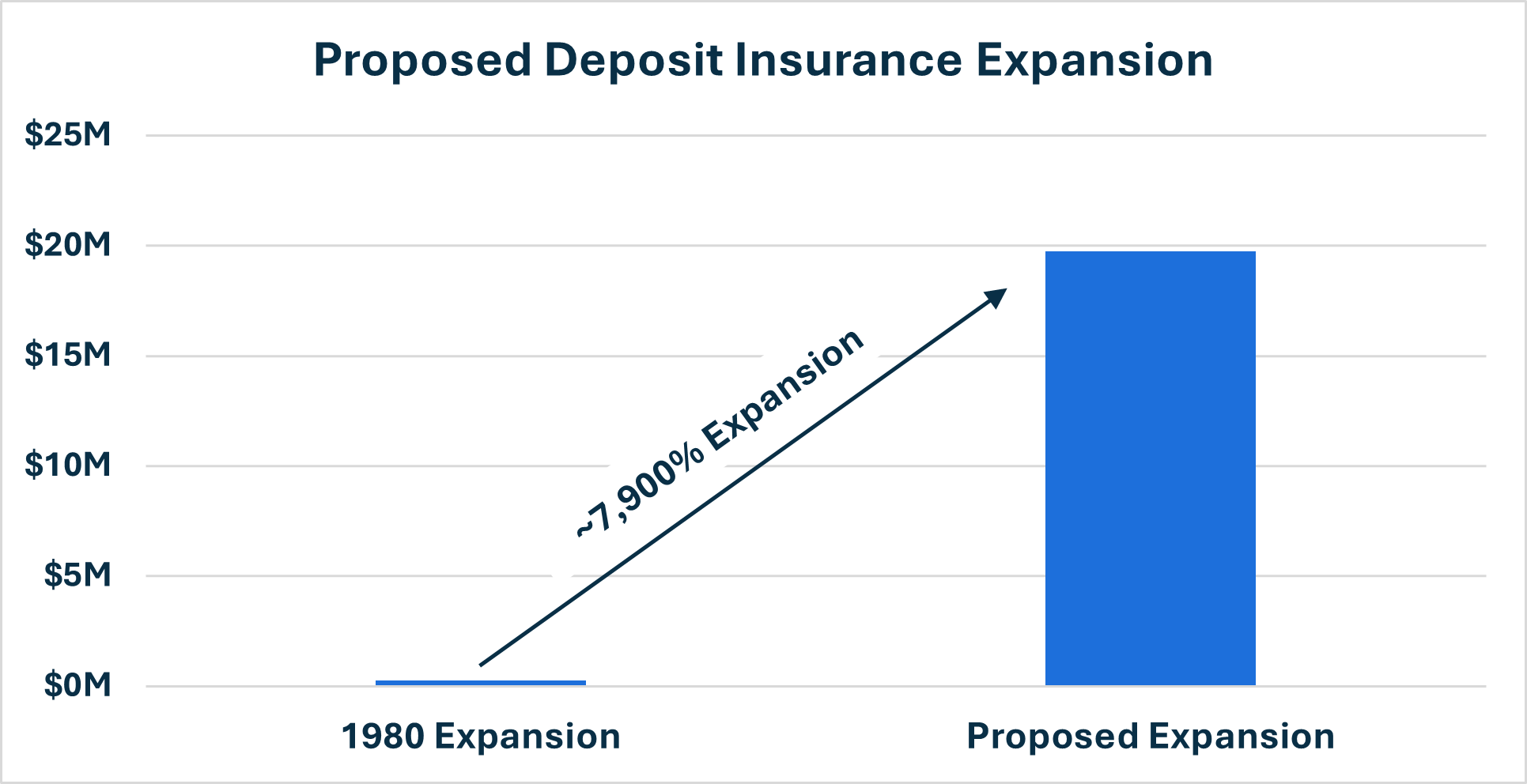

Recent discussions of expanding deposit insurance for small and mid-sized banks make the 1980 deposit insurance expansion look trivial by comparison. In the chart below we compare the relative size of the 1980 increase with the proposed increase that would raise the FDIC limit for some accounts from $250,000 to $20 million, representing a 7,900 percent increase in FDIC coverage.

Whatever mal incentives were created by the 1980 expansion would be dwarfed by expanding FDIC insurance to $20 million. And while it may be the case that the existing $250,000 limit may be too small for some small and mid-sized businesses, it is not credible that a company with $20 million in cash resources, in addition to other valuable assets, would not have the resources and acumen to meaningfully assess whether a bank is in appropriate financial condition to prudently manage its $20 million deposit.

Better Solutions for a Stable Banking Sector

Some have suggested that a massive increase in deposit insurance is needed to deal with the fragilities that were revealed during the collapse of Silicon Valley Bank (SVB) in 2023. It is certainly true that smaller and mid-sized banks lost deposits and came under pressure during the SVB turmoil while large banks absorbed deposits and proactively supported smaller banks.

The strong performance and confidence shown in larger banks during the SVB collapse can be directly traced to the rigorous regulatory standards and market discipline to which they are subject. In particular, large banks are subject to:

- the strictest capital standards that support bank resiliency.

- the strictest liquidity standards that support a bank’s ability to meet short-term liquidity demands from depositors and others.

- the strictest requirements on reflecting mark-to-market changes in reported capital levels, providing strong market discipline.

- the strictest level of supervisory oversight.

Simply “throwing more money at the problem” by massively expanding deposit insurance does nothing to deal with the fundamental sources of fragility that were revealed in the wake of the SVB collapse. A commitment to addressing that fragility demands consideration of policies that directly address real underlying weaknesses.

Conclusion

National deposit insurance is an important and successful policy that has significantly improved financial stability since the Great Depression. Over time, general increases in deposit insurance that accords with inflation and economic growth is sensible policy. Deposit insurance works by assuring smaller, less financially sophisticated depositors that their deposits will be kept safe. Massive increases in deposit limits would erode market discipline provided by larger and financially sophisticated depositors and invite moral hazard without addressing the fundamental sources of fragility that were revealed following the 2023 collapse of SVB. Policymakers should not rush to judgment on deposit insurance but should take a more holistic approach to supporting financial system stability.