CONTACT: Barbara Hagenbaugh

(202) 457-8783

bhagenbaugh@fsforum.com

Largest banks lead the way in offering low-cost, no overdraft accounts

Washington, D.C. – Financial Services Forum President and CEO Kevin Fromer issued the following statement today following a report from the Consumer Financial Protection Bureau (CFPB) on overdraft:

“The nation’s largest banks have led the way in offering low-cost checking accounts with no overdraft fees and ensuring banking services are transparent, accessible and understandable.

“The largest banks generate a small portion of their overall revenue from overdraft fees and in 2020 waived hundreds of millions of dollars in overdraft fees for customers affected by COVID-19. Financial Services Forum members offer overdraft protection for customers who opt in and encourage customers to receive low-fund alerts via text and/or email when their account balances fall below a certain dollar amount so that they do not overdraft their accounts. They also have introduced additional consumer benefits, such as grace periods and small, short-term loans and other alternatives to the traditional overdraft model.”

###

Background

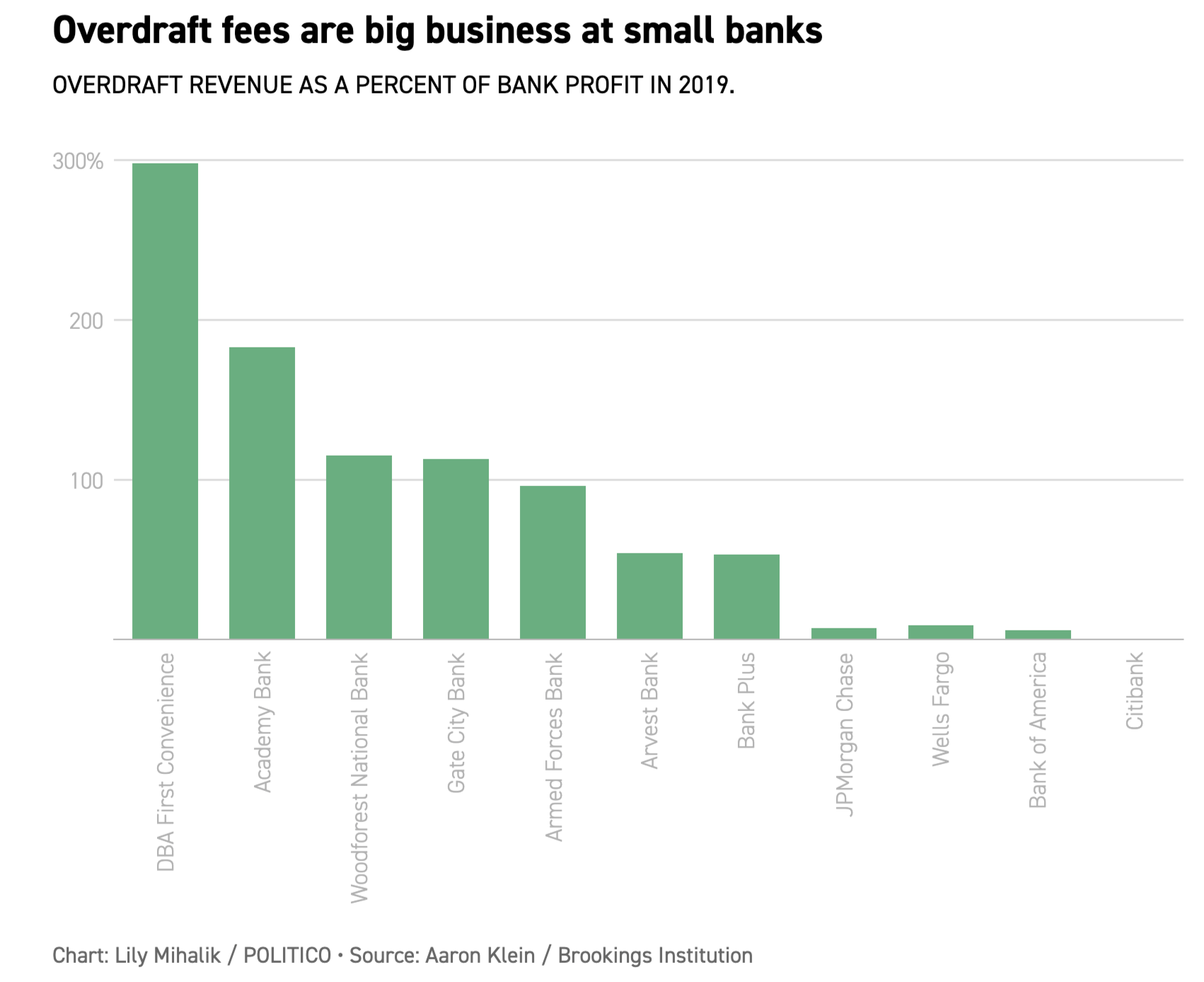

In an article in Politico, “Overdraft Fees Are Big Money for Small Banks,” former Treasury Department official Aaron Klein said his research has shown that overdraft accounts for a small percentage of total profit at large banks. Indeed, he said “a handful of smaller banks are the true overdraft giants” and pointed to some small banks who make nearly all of their profits from overdraft fees. “These banks are running a business model more akin to a check casher than a bank,” said Klein, now a senior fellow in economic studies at the Brookings Institution.

According to a new study from Curinos, a majority of consumers said they see benefit in overdraft and nearly two-thirds of respondents indicated that triggering an overdraft payment was a conscious choice. The study also found that regular overdraft use fell 40 percent from 2010 to 2020 and that bank-led initiatives aimed to help consumers avoid unintended fees have dramatically reduced the number of small purchases tied to overdraft.

The Financial Services Forum is an economic policy and advocacy organization whose members are the chief executive officers of the eight largest and most diversified financial institutions headquartered in the United States. Forum member institutions are a leading source of lending and investment in the United States and serve millions of consumers, businesses, investors, and communities throughout the country. The Forum promotes policies that support savings and investment, deep and liquid capital markets, financial inclusion, a competitive global marketplace, and a sound financial system.

Visit our website: fsforum.com