CONTACT: Barbara Hagenbaugh

(202) 457-8783

bhagenbaugh@fsforum.com

ICYMI: Reuters – “UK lenders face smaller impact from Basel rules than rivals”

U.S. economy to be at an even bigger competitive disadvantage after finalization of Basel 3 Endgame capital rules

Washington, D.C. – The Bank of England this week announced that UK banks will see a much smaller increase in capital requirements after implementation of the Basel 3 Endgame package than U.S. banks, Reuters reported.

“The BoE said it estimates the impact of the final leg of Basel on UK banks will be ‘low’ at an average increase in Tier 1 capital of about 3.2% once fully phased in by January 2030, down from an estimated 6% increase last year as data is refined,” author Huw Jones wrote.

” ‘This is lower than the European Banking Authority’s estimate of a Tier 1 increase of around 10% in the EU and the US agencies’ estimate of a CET 1 increase of around 16% for US firms,’ the BoE said.”

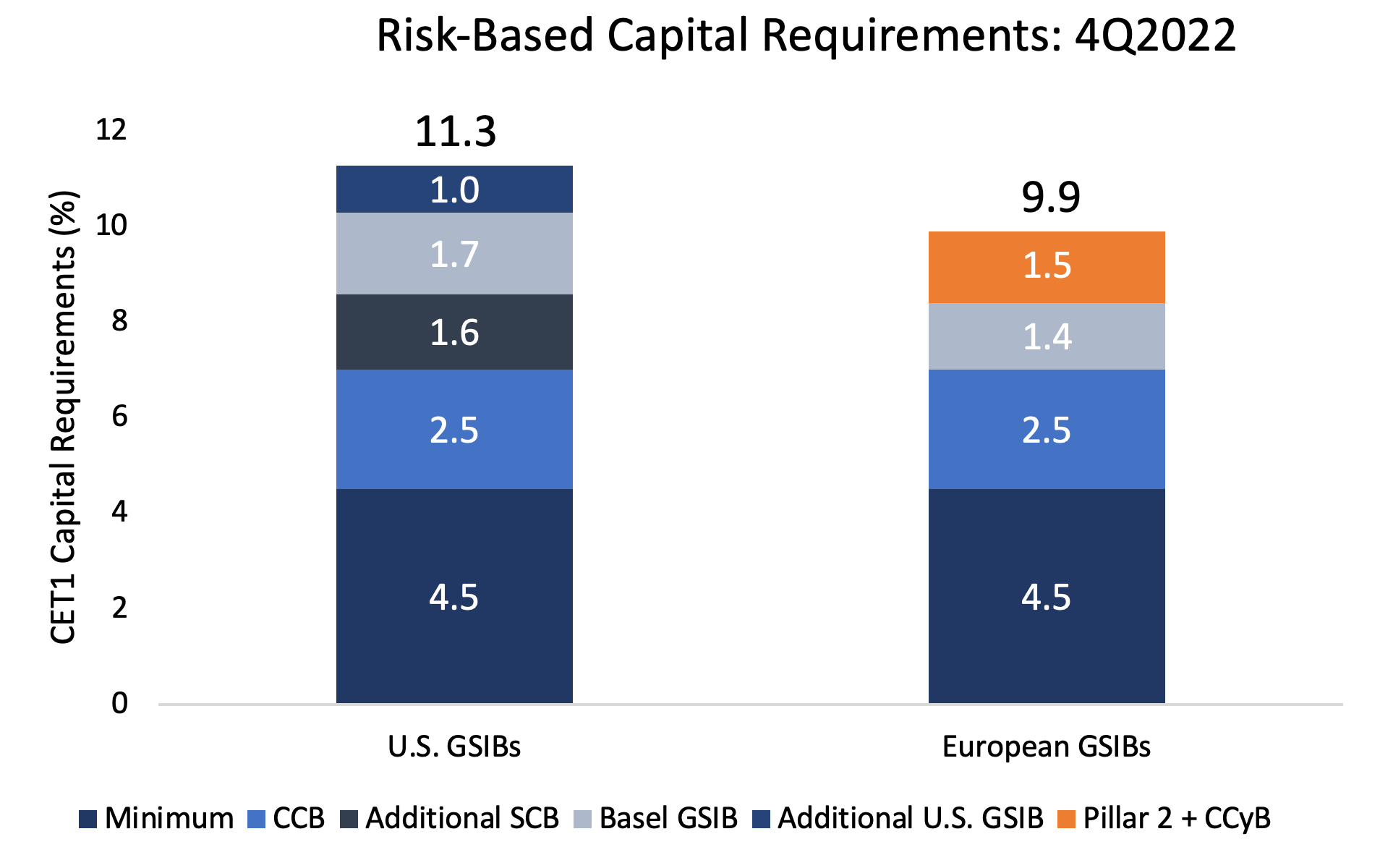

Capital requirements for the eight U.S. Global Systemically Important Banks, or GSIBs, are expected to increase by more than 20 percent. U.S. GSIBs already have substantially larger risk-based capital requirements than European banks.

Source: Federal Reserve Y-9C, Company Annual Reports

Higher capital requirements lead to reduced availability of credit and higher borrowing costs.

The United States historically has gone far beyond international agreements when implementing capital accords, leading to a gulf between U.S. requirements and those for banks around the world. That makes it more expensive and more difficult for U.S. companies to borrow and to compete overseas.

To learn more, go to smartbankcapital.com

Full Reuters story:

REUTERS: UK lenders face smaller impact from Basel rules than rivals, BoE says

By: Huw Jones

LONDON, Dec 12 (Reuters) – The Bank of England said on Tuesday that implementing the final leg of the global Basel bank rules will increase capital requirements at UK banks by 3%, far less than for their European Union and U.S. peers.

Regulators began rolling out the tougher capital rules after the global financial crisis of 2007-09 when taxpayers had to rescue ailing banks.

Britain, the EU, U.S. and other countries are now finalising how they will implement the final leg of the so-called Basel III capital standards, tailoring them to local circumstances.

The BoE published on Tuesday the first of two “near final” policy statements on implementing the Basel rules, saying it had made some tweaks to its original proposals following a public consultation.

The BoE said it estimates the impact of the final leg of Basel on UK banks will be “low” at an average increase in Tier 1 capital of about 3.2% once fully phased in by January 2030, down from an estimated 6% increase last year as data is refined.

“This is lower than the European Banking Authority’s estimate of a Tier 1 increase of around 10% in the EU and the US agencies’ estimate of a CET 1 increase of around 16% for US firms,” the BoE said.

U.S. banks have mounted a heavy lobbying campaign against the Federal Reserve’s proposals for implementing Basel, which follow several bank failures, including Silicon Valley Bank, earlier this year.

“The rules published today implement the latest Basel standards in the UK and include appropriate adjustments to take on points raised by respondents to our consultation,” BoE Deputy Governor Sam Woods said in a statement.

Britain and the United States have said they will begin rolling out the final phase of Basel III in mid-2025, with the EU, which has already finalised its Basel rules containing several temporary waivers, starting in January 2025 but with longer phase-ins.

Markets industry body AFME said it will be important to coordinate the timeline for implementing Basel internationally to avoid harming the UK’s competitiveness.

The BoE said its alterations boost competition by narrowing the advantage big banks have in using their own models to calculate capital buffers, over the more conservative norms for smaller lenders, to make capital ratios more comparable.

More substantive changes are expected in a second policy paper in the second quarter of next year covering a minimum capital “floor” for lenders that use their own calculation models, which is expected to cut the capital hit further.

“The second statement, due out in Q2 next year, will be much more important for firms’ ability to boost the UK’s economic growth through lending,” said Simon Hills, director of prudential policy at UK Finance, a banking industry body.

Tuesday’s statement includes an interim capital regime that small, domestic focused banks can apply as an alternative to Basel.

###

The Financial Services Forum is an economic policy and advocacy organization whose members are the chief executive officers of the eight largest and most diversified financial institutions headquartered in the United States. Forum member institutions are a leading source of lending and investment in the United States and serve millions of consumers, businesses, investors, and communities throughout the country. The Forum promotes policies that support savings and investment, financial inclusion, deep and liquid capital markets, a competitive global marketplace, and a sound financial system.

Visit our website: fsforum.com