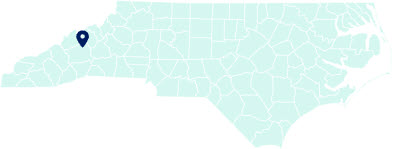

Charleston

Citi acted as lead advisor on behalf of The West Virginia Economic Development Authority as the authority issued $54 million of bonds to finance the cost of constructing, improving, and maintaining the state parks within West Virginia.

Huntington

In 2023, the West Virginia Economic Development Authority issued over $70 million in municipal bonds, underwritten entirely by Bank of America. The bonds aid in financing construction costs for a 418-unit student housing complex and a 123,850-square-foot recreation and wellness center at Marshall University.

Ripley

In 2023, the West Virginia Hospital Finance Authority issued $285.9 million in municipal bonds, partially underwritten by Bank of America, to finance renovation projects at several locations within the West Virginia University Health System. One of these projects is a two-story addition to Jackson General Hospital that will include a new emergency department, a surgical department, two operating suites and procedure rooms, and a floor of private rooms for inpatients.

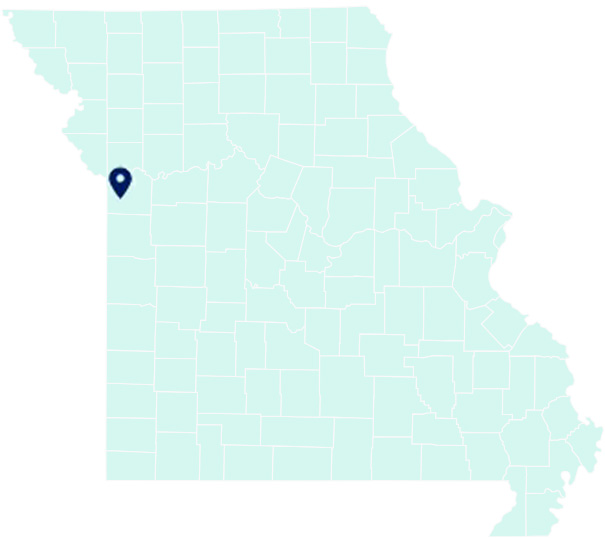

Milwaukee

In 2023, Milwaukee County issued $37.4 million in municipal bonds, underwritten by Citi, to support operations of the county’s airport system. The system includes Milwaukee Mitchell International Airport, Wisconsin’s largest and busiest airport.

In 2023, the City of Milwaukee issued $62 million in municipal bonds, underwritten by Morgan Stanley, to allow the city to increase its annual contribution to its Employes’ Retirement System.

In 2023, the Milwaukee Metropolitan Sewerage District issued $62 million in municipal bonds, underwritten by Citi, to finance the acquisition, leasing, design, construction, renovation and improvement of land, water, property, highways, buildings and equipment involved with the city’s sewerage system.

In 2024, the Milwaukee Area Technical College District issued $1.5 million in municipal bonds, underwritten by BNY. The bonds finance renovations and remodeling of the college’s buildings, projects that are part of the district’s 2023-2024 improvement program.

Seattle

In 2023, Citi Community Capital provided a $61.85 million construction loan and a $32.55 million permanent loan for the financing of the construction of Cedar Crossing, a mixed-income housing property. The 254-unit apartment complex reserves units for tenants with incomes ranging from 30% to 60% of the Area Median Income. Read More

Burlington

JPMorganChase provided philanthropic capital to Champlain Housing Trust, a Burlington-based community land trust. The funding helps Vermont residents overcome housing barriers through homebuying education, financial health education and coaching. Read More

The Vermont Housing Finance Agency issued $55.7 million in municipal bonds, partially underwritten by JPMorganChase and Morgan Stanley. The funds support affordable housing across Vermont, including single-family home purchases and multifamily developments like Post Apartments in Burlington.

Essex Junction

The Vermont Housing Finance Agency issued $55.7 million in municipal bonds, partially underwritten by JPMorganChase and Morgan Stanley. The funds support affordable housing across Vermont, including single-family home purchases and multifamily developments like Whitcomb Woods in Essex Junction.

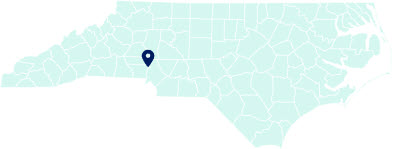

Ladson

In 2024, Dorchester County issued over $13 million in municipal bonds, underwritten by Wells Fargo, to finance a variety of infrastructure purchase and construction costs for the Oakbrook Redevelopment Project. A portion of the bonds will fund renovations at Oakbrook Middle School.

In 2024, Dorchester County issued over $13 million in municipal bonds, underwritten by Wells Fargo, to finance a variety of infrastructure purchases and construction costs for the Oakbrook Redevelopment Project. A portion of the bonds are being used to fund renovations at Oakbrook Elementary School.

In 2024, the City of North Charleston issued $29.4 million in municipal bonds, underwritten by Wells Fargo, to finance construction involved in the Ingleside Community Redevelopment Project. The project includes improvements to roads, traffic controls, street lighting, sidewalks, parks and recreation facilities, and construction of a new fire station.

North Charleston

In 2023, the Charleston County School District issued $40 million in municipal bonds, underwritten by Bank of America, to support the designing, constructing, and equipping of a replacement Morningside Middle School.

In 2023, the Charleston County School District issued $40 million in municipal bonds, underwritten by Bank of America, to support the purchase of land near Midland Park Primary School.

In 2023, the Charleston County School District issued $40 million in municipal bonds, underwritten by Bank of America. A portion of the bonds are dedicated to funding construction to expand Deer Park Middle School.

In 2023, the Charleston County School District issued $40 million in municipal bonds, underwritten by Bank of America. A portion of the bonds finance the designing, constructing, and equipping of a replacement A.C. Corcoran Elementary School.

In 2023, the Charleston Educational Excellence Financing Corporation issued $141.6 million in municipal bonds, underwritten by Wells Fargo, to partially refund a previous series of bonds that financed the acquisition, construction, renovation, and expansion of educational facilities in the Charleston County School District.

Summerville

In 2023, Dorchester County issued $18.9 million in municipal bonds, underwritten by Wells Fargo, to support roadway improvements and to fund the purchase, construction, and equipping of a 4,800 square-foot fire and EMS station.

In 2023, Dorchester County issued $28.2 million in municipal bonds, underwritten by Wells Fargo, to finance a series of upgrades to the county’s water and sewer system.

In 2024, Dorchester County issued over $13 million in municipal bonds, underwritten by Wells Fargo, to finance a variety of infrastructure purchases and construction costs for the Oakbrook Redevelopment Project. Plans include improvements to stormwater systems, water and sewer utilities, street lighting, bicycle trials, pedestrian paths and crosswalks, vegetative buffers, and landscaped medians. Improvements also include renovation and construction of public environmental, cultural, and recreational facilities.

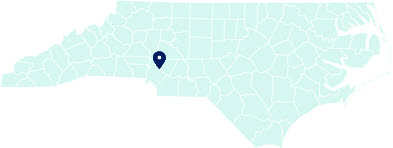

Las Vegas

In 2023, Clark County issued $200 million in municipal bonds, underwritten by JPMorganChase. The bonds support the Regional Transportation Commission of Southern Nevada in financing construction for major streets and highways.

In 2023, Clark County issued $43.7 million in municipal bonds, underwritten by Morgan Stanley, to upgrade and equip a fire station and fire training center.

In 2024, Clark County issued $150.9 million in municipal bonds, partially underwritten by Bank of America and Wells Fargo. The bonds finance extensions, replacements, and repairs to the county’s airport system.

North Las Vegas

In 2024, the Clark County School District issued $200 million in municipal bonds, underwritten by JPMorganChase, to obtain, construct, renovate, and equip school facilities.

Pahrump

In 2023, the Nye County School District issued $25.6 million in municipal bonds, underwritten by BNY, to fund the acquisition, construction, improvement, and equipping of school facilities.

Reno

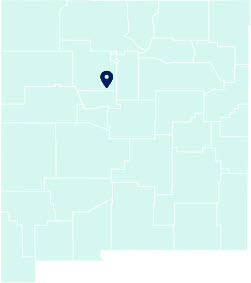

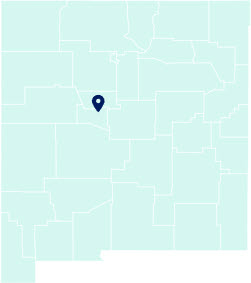

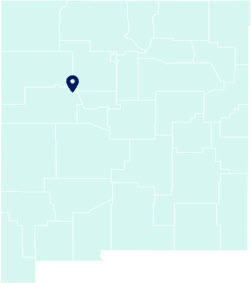

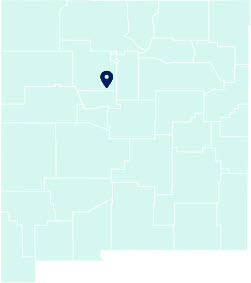

Bank of America and Morgan Stanley provided funding that supported United Way of North Central New Mexico’s efforts to strengthen economic stability and improve access to basic needs for families across the region. Their investments helped expand workforce readiness and job training, financial education and coaching, housing stability initiatives, and food security programs designed to support both immediate needs and long-term self-sufficiency. Read More

Arlington

State Street partnered with Leader Bank, an Arlington-based Minority Depository Institution, as part of the firm’s $100 million program to provide low-cost, stable deposit funding to Minority Depository Institutions and Community Development Financial Institutions. “We are honored to be partnering with State Street Bank and appreciate its ongoing commitment to supporting our broader mission to offer our clients creative financial products and customized solutions that allow them to achieve financial prosperity for themselves, their families, and their businesses,” said Sushil K. Tuli, chairman and chief executive officer of Leader Bank. Read More

Boston

Bank of America has set a new fundraising milestone, generating $50.4 million for charitable causes through its involvement in the 2025 Boston Marathon. This achievement brings the company’s total charitable contributions through the event to over $600 million since 1989. Read More

State Street employees volunteered at the Pine Street Inn, a nonprofit supporting homeless individuals in Greater Boston, and prepared nearly 4,000 meals. Read More

The Bank of America Boston Marathon Official Charity Program raised $45.7 million, contributing to the marathon’s record total of $71.9 million in charitable funds raised in 2024. The funds went toward nearly 160 non-profit organizations in the Greater Boston community. Read More

The Bank of America Sports with Us Clinic partnered with the Boston Athletic Association, the Patriots, and other local sports organizations to provide young athletes with a unique experience combining sports training and financial education. The event encouraged healthier lifestyles while helping participants build essential life skills like physical wellness, resilience, and money management. Read More

Holyoke

In 2024, the City of Holyoke issued $9.3 million in municipal bonds, underwritten by BNY. The bonds finance a variety of local utility renovations, including sidewalk and road improvements, new traffic signals, and water main replacement.

Southbridge

In 2024, the Town of Southbridge issued $6 million in municipal bonds, underwritten by BNY, to finance a fire station, road paving, and West Main Street sewer and water improvements.

Springfield

In 2024, the City of Springfield issued $3.8 million in municipal bonds, underwritten by BNY, to finance a variety of public projects, including renovations to the Cyr Skating Arena.

In 2024, the City of Springfield issued $3.8 million in municipal bonds, underwritten by BNY, to finance a variety of public projects, including the construction of a grandstand at the Walker Building.

In 2024, the City of Springfield issued $3.8 million in municipal bonds, underwritten by BNY, to finance a variety of public projects, one of which includes the construction of a new clubhouse at the Veterans Memorial Golf Course.

In 2024, the City of Springfield issued $3.8 million in municipal bonds, underwritten by BNY, to finance a variety of public projects, one of which involves constructing a new clubhouse at the Franconia Golf Course.

Weymouth

Morgan Stanley volunteers partnered with South Shore Stars to pack up and prepare Stars Camp for its next chapter. From moving picnic tables to breaking down equipment, their hands-on support marked a meaningful close to 50 incredible years of summer memories. Their efforts helped advance South Shore Stars’s mission to provide education and enrichment to youth across the community. Read More

Morgan Stanley volunteers partnered with South Shore Stars to pack up and prepare Stars Camp for its next chapter. From moving picnic tables to breaking down equipment, their hands-on support marked a meaningful close to 50 incredible years of summer memories. Their efforts helped advance South Shore Stars’s mission to provide education and enrichment to youth across the community. Read More

State Street volunteers teamed up with South Shore Stars to sort, screen, and organize nearly 900 donated books. These books will soon be placed into the hands of children participating in South Shore Stars’s Early Childhood, Preschool, and Afterschool programs, supporting literacy and learning across the community. Read More

State Street volunteers teamed up with South Shore Stars to sort, screen, and organize nearly 900 donated books. These books will soon be placed into the hands of children participating in South Shore Stars’s Early Childhood, Preschool, and Afterschool programs, supporting literacy and learning across the community. Read More

Baton Rouge

In 2023, Wells Fargo donated $10,000 to Outstanding Mature Girlz, a nonprofit organization committed to mentoring and teaching life skills to girls, as well as promoting community service in the Baton Rouge area. Read More

Monroe

JPMorganChase partnered with the Food Bank of Northeast Louisiana (Food Bank of NELA) to organize and support a meal-packaging event that helped prepare food for families in need amid rising food insecurity. Employees joined volunteers to package meals, contributing time and resources to increase access to nutritious food for local residents and support the community through direct volunteer action. The initiative reflected JPMorgan’s ongoing commitment to addressing hunger and strengthening communities through hands-on involvement with nonprofit partners. Read More

New Orleans

Bank of America will open five financial centers in New Orleans in 2025, bringing banking, investing, retirement, lending and small business services and solutions to more clients and communities. By expanding its retail footprint in the area, Bank of America is building on the $62 million in loans to small businesses and $1 billion to commercial business clients in the New Orleans/Baton Rouge area. Since 2018, the firm has invested nearly $550,000 in New Orleans/Baton Rouge through grants to local nonprofits, employee matching gifts and scholarship programs. Read More

JPMorganChase delivered a $1 million grant to the Financial Wellness Collaborative, a partnership of three nonprofit organizations — Propeller, Thrive New Orleans, and Fund 17 — to support local small business growth and increase access to capital in the Greater New Orleans region. The investment funded comprehensive services including financial coaching, credit counseling, loan package preparation, and technical assistance that helped undercapitalized entrepreneurs enhance financial health and secure funding. Read More

State Street partnered with Liberty Bank, a New Orleans-Based Community Development Financial Institution, as part of the firm’s $100 million program to provide low-cost, stable deposit funding to Minority Depository Institutions and Community Development Financial Institutions. “This partnership will help address community inequities and advance our financial inclusion and economic empowerment mission at Liberty Bank,” said Todd McDonald, president of Liberty Bank and Trust Company. Read More

The family-owned marine transportation operator, Canal Barge Company, is an integral partner in the New Orleans business base. President and CEO of Canal Barge Company, Merritt Lane III, recognized Chase bank as a valuable part of the company’s business and industry. “The bank, and its predecessors, has been our agent since the 1950s, collaborating and brainstorming with us. We have a relationship built on trust, local and mariner knowledge, and community,” Lane says. Read More

Westlake

JPMorganChase and Wells Fargo were key issuers in the $1.33 billion tax-exempt private activity bond financing that reached financial close to support the Calcasieu River Bridge Project on Interstate 10. The financing enabled the Calcasieu Bridge Partners consortium to proceed with a long-term 50-year concession to design, build, operate, and maintain the new bridge connecting Lake Charles and Westlake, replacing the more than 70-year-old structure and expanding critical regional infrastructure. Read More

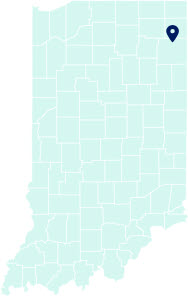

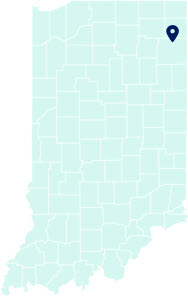

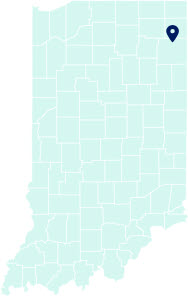

Fort Wayne

In 2024, Wells Fargo partnered with Habitat for Humanity of Greater Fort Wayne to install exterior wall coverings on homes in the community. Read More

Indianapolis

In 2023, Bank of America awarded a $200,000 grant to the Community Alliance of the Far East Side (CAFE), an Indianapolis-based community development organization. The grant helped revitalize CAFE’s after-school program that was inactive for 10 years. In addition, the funding supports CAFE’s day-to-day operations, staff salaries and additional events and programming for the kids they serve. Read More

Seymour

Guardian Bikes, a brand committed to protecting young riders, has secured $19 million in financing from JPMorganChase to establish the first large-scale bicycle frame manufacturing facility in the United States. Located in Seymour, Indiana, the new plant marks a significant milestone in reshoring a critical industry that was once a pillar of American manufacturing. Read More

Chicago

In 2023, JPMorganChase announced a $7.2 million philanthropic commitment to The Resurrection Project (TRP), an organization focused on transforming abandoned lots into affordable housing and hosting workshops on how to build credit and buy property. This commitment helps TRP with building or preserving more than 150 affordable housing residences throughout the Chicago area over the next three years. The funding also supports financial education programs and provides lending solutions for both first-time homebuyers and long-term homeowners. Read More

In 2023, JPMorganChase helped local developer, Carlos Nelson, build a health and community center in Auburn Gresham. The Auburn Gresham Healthy Lifestyle Hub (HLH) houses medical facilities, restaurants, pharmacies, and provides a space for community members to convene. Through the New Markets Tax Credit initiative, JPMorganChase supported the $18 million project by providing a $14.5 million equity investment. Read More

JPMorganChase announced its renovation plans for Chase Tower in Chicago. The project creates 970 local construction jobs – generating additional economic activity of $264 million for Cook County. Read More

JPMorganChase committed $650,000 to HIRE360, a Chicago-based organization that works across unions, apprenticeship schools, and construction industry firms to align job opportunities with eligible workers. The funding supports HIRE360’s job training center in the city’s South Loop, connecting women, veterans and underrepresented groups to good-paying careers in over 30 skilled trades. Read More

JPMorganChase has announced an $18 million commitment to the IFF, one of the nation’s largest nonprofit Community Development Financial Institutions. The investment includes a $15 million loan to expand lending to nonprofits and affordable housing developers, and a $3 million grant to support IFF’s Stronger Nonprofits Initiative, which provides capital, real estate access, and advisory services to mission-driven organizations. Read More

The 2024 Bank of America Chicago Marathon delivered a record-breaking $683 million boost to the Chicago Metropolitan Area economy. The event supported 4,589 full-time jobs, generating $229 million in wages and salaries for local residents—underscoring the marathon’s growing impact on economic development and employment in the region. Read More

The Wells Fargo Foundation provided a $500,000 grant to Neighborhood Housing Services of Chicago, Inc. (NHS) in support of its Chicago flats initiative. The goals of the initiative are to preserve and rehab two- and four-unit flats, maintain rental affordability, and help homeowners build wealth. The grant will help NHS connect homeowners and renters to available mortgage and rental assistance programs. Read More

Wells Fargo launched its Open for Business Growth program, a $20 million initiative designed to support small business owners, beginning with its first rollout in Chicago. Read More

With support from Wells Fargo’s $20 million small business initiative, Chicago restaurant startup Onigiri Koroin received $210,000 through a grant to Allies for Community Businesses. The flexible financing helped founder Yuta Katsuyama maintain cash flow, move to a new production space, and grow operations to serve more neighborhoods. Read More

Boise

Bank of America announced it will expand its financial center network into nine new markets by 2026, bringing banking, investing, retirement, lending and small business services and solutions to more clients and communities. The bank plans to open four financial centers in Boise in 2024. Read More

Wells Fargo sponsored the Avenues for Hope Challenge by the Home Partnership Foundation in Idaho, supporting organizations that provide housing and services to those in need. In 2024, Wells Fargo contributed $375,000 in matching funds, helping raise a total of $501,000 for 20 nonprofits. Read More

Mountain Home

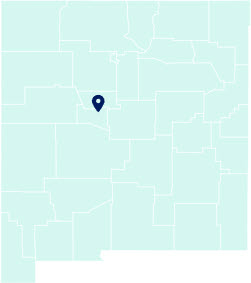

JPMorganChase provided a $6.4 million New Markets Tax Credit investment to build Desert Sage Health Centers’ new facility in Mountain Home. The center provides one-stop primary healthcare services for Elmore County’s 28,000 residents, many of whom work in agriculture and hold multiple jobs. “When we were planning for the new building—it was the spirit everyone had at JPMorganChase that made the difference,” CEO of Desert Sage Health Centers Mary Ferguson said. “You could tell this project is purposeful. It’s not just a transaction.” Read More

Nampa

Bank of America announced plans to open more than 150 financial centers across 60 markets by the end of 2027. In 2025, the bank will open four new financial centers in Idaho, starting with the first location in Nampa. Read More

Guam

Citi provided $75.25 million to finance the construction of three phases of Summer Town Estates, the first affordable housing community for seniors built in Guam in over 30 years and the first private affordable senior housing community in Guam ever. Totaling 399 units, the homes will be reserved for families and seniors earning no more than 60% of the area median income. The development also helps meet the demand for housing for people with special needs, with 20% of the homes set aside for residents with vision, hearing, and mobility impairments.

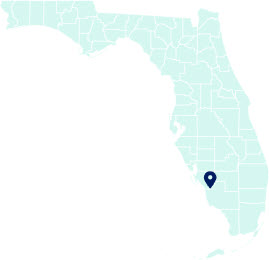

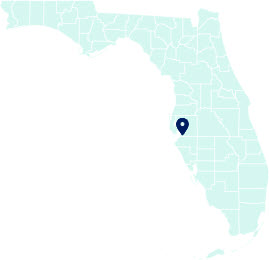

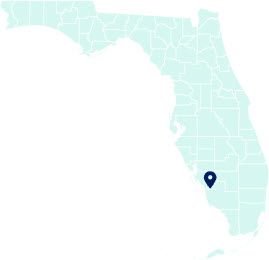

Bradenton

In 2023, Manatee County issued $175 million in municipal bonds, partially underwritten by Bank of America and Wells Fargo. The bonds finance projects to improve the county’s transportation, parks and recreation, and fleet and warehouse facilities.

In 2023, Manatee County issued over $190 million in municipal bonds, partially underwritten by Bank of America, JPMorganChase and Wells Fargo. The bonds support improvements, extensions, and additions to the county’s utilities system.

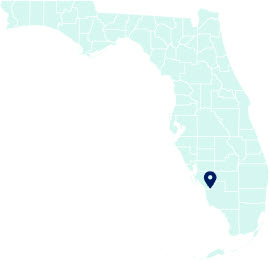

Cape Coral

In 2023, the City of Cape Coral issued $138 million in municipal bonds, partially underwritten by Morgan Stanley, Bank of America and Citi, to fund the improvement of various utilities, including the development and construction of potable water, wastewater, and irrigation water systems within the North 1 West Area.

In 2024, the City of Cape Coral issued $17.6 million in municipal bonds, underwritten by Wells Fargo, to finance the acquisition, construction and equipping of various park and recreational improvements in the city.

Fort Myers

In 2023, the City of Fort Myers issued $139 million in municipal bonds, partially underwritten by Bank of America. The bonds support improvements to the city’s utility system, which includes facilities for wastewater, irrigation, reclaimed water, and sewage treatment.

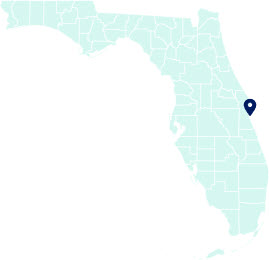

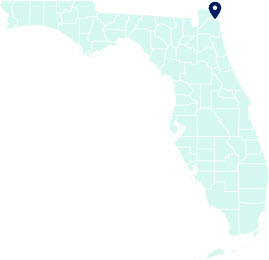

Jacksonville

The Wells Fargo Military Home Donation Program provided a mortgage-free condo to the widow of a U.S. Army sergeant who lost his life in action. Read More

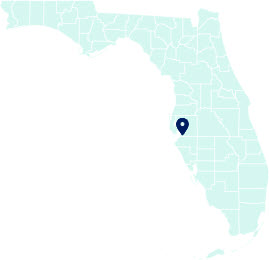

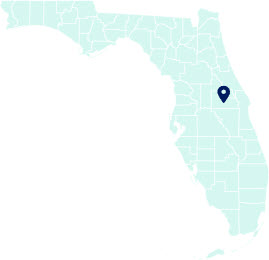

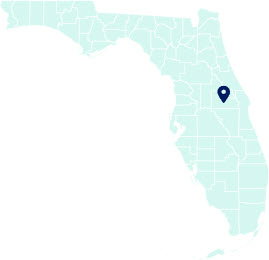

Kissimmee

In 2024, JPMorganChase awarded a $500,000 grant to CareerSource Central Florida to strengthen Osceola County’s semiconductor industry. The funding also supports the organization’s goal of training 100 individuals by the end of 2026. “CareerSource Central Florida is honored to receive this grant from JPMorganChase to support the advancement of workforce development for the semiconductor industry,” said Pamela Nabors, President and CEO of CareerSource Central Florida. Read More

Melbourne

In 2022, the city of Melbourne issued $35.0 million in municipal bonds, underwritten by Citi. The bonds will be used for financing the property acquisition, design, construction, and equipping of a new police headquarters facility within the city.

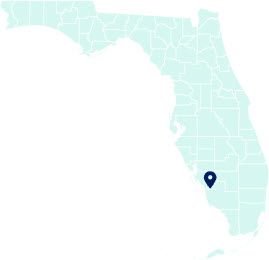

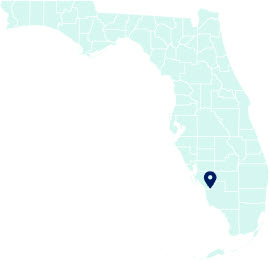

Miami

In 2024, Wells Fargo partnered with the Miami-Dade County’s Office of Innovation and Economic Development to launch the Strive305 Hub, an all-in-one resource platform designed to help small business owners connect with essential resources, community partners, and growth opportunities. Read More

The Citi Foundation announced its latest cohort of Community Progress Makers, an initiative that expands the impact of community organizations through unrestricted, trust-based funding. Branches, a Miami-Dade County-based recipient, will receive $1 million over three years to advance its financial wellness services and academic programs to low-income students and families. Read More

Wells Fargo’s Open for Business Fund has supported more than 336,000 small businesses and helped create over 461,000 jobs across the country. Among the recipients is Sara Agudelo, owner of Purple Orchid, who received a grant through the Miami Foundation that enabled her to expand her smoothie and salad chain in South Florida. Read More

With support from the Wells Fargo Foundation, the Business and Leadership Institute for Early Learning is empowering childcare providers in underserved Miami communities—like the Carter Academy—with the tools and training to build strong, sustainable businesses. Read More

Naples

In 2024, the Collier County Industrial Development Authority issued $200 million in municipal bonds, partially underwritten by JPMorganChase, to finance the design, construction and equipping of medical facilities at several locations of the NCH Healthcare System. These specialized facilities include a 200,000-square-foot cardiac and vascular center and a three-story orthopedic care and surgery center.

Orlando

In partnership with Universal Destinations & Experiences and Wendover Housing Partners, JPMorganChase helped transform affordable housing in Orlando. The firm provided $29.1 million to build Catchlight Crossings, a 1,000-unit community with on-site amenities, services, and access to transit and nearby jobs. Read More

In partnership with Universal Destinations & Experiences and Wendover Housing Partners, JPMorganChase helped transform affordable housing in Orlando. The firm provided $29.1 million to build Catchlight Crossings, a 1,000-unit community with on-site amenities, services, and access to transit and nearby jobs. Read More

Palm Bay

In 2024, Wells Fargo awarded a $300,000 grant to Space Coast Habitat for Humanity and Macedonia CDC to support the construction, appliances, and furnishings for two affordable housing units. Read More

Riverview

In 2023, Hillsborough County issued $53.4 million in municipal bonds, underwritten by Bank of America, to finance the obtainment, preservation, and restoration of environmentally vulnerable sites.

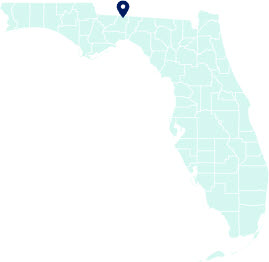

Tallahassee

In 2023, Wells Fargo donated $500,000 to Volunteer Florida’s Florida Disaster Fund to aid in the aftermath of Hurricane Idalia and the emergency response, including shelter, supply, and services for those displaced. “We are grateful for Volunteer Florida’s leadership in local relief efforts and its ability to offer essential services in the wake of the devastation. Our donation is aimed at expanding its capacity to reach those who need it most,” said Wells Fargo CEO Charles Scharf. Read More

Juneau

Wells Fargo and Enterprise Community Partners announced the winners of the 2023 Housing Affordability Breakthrough Challenge, a $20 million national initiative that advanced innovative solutions to expand affordable housing nationwide. One recipient, Juneau-based Tlingit Haida Regional Housing Authority, pioneered a housing model that bridged traditional mortgages and the unique financial needs of rural Alaska, expanding homeownership for low-income tribal citizens on tribal lands. Read More

Soldotna

In 2023, the Alaska Municipal Bond Bank issued $86.5 million in municipal bonds, partially underwritten by Wells Fargo. $10 million of the bonds support construction costs for a new recreational field house in the City of Soldotna.

In 2023, the Alaska Municipal Bond Bank issued $86.5 million in municipal bonds, partially underwritten by Wells Fargo. Over $50.3 million of the issuance is going toward improving educational facilities borough-wide and constructing a new Central Emergency Services station on the Kenai Peninsula.

Wrangell

In 2023, the Alaska Municipal Bond Bank issued $86.5 million in municipal bonds, partially underwritten by Wells Fargo. A portion of the funds support construction and equipment costs for renovations at Evergreen Elementary School, Stikine Middle School, and Wrangell High School.

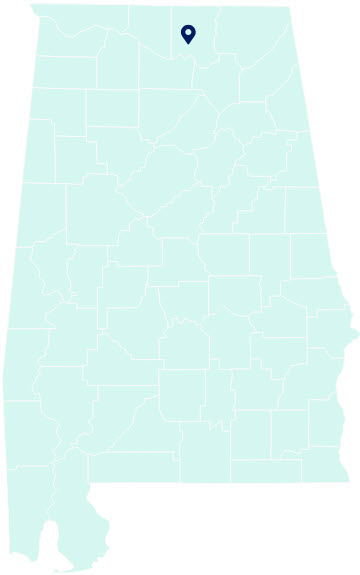

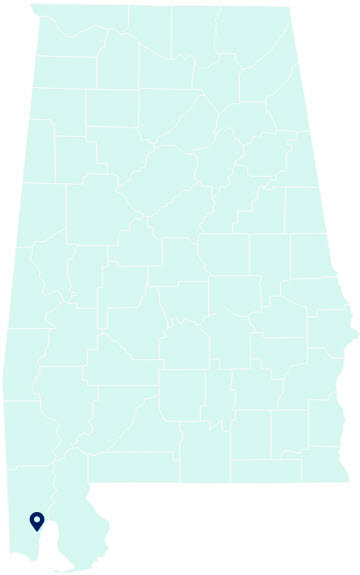

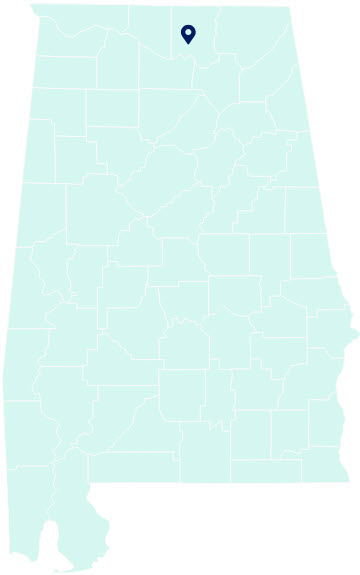

Birmingham

JPMorganChase has committed $2 million to launch the Alabama Capital Access Collaborative, a statewide initiative to help small businesses thrive. The program improves access to capital, supports entrepreneurs in running their businesses more efficiently, and provides technical assistance to local capital providers. A cohort of Birmingham-based lenders, including the Birmingham Business Resource Center, will participate in the effort. Read More

In 2023, The Wells Fargo Foundation and Enterprise Community Partners awarded $3 million to BuildUp, a Birmingham-based community school that offers paid internships and industry-aligned coursework to low-income high school students. The three-year grant helps BuildUp expand to new sites in Alabama and expand its house donation/relocation program. Read More

Bank of America announced it will expand its financial center network into nine new markets by 2026, bringing banking, investing, retirement, lending and small business services and solutions to more clients and communities. The bank will open its first financial center in Birmingham in 2024, with plans to open five by the end of 2026. Read More

JPMorganChase has committed $2 million to launch the Alabama Capital Access Collaborative, a statewide initiative to help small businesses thrive. The program improves access to capital, supports entrepreneurs in running their businesses more efficiently, and provides technical assistance to local capital providers. A cohort of Birmingham-based lenders, including Bronze Valley, will participate in the effort. Read More

Montgomery

In 2023, Wells Fargo sponsored the Alabama Legal Food Frenzy, a statewide competition among law firms and legal organizations to support Alabama’s regional food banks. Wells Fargo donated $20,000, which helped provide nearly 350,000 meals to food insecure people in the state. Read More

Huntsville

JPMorganChase has committed $2 million to launch the Alabama Capital Access Collaborative, a statewide initiative to help small businesses thrive. The program improves access to capital, supports entrepreneurs in running their businesses more efficiently, and provides technical assistance to local capital providers. A Huntsville-based lender, Neighborhood Concepts, will participate in the effort. Read More

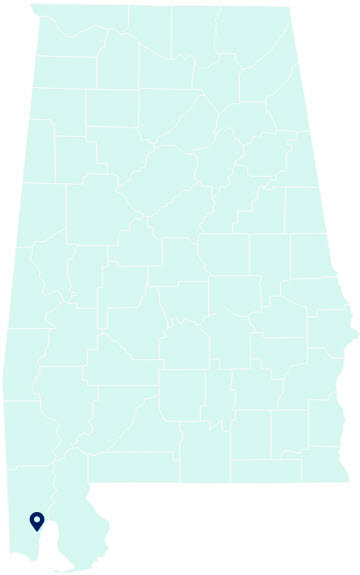

Mobile

The Alabama Federal Aid Highway Finance Authority issued $650 million in municipal bonds, partially underwritten by Bank of America, Wells Fargo, and Goldman Sachs to finance road and bridge improvements. The funding helps construct two bridges along Interstate 10, including one crossing the Mobile River and another replacing existing Bayway bridges.

Goldman Sachs committed $3 million to community development financial institutions supporting small business owners in Alabama. In partnership with HOPE, the firm will also deploy $20 million to support small businesses across the rural South. “We are proud to partner with additional Alabama-serving CDFIs and Goldman Sachs to advance entrepreneurial growth across the state,” said Bill Bynum, CEO of HOPE. Read More

JPMorganChase has committed $2 million to launch the Alabama Capital Access Collaborative, a statewide initiative to help small businesses thrive. The program improves access to capital, supports entrepreneurs in running their businesses more efficiently, and provides technical assistance to local capital providers. A Mobile-based lender, Commonwealth National Bank, will participate in the effort. Read More

Auburn

Bank of America announced a $250 million national commitment over five years to fight hunger and support basic needs in local communities, delivering $5 million in immediate funding to nearly 100 nonprofit organizations and $240,000 to hunger-relief groups across New England. As part of this effort, Good Shepherd Food Bank, Maine’s largest hunger relief organization serving more than 400 partner agencies statewide, received funds that helped expand the distribution of fresh produce and pantry staples, extend meal programs, and strengthen logistical capacity to reach more households ahead of the holiday and winter seasons. The investment supported enhanced food security and community resilience for families facing increased need in Maine. Read More

Belfast

Bank of America awarded a $50,000 grant to the Belfast Soup Kitchen to support its efforts to address food insecurity in Maine. The funding helped the organization expand access to nutritious meals, purchase food and supplies, and sustain daily operations as demand for services increased. Read More

Brunswick

In Maine’s midcoast region, where homelessness is reaching crisis levels, Tedford Housing is stepping up—and Bank of America is backing them. Named the local Neighborhood Champion, Tedford Housing received a $50,000 grant, leadership training, and access to a national nonprofit network to help scale its impact. Serving 40 towns and 150,000 residents, Tedford Housing is expanding its shelter capacity by 60% with a new facility in Brunswick. “So many more people in the Midcoast are struggling today who never imagined they would need assistance,” said Andrew Lardie, Tedford’s executive director. “This funding will allow us to expand our reach and enhance the quality of services in our new facility.” Read More

In Maine’s midcoast region, where homelessness is reaching crisis levels, Tedford Housing is stepping up—and Bank of America is backing them. Named the local Neighborhood Champion, Tedford Housing received a $50,000 grant, leadership training, and access to a national nonprofit network to help scale its impact. Serving 40 towns and 150,000 residents, Tedford Housing is expanding its shelter capacity by 60% with a new facility in Brunswick. “So many more people in the Midcoast are struggling today who never imagined they would need assistance,” said Andrew Lardie, Tedford’s executive director. “This funding will allow us to expand our reach and enhance the quality of services in our new facility.” Read More

Gorham

Morgan Stanley provided $160 million in tax equity financing to support two utility-scale battery energy storage system projects in New England, including a $65 million investment in the Cross Town Energy Storage facility in Gorham. The Cross Town project, designed to deliver 175 megawatts of capacity and 350 megawatt-hours of storage, was funded in part by Morgan Stanley’s capital and helped advance grid reliability, support integration of renewable generation, and increase energy resilience for the region’s electricity system. Read More

South Portland

Bank of America awarded a $50,000 Neighborhood Champion grant to Special Olympics Maine to support the organization’s efforts to expand inclusive sports and wellness programming for individuals with intellectual disabilities. The funding helped Special Olympics Maine enhance athlete training, increase access to competitions and community events, and strengthen volunteer and coaching resources, contributing to broader community engagement and improved health and well-being for participants across the state. Read More

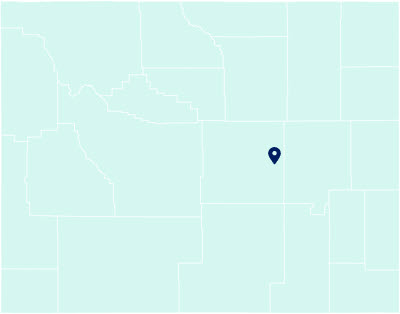

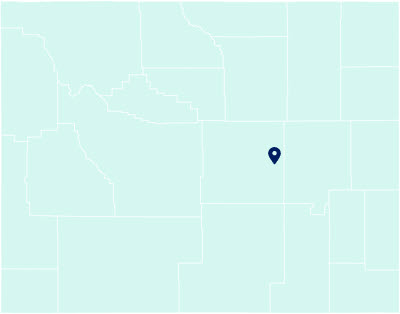

Casper

In 2023, the Wyoming Community Development Authority issued $153.5 million in municipal bonds, partially underwritten by Bank of America, to finance and refinance loans supporting the state’s Single Family Mortgage Program.

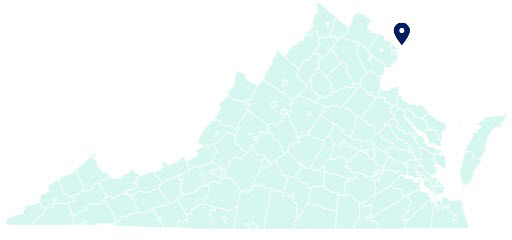

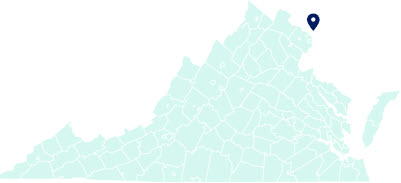

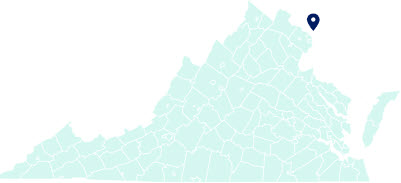

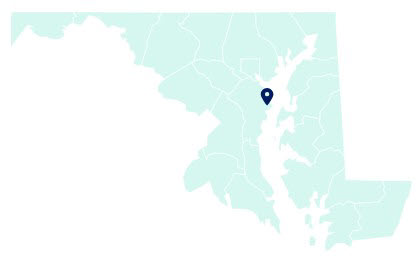

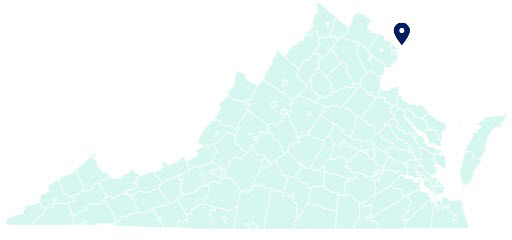

Alexandria

In 2023, the City of Alexandria issued $246.6 million in municipal bonds, underwritten by Bank of America, to fund various public improvement projects, benefitting city parks and buildings, school facilities, the redevelopment of the Landmark Mall site, and the Washington Metropolitan Area Transit Authority.

In 2024, the City of Alexandria, Virginia, Sanitation Authority issued $45.7 million in municipal bonds, partially underwritten by Wells Fargo, to fund multiple initiatives to upgrade the city’s sanitation systems. Initiatives include the Solids Upgrade Program, which will improve the handling, disposal, and reduce the volume of solids, the Preliminary and Primary System Upgrades Project to replace aging treatment systems, and the Tertiary Systems Upgrade Project, which will repair and replace filters, settling tanks, and chemical treatment systems.

The Citi Foundation announced its latest cohort of Community Progress Makers, an initiative that expands the impact of community organizations through unrestricted, trust-based funding. Community Lodgings, an Alexandria-based recipient, will receive $1 million over three years to advance its programs that lift low-income families from homelessness and housing instability, including transitional housing, affordable housing, and youth education. Read More

Arlington

Bank of America awarded $200,000 to Arlington-based Kitchen of Purpose through its Neighborhood Builders Award. Kitchen of Purpose helps unemployed immigrants start culinary careers and businesses while promoting healthy lifestyles. Read More

Reston

Citi donated over $6.6 million in support of education-focused non-profit organizations as part of its “e for education” campaign. The selected non-profit organizations focus on tackling childhood illiteracy and improving access to quality education. One recipient is Reston-based Fallen Patriots, an organization dedicated to educating children who have lost a parent in the U.S. military. Read More

Richmond

Bank of America is providing a $35 million construction loan to help lower utility bills for residents of a new affordable housing development in Henrico County, known as The Helios. Funding from the bank is supporting the construction of on-site solar power generation that will significantly reduce utility and electric costs for residents. Read More

JPMorganChase has committed $780,000 in philanthropic capital to expand services for entrepreneurs in Richmond. This includes a $400,000 grant to the Metropolitan Business League to enhance access to Richmond’s free online resource hub—connecting small business owners with tools to grow and succeed. Read More

JPMorganChase has invested $780,000 in philanthropic capital to expand services for entrepreneurs in Richmond. This includes a $150,000 grant to the Virginia Hispanic Foundation to expand access to training and technical assistance, one-on-one mentoring, and access to capital for local small businesses. Read More

JPMorganChase has invested $780,000 in philanthropic capital to expand services for entrepreneurs in Richmond. This includes a $230,000 grant to Local Initiatives Support Corporation Virginia to assess and strengthen the tools entrepreneurs need to succeed. Read More

Salt Lake City

Goldman Sachs celebrated the 1,000th graduate of its 10,000 Small Businesses program in Salt Lake City, in partnership with Salt Lake Community College. The 35th cohort included nearly 30 entrepreneurs. The local alumni represent over $2 billion in revenue and 24,000 jobs, highlighting the firm’s impact on regional economic growth. Read More

Goldman Sachs partnered with Salt Lake Community College to provide an advanced education program for small business owners. For over a decade, the Goldman Sachs 10,000 Small Businesses program has helped entrepreneurs nationwide grow their businesses by offering a free, practical business training program, access to capital and personalized support services. Read More

Sandy

As part of its 25th anniversary in Salt Lake City, Goldman Sachs 10,000 Small Businesses celebrated a major milestone—its 1,000th program graduate in the city. “Goldman Sachs has been a key pillar in the Salt Lake community for 25 years, and10,000 Small Businesses has helped to equip entrepreneurs in the city with the tools they need to increase revenue, drive innovation and employ thousands of Utahns,” said Governor Spencer Cox. Read More

Alvarado

Wells Fargo continues its commitment to supporting veterans and their families. In partnership with Warriors Support, the firm provided a mortgage-free home in Alvarado to Retired U.S. Army Specialist Carl Reiher and his family. Read More

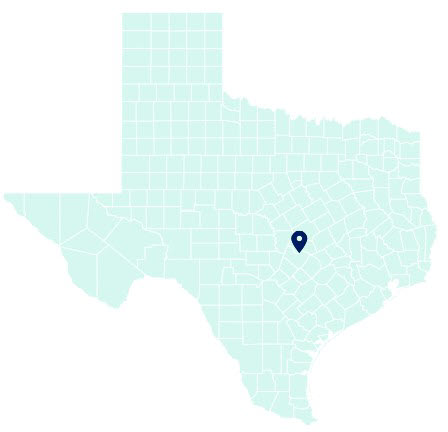

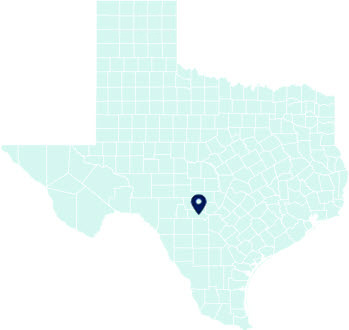

Austin

Bank of America awarded a $125,000 grant to St. Edward’s University to support low-income students. The university will use the funding to provide economic mobility and workforce development support, with a focus on building pathways for low-income students. Moreover, the funding will support mentoring programs. Read More

In response to the catastrophic flooding across Central Texas, JPMorganChase has committed $1 million in philanthropic support to aid relief and recovery efforts. The firm is also matching employee donations dollar-for-dollar to the Central Texas Food Bank. Read More

The Wells Fargo Foundation committed $500,000 in grant funding to Austin-based nonprofit Mobile Loaves & Fishes to build 3D-printed designs to serve the underhoused community. Read More

Wells Fargo has committed $1 million to support immediate relief and long-term recovery efforts following the tragic flooding in Texas. A portion of the funding will aid the Austin Disaster Relief Network, helping provide critical resources to affected communities. Read More

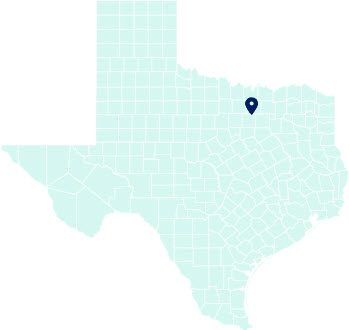

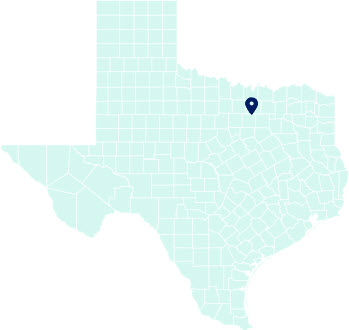

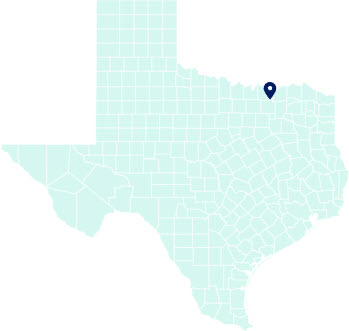

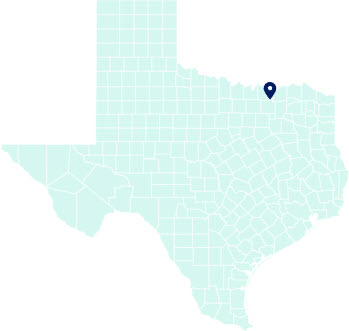

Dallas

For over a decade, JPMorganChase has partnered with Carry The Load, a Dallas-based nonprofit that encourages individuals to actively remember the true meaning of Memorial Day. As a title sponsor, the firm has supported hundreds of Memorial May events across the U.S. Read More

Founder of HD Waste & Recycling, Diana Martinez, expanded her two-truck waste management company into a multi-million-dollar business with help from JPMorganChase. In 2013, Martinez connected with a local analyst who helped her secure a loan to expand her fleet. Today, the company has 42 employees and over 30 trucks, serving thousands of clients across the Dallas-Fort Worth region. “I tell other women: It’s a lot of work. But you can do it if you put in the effort and have the right people to guide you,” Martinez says. Read More

In 2023, Goldman Sachs broke ground on its Dallas Campus, with the capacity to have more than 5,000 people employees working in its new building. The project also supported opportunities to work with small, diverse, and local talent as part of the firm’s supplier diversity goals. Read More

In 2023, JPMorganChase invested $500,000 in Builders of Hope CDC, a nonprofit that creates affordable homeownership and housing options for residents in Dallas County. This funding supported the creation of a data-based toolkit, which aims to keep homeownership affordable and accessible for residents amidst real estate booms. Read More

In 2023, JPMorganChase invested $6 million in philanthropic capital to The Real Estate Council (TREC), a commercial real estate organization focused on South Dallas neighborhoods that are vulnerable to rapid transition. TREC works to ensure more accessible homeownership for low-income families and that property remains in the hands of the community. Read More

Wells Fargo employees in the Dallas-Fort Worth area joined ZeroMils’ “Uniting in Service: Military Thriving Dallas” event to support the military and veteran community. Volunteers assembled 2,500 care packages, which were delivered to deployed service members, military families, veterans, and first responders. Read More

Wells Fargo is investing $500,000 in local entrepreneurs through The Good Soil Forum’s Seed Capital Pitch Competition in Dallas. In addition to funding opportunities, participants will gain access to expert mentorship and a robust network of industry leaders and like-minded peers. Read More

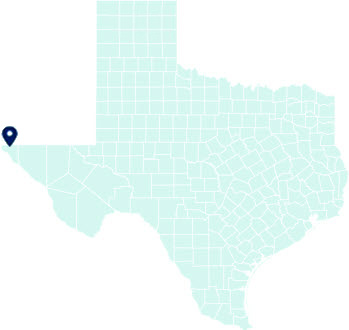

El Paso

Bank of America provided a grant to Project ARRIBA, Advanced Retraining and Redevelopment Initiative in Border Areas, which connects residents of El Paso with resources that can prepare them for higher education and train them for careers like health care, information technology, and more. Bank of America provided a grant that supports Project ARRIBA’s partnership with El Paso Community College, University of Texas at El Paso School of Nursing, and Texas Tech School of Nursing to train 425 women for jobs in healthcare. Read More

Fort Worth

JPMorganChase has invested $3.75 million in the Tarrant To & Through Partnership to expand opportunities for Texas students. In 2023, the firm contributed $750,000 to fund the Pathways to Careers digital platform, which helps students explore careers and potential earnings. Read More

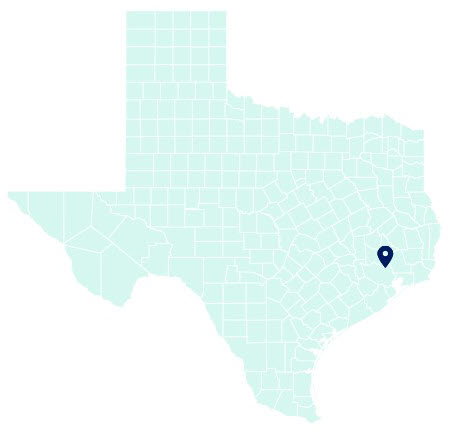

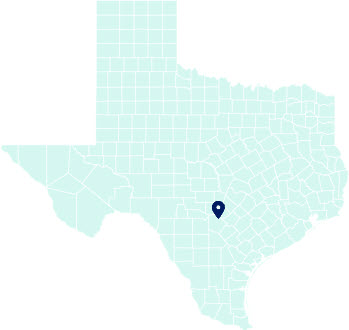

Houston

Bank of America is partnering with Operation HOPE and announced they will offer free financial counseling in 180 financial centers in 17 U.S. markets in 2023, including Houston. This Operation HOPE program, known as Hope Inside, offers in-person financial health coaching sessions to help individuals build savings, improve FICO (credit) scores, and decrease debt. Read More

Bank of America, Citi, JPMorganChase, and Wells Fargo offer Bank On certified accounts to improve the financial stability of unbanked and underbanked individuals in communities across the country, including Houston. Bank On coalitions are locally-led partnerships that work together to connect people to safe and affordable bank accounts, raise public awareness, target outreach to unbanked and underbanked, and expand access to financial education. Read More

Kerrville

In response to the devastating flooding across Central Texas, Bank of America has pledged $1 million to support relief and recovery efforts. This includes a $250,000 donation to the Community Foundation of the Texas Hill Country, helping provide immediate aid and long-term recovery resources to affected communities. Read More

McKinney

Twenty years ago, founder of natural skincare company FarmHouse Fresh, Shannon McLinden, was able to secure the financial flexibility FarmHouse Fresh needed to grow through JPMorganChase’s business credit line. “Having access to a credit line that grew with us really helped us take on more opportunities and risks and ultimately set up the business for success,” McLinden says. Now, the company is a thriving natural skincare business with $50 million in annual sales and almost 80 employees. The company also donates 10 percent or more of its profits to animal rescue organizations and to provide critical care for the farm animals at its sanctuary. Read More

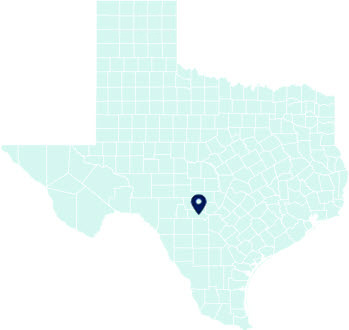

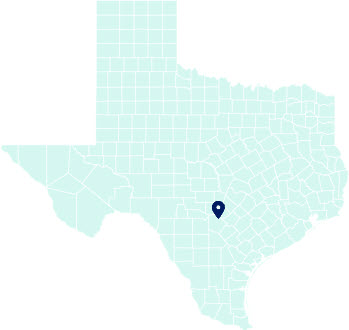

San Antonio

Bank of America is partnering with Operation HOPE and announced they will offer free financial counseling in 180 financial centers in 17 U.S. markets in 2023, including San Antonio. This Operation HOPE program, known as Hope Inside, offers in-person financial health coaching sessions to help individuals build savings, improve FICO (credit) scores, and decrease debt. Read More

In 2023, the Bexar County Hospital District issued $188 million in municipal bonds, partially underwritten by JPMorganChase, for a variety of improvement projects to the University Health system. Projects include acquiring and reconstructing hospitals, medical offices, public health buildings, and purchasing the necessary technology and software to equip those facilities. Improvements also involve the construction of parking garages and the purchase of corresponding property, supplies, equipment, and machinery.

In 2024, the City of San Antonio issued $1.1 billion in municipal bonds, partially underwritten by Wells Fargo, to finance constructing, expanding, repairing, and maintaining the city’s electric and gas systems.

In 2024, the City of San Antonio, Texas Education Facilities Corporation issued $67.2 million in municipal bonds, partially underwritten by Wells Fargo, to finance renovations to several facilities at Trinity University. Campus renovations will include the University’s Welcome Center, an event space building, and residence halls.

In response to the catastrophic flooding across Central Texas, JPMorganChase has committed $1 million in philanthropic support to aid relief and recovery efforts. The firm is also matching employee donations dollar-for-dollar to the Community Foundation of the Texas Hill Country. Read More

Nashville

Bank of America launched a national initiative to expand access to soccer by investing in six community soccer parks across the U.S., in partnership with Street Soccer USA and Visa, including one in Nashville, Tennessee. The initiative aims to bring people together, foster youth development, and strengthen community ties through sport and purpose-driven programming. Read More

In 2023, the Health and Educational Facilities Board issued over $145 million in municipal bonds, partially underwritten by Bank of America, to finance facility improvements and expansions at several Vanderbilt University Medical Centers. Projects include the construction of a tower at Vanderbilt University Hospital, which will hold 180 adult inpatient beds and 10 operating rooms.

In 2023, the Health and Educational Facilities Board issued over $145 million in municipal bonds, partially underwritten by Bank of America, to finance facility improvements at several Vanderbilt University Medical Centers. One of these projects involves expanding two floors of Monroe Carell Jr. Children’s Hospital at Vanderbilt to make 76 additional beds available.

In 2023, the Metropolitan Sports Authority of Nashville issued $705.4 million in municipal bonds, partially underwritten by Goldman Sachs and JPMorganChase, to aid in financing the New Nissan Stadium. The bonds will support the design, engineering, construction, and furnishing of the stadium, which will be the new home of the Tennessee Titans NFL team and will host other entertainment, sporting, and civic events.

In 2024, the Metropolitan Government of Nashville and Davidson County issued $366.7 million in municipal bonds, partially underwritten by Bank of America and JPMorganChase, to finance construction to improve and expand the area’s electricity system.

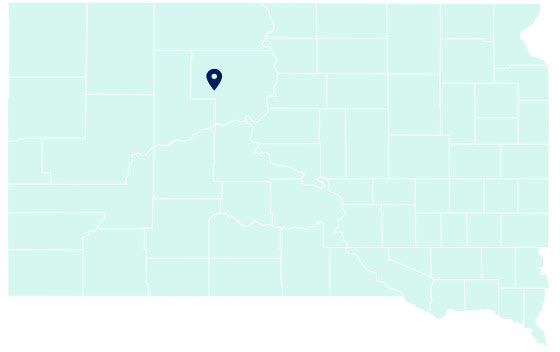

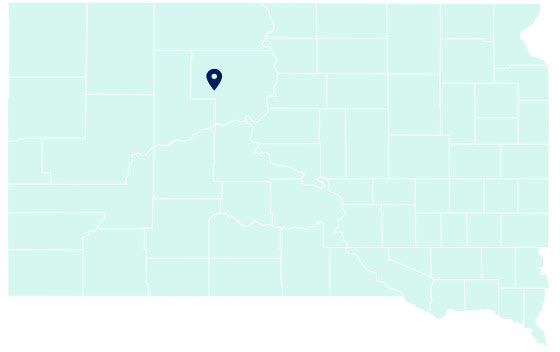

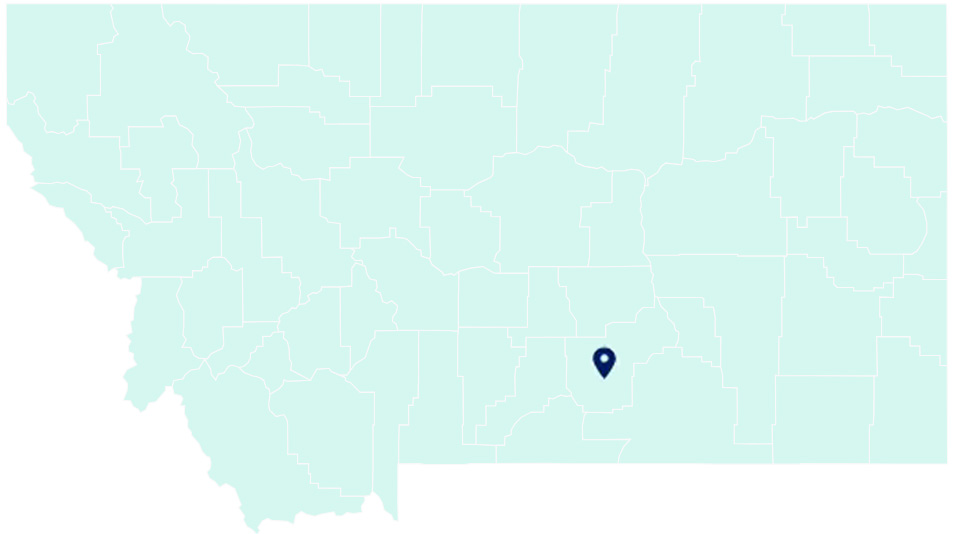

Eagle Butte

In 2023, Wells Fargo launched a $20 million program, Invest Native Initiative, to work with Native-led organizations and advance economic opportunities in Native American communities. Wells Fargo provided $500,000 to Eagle Butte-based economic opportunity organization, Four Bands Community Fund, and worked with the Mountain I Plains Regional Native Community Development Financial Institution Coalition to increase capital to Native entrepreneurs and drive small business growth. Read More

Wells Fargo is proud to celebrate its $1 million philanthropic investment in partnership with Akiptan, Inc. This funding is dedicated to helping rural and Native small businesses thrive across the state by expanding access to capital and expertise. The initiative opens new pathways for economic growth and community development throughout South Dakota. Read More

Wells Fargo is proud to celebrate its $1 million philanthropic investment in partnership with Akiptan, Inc. This funding is dedicated to helping rural and Native small businesses thrive across the state by expanding access to capital and expertise. The initiative opens new pathways for economic growth and community development throughout South Dakota. Read More

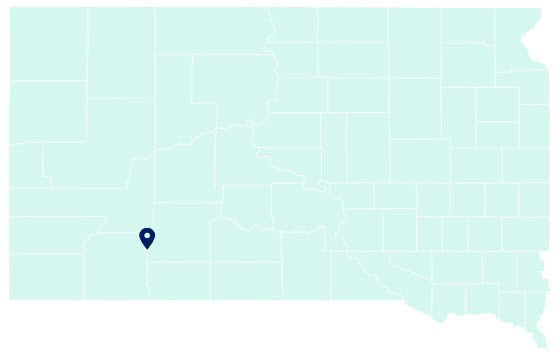

Kyle

In 2023, Wells Fargo launched a $20 million program, Invest Native Initiative, to work with Native-led organizations and advance economic opportunities in Native American communities. Wells Fargo provided $500,000 to a Kyle-based Native American Community Development Financial Institution, Lakota Fund, and worked with the South Dakota Homeownership Coalition to expand homeownership in Native American communities across South Dakota. Read More

Sisseton

Wells Fargo is proud to celebrate its $1 million philanthropic investment in partnership with GROW South Dakota. This funding is dedicated to helping rural and Native small businesses thrive across the state by expanding access to capital and expertise. The initiative opens new pathways for economic growth and community development throughout South Dakota. Read More

Wells Fargo is proud to celebrate its $1 million philanthropic investment in partnership with GROW South Dakota. This funding is dedicated to helping rural and Native small businesses thrive across the state by expanding access to capital and expertise. The initiative opens new pathways for economic growth and community development throughout South Dakota. Read More

Brooklyn Park

Since 1977, Wells Fargo has been a leading partner of BestPrep, a Brooklyn Park-based organization that provides education programs to young students. Support from Wells Fargo helps expand BestPrep’s financial literacy programs to underrepresented students. Read More

Minneapolis

JPMorganChase announced $20 million in new philanthropic funding to organizations across the country working to expand homeownership for underserved communities. Build Wealth MN, a Minneapolis-based recipient, received $3 million and will expand access to homebuyer education, affordable mortgage and downpayment assistance, and a matched savings account for Black homeowners. Read More

The Wells Fargo Foundation announced a $3.2 million grant to help accelerate affordable housing access, small business growth, and workforce development in North Minneapolis. The grant is funding BuildWealth MN’s Family Stabilization Program, which provides coaching to local families to increase savings, build credit, and buy homes. Read More

The Wells Fargo Foundation announced a $3.2 million grant to help accelerate affordable housing access, small business growth, and workforce development in North Minneapolis. The grant is funding NEON Collective Kitchens, an initiative to provide food entrepreneurs with kitchen spaces, food storage, packaging facilities, and event spaces. Read More

The Wells Fargo Foundation announced a $3.2 million grant to help accelerate affordable housing access, small business growth, and workforce development in North Minneapolis. The grant is funding Northside Forward, an initiative aimed at creating more than 1,200 new jobs, businesses, and affordable homes. Read More

The Wells Fargo Foundation announced a $3.2 million grant to help accelerate affordable housing access, small business growth, and workforce development in North Minneapolis. The grant is funding Summit Academy’s Training for In-Demand Careers, which offers certification trainings for careers in technology, construction, financial services, and healthcare fields. Read More

St. Cloud

Goldman Sachs partnered with St. Cloud Technical and Community College to bring its 10,000 Small Businesses program to the region and help small businesses grow. The first class of 32 cohorts included Donella Westphal, owner of Jules’ Bistro. “The energy is just really incredible, and I just feel so lucky to have been selected and to meet such amazing entrepreneurs from across the state. We’re all really excited to be part of this, and we’re already learning from each other,” Donella said. Read More

St. Paul

State Street partnered with Sunrise Banks, a St. Paul-based Community Development Financial Institution, as part of the firm’s $100 million program to provide low-cost, stable deposit funding to Minority Depository Institutions and Community Development Financial Institutions. “With this mission-based deposit through State Street, we will be able to invest in more projects and initiatives designed to empower financial wellness, foster inclusivity, and support economic growth,” said David Reiling, president and CEO of Sunrise Banks. Read More

Providence

Bank of America awarded a $200,000 grant over two years to the Junior Achievement of Rhode Island, an organization that works to provide financial literacy, work readiness and entrepreneurship programs to K-12 students. The multiyear grant funding strengthens programs and services that help enrich the education of young people. Read More

Bank of America awarded a $200,000 grant over two years to the Providence After School Alliance, an organization that works to expand high-quality, after-school and summer learning opportunities for Providence youth. The multiyear grant funding strengthens programs and services that help enrich the education of young people. Read More

Bank of America made a historic $3 million philanthropic investment in Trinity Repertory Company to support major capital improvements to the Lederer Theater Center in downtown Providence and strengthen artistic, educational, and community engagement programming. Of the total, $2.75 million funded renovations—including a five-story addition, new elevator access, and upgraded performance spaces—and $250,000 supported annual programs over the next five years, enhancing accessibility and sustainability for the state’s flagship theater. Read More

In 2023, the Wells Fargo Foundation invested $40,000 to Capital Good Fund, a Providence-based Community Development Financial Institution, in support of its financial coaching programs. The grant funding helped expand access to financial coaching to 500 low-income families. Read More

San Juan

Bank of America and Vital Voices Global Partnership brought together women leaders from the private sector, social enterprise and the nonprofit community in San Juan, Puerto Rico, for a weeklong initiative that connects women leaders in business and social enterprise to mentoring and expertise. The week focused on building organizational leadership and business acumen and enhancing skills in key areas such as financial and human resources management, business strategy, and communications.

In Puerto Rico, Citi invested in the Caño Martin Peña Community Land Trust that is aiming to help families secure a pathway to ownership and long-term affordability in the parts of San Juan hit hardest by Hurricane Maria. The Caño Martin Peña CLT focuses on a densely populated area of San Juan that is home to a disproportionate number of low-income residents. Citi’s investment aims to help families secure a pathway to ownership and long-term affordability. Since 2016, Citi has invested more than $1 million in housing assistance in Puerto Rico.

Philadelphia

In 2023, JPMorganChase announced its plan to contribute $5 million over three years to support economic development in the Kensington Neighborhood Commercial Corridor in North Philadelphia. In addition, the firm invested $3 billion in mortgage and small business lending and planned its expansion of retail branches. “We’re proud JPMorganChase is not only expanding its business into the Philadelphia region, but also investing in long-term economic solutions for the Kensington neighborhood,” Former Philadelphia Mayor Jim Kenney said. Read More

Wells Fargo donated $5 million to HomeFree-USA to aid first-time homebuyers in Philadelphia. Through its NeighborhoodLIFT program, the firm offers up to $15,000 in assistance and provides education and financial coaching for homeownership. Read More

Pittsburgh

BNY and Carnegie Mellon University announced a five-year, $10 million partnership to advance the research and development of artificial intelligence and prepare the next generation of leaders. This partnership allows BNY experts to work directly with the University students and faculty to participate in joint research, education projects, and talent recruitment. Read More

JPMorganChase announced $9.6 million in philanthropic commitments to organizations that help preserve homeownership by addressing heirs’ property issues, appraisal bias and the undervaluation of homes. Catapult Greater Pittsburgh, a community-based nonprofit, received $3 million and is providing a clinic to help people who do not have a legal title to their property in their name. Read More

Over the past decade, BNY has contributed $500 million to the city of Pittsburgh through the BNY Foundation of Southwest Pennsylvania. As a proud part of Pittsburgh for more than a century, BNY remains dedicated to revitalizing Downtown and strengthening its ties to the city. Read More

Forest Grove

Wells Fargo contributed to a $205,000 grant to Adelante Mujeres, a Forest Grove-based non-profit organization that empowers Latina women in Washington County. The grant supports the organization’s work to provide opportunities and education to Latina women and their families. Read More

Lincoln City

In 2023, Morgan Stanley financed the construction of Wecoma Place, a low-income housing tax credit project located in Lincoln City in response to the Echo Mountain Wildfire of 2020. The wildfire spanned over 2,500 acres north of Lincoln City and over 400 homes were lost. The construction of Wecoma Place provides one- and two-bedroom apartments for seniors, disabled persons, and families. Read More

Portland

In 2024, Bank of America sponsored 12 scholarships for the Small Business Management Program, a collaboration with the Portland Metro Chamber and Portland Community College. This initiative is designed to help both new and experienced business owners enhance revenue, improve operations, and hire talented employees. Read More

In 2024, JPMorganChase partnered with Habitat for Humanity Portland Region to build four playhouses. “Working alongside a team of compassionate individuals, we crafted more than just a structure. We built a place where children can dream, play, and reclaim a sense of normalcy and joy,” said Julie Campbell, JPMorganChase’s Executive Director/Market Director. Read More

In 2024, Wells Fargo partnered with Habitat for Humanity Portland Region to build a playhouse which will be donated to Wapato Island Farm in support of Native American youth. Read More

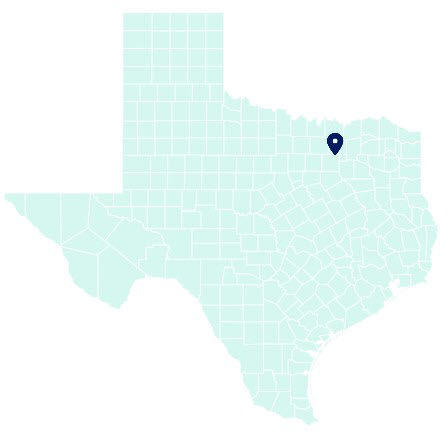

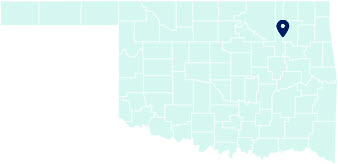

Bixby

In 2024, Independent School District No. 4 of Tulsa County issued $20.9 million in municipal bonds, underwritten by JPMorganChase, to fund an array of facility and equipment improvements at Bixby High School. Facility improvements include the construction and furnishing of Phase 3 of a new academic building with classrooms, offices, and arts and science labs. Improvements to existing facilities include new track locker rooms, stadium fencing, swimming pool repairs, and new instructional technology.

Hulbert

State Street partnered with Local Bank, a Hulbert-based Minority Depository Institution (MDI) and Community Development Financial Institution (CDFI), as part of the firm’s $100 million program to provide low-cost, stable deposit funding to MDIs and CDFIs. “From supporting small businesses to achieving homeownership and everything in between, we are confident that State Street’s deposit will create a long-lasting impact within the communities that we serve,” said Susan Plumb, chairman and chief executive officer of Local Bank. Read More

Oklahoma City

In 2022, Bank of America announced over $527,000 in grants to seven Oklahoma organizations to drive economic opportunities for individuals and families in Native American/Indian communities. Two recipients are the Oklahoma City Indian Clinic and the Regional Food Bank of Oklahoma. The Oklahoma Indian City Clinic is a nonprofit clinic that provides health and wellness services to American Indians in central Oklahoma. The Regional Food Bank provides food through a network of more than 1,300 community-based partner agencies and schools in 53 countries in central and western Oklahoma. Through this partnership, the organization will convert a warehouse into a fully operational, permanent food resource center. Read More

Tulsa

Wells Fargo collaborated with the T.D. Jakes Foundation to create opportunities for historically underrepresented communities with a philanthropic investment of $9 million to community-based organizations across the United States. Greenwood Rising, a Tulsa-based culture and history center, received $25,000 to support its educational programs. Read More

Akron

Citi Community Capital provided a $28 million construction loan and a $20.4 million permanent loan to finance the acquisition and rehabilitation of The Ericsson Apartments, a 240-unit project in Akron. The property’s affordability was preserved for an additional 20 years through a Housing Assistance Payment contract for all units. Read More

Cleveland

As part of Bank of America’s $1.25 billion five-year commitment to advance racial equality and economic opportunity, the firm is supporting the construction of CentroVilla25, a business and cultural hub slated to open in Cleveland’s Clark-Fulton neighborhood in 2024. This project supports the Northeast Ohio Hispanic Center for Economic Development’s mission to provide economic mobility for the Hispanic-Latino residents in the area. Read More

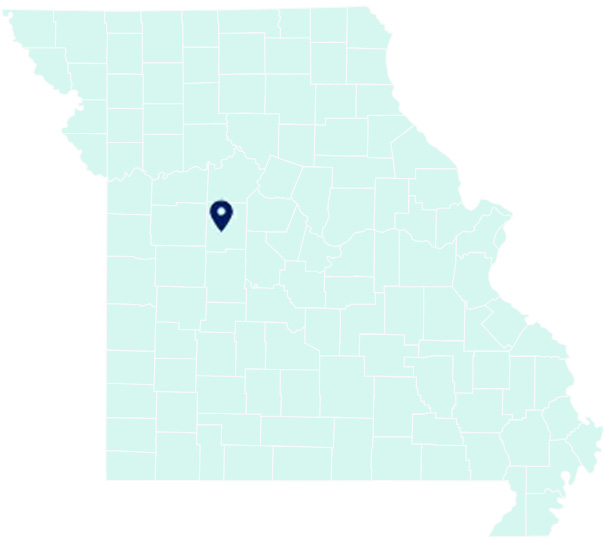

Columbus

In 2023, JPMorganChase announced a $3 million investment in The Columbus Urban League (CUL)’s Accelerate Her initiative, which provides education, support, access to capital, and contracting opportunities for women entrepreneurs and business owners to help them scale and grow. “The Accelerate Her initiative and the multi-year, multi-million-dollar investment by our partners at JPMorganChase will have a rippling and residual impact on the economic empowerment of Black women and a tremendous economic impact on the community as a whole,” said CUL President & CEO Stephanie Hightower. Read More

In 2023, JPMorganChase announced their $3 million commitment over the next three years in the Columbus Urban League (CUL), a resource for Black and urban communities that is dedicated to growing wealth, education, earning power and small businesses, while also supporting strong families. This commitment will fund CUL’s new program that aims to provide education, support and access to capital and contracting opportunities for 100 women entrepreneurs and business owners in Greater Columbus. Read More

JPMorganChase committed $2.1 million to four Columbus-based organizations to support a regional workforce collaborative that advances career pathways for individuals and families. This funding assists Ohio Excels, a nonprofit dedicated to enhancing Ohio’s education system, in providing project management support for the initiative. Read More

JPMorganChase committed $2.1 million to four Columbus-based organizations to support a regional workforce collaborative that advances career pathways for individuals and families. This funding enables One Columbus, an economic development organization, to lead the initiative by fostering collaboration among businesses, education institutions, and workforce partners. Read More

JPMorganChase committed $2.1 million to four Columbus-based organizations to support a regional workforce collaborative that advances career pathways for individuals and families. This funding enables the Columbus City Schools District to promote business opportunities for their high school redesign work. Read More

JPMorganChase is providing $10 million to the Affordable Housing Trust, a nonprofit dedicated to developing housing opportunities within the City of Columbus and Franklin County to increase the number of affordable housing units in the area. This long term, low-cost loan doubles down on the firm’s investments to power a stronger economy in Ohio by helping scale the supply of multi-family affordable housing units in the region. Read More

JPMorganChase’s Forward Program provides mentorship to small business owners and offers support on business challenges, such as financial modeling, e-commerce, and more. In 2023, Lisa Gutierrez, owner of Dos Hermanos, a Mexican-inspired food business in Columbus, worked with JPMorganChase’s volunteers to expand her services online. Together, they created and streamlined an app that is user-friendly for both guests and staff to engage in her business. Read More

Medina

Forty years ago, Medina-based Fire-Dex produced one product: leather gloves for welders. Today, the company manufactures protective gear for first responders and firefighters across the country. With capital support from JPMorganChase, Fire-Dex expanded its production capacity and bought the patent for its new line of firefighter gear. “JPMorganChase has always been there for us. I can’t say enough about their willingness to work with us and help us grow,” Fire-Dex owner and chairman Bill Burke says. Read More

Adams

In 2024, the South Jefferson Central School District issued $2.2 million in municipal bonds, underwritten by BNY, to finance the purchase of school buses.

Bronx

BNY collaborated with Ponce Bank, a Bronx-based Minority Depository Institution, as part of the U.S. Treasury Department’s Financial Agent Mentor-Protégé Program. This alliance supports Ponce Bank’s investment in local businesses and housing in underserved communities. Read More

JPMorganChase partnered with BronxWorks, an organization that provides supportive housing and social services to families and individuals. The firm’s $450,000 commitment supports the launch of BronxWorks Landlord Engagement Program, an initiative to educate and support small landlords who want to provide affordable housing in their communities. Read More

State Street partnered with Ponce Bank, a Bronx-based Minority Depository Institution, as part of the firm’s $100 million program to provide low-cost, stable deposit funding to Minority Depository Institutions and Community Development Financial Institutions. “Deposits from forward looking institutions like State Street help us bring financial equity to the underserved but highly deserving communities in and around New York City that we’ve been so proud to support for over 60 years,” said Carlos P. Naudon, President and CEO of Ponce Bank. Read More

Brooklyn

Bank of America announced four beneficiaries for its 2025 Small Business Spotlight Program, which offers New York-based small business owners support to reach new customers. A Brooklyn-based store that sells home essentials, Tribe & Oak, was selected to showcase its products at the Bank of America Winter Village at Bryant Park. Read More

Goldman Sachs is financing a $270 million affordable housing initiative in Brooklyn’s East New York neighborhood. The project will deliver 385 new apartments, bringing a major boost to the community. “This project is helping us fight the housing affordability crisis while also prioritizing improvements that will make the neighborhood more livable for families,” New York Governor Kathy Hochul said. Read More

In 2023, the NYC Housing Development Corportation issued $400.2 million in municipal bonds, partially underwritten by Bank of America, Morgan Stanley, Citi, JPMorganChase, and Wells Fargo. The bonds finance construction costs and mortgage loans for multi-family housing developments, plans which include improvements in Brooklyn neighborhoods.

In 2024, Bank of America announced four New York City-based small business beneficiaries of its Small Business Spotlight program, which offers local entrepreneurs and businesses support to reach new customers. A Brooklyn-based pet shop, What a Cutie, was selected to showcase its products at the Bank of America Winter Village at Bryant Park. Read More

The Goldman Sachs Urban Investment Group has deployed capital to support the second phase of an affordable housing development in Coney Island, which recently broke ground and is expected to deliver 420 new residences. Read More

Brownsville

Goldman Sachs, in partnership with Slate Property Group and RiseBoro Community Partnership, celebrated the completion of a 216-unit affordable mixed-use development in Brooklyn, New York, allocated to low-income and formerly homeless New Yorkers. The project received a nearly $170 million commitment from The Urban Investment Group at Goldman Sachs Alternatives. Read More

Fonda

In 2023, Montgomery County issued $5.4 million in municipal bonds, underwritten by BNY. The bonds finance construction costs to demolish a former Beech-Nut factory site and replace a bridge on Cranes Hollow Road.

In 2023, the Fonda-Fultonville Central School District issued $6.5 million in municipal bonds, underwritten by BNY, to finance renovations at several of its buildings and sites. The bonds also help finance new furnishings, equipment, and machinery.

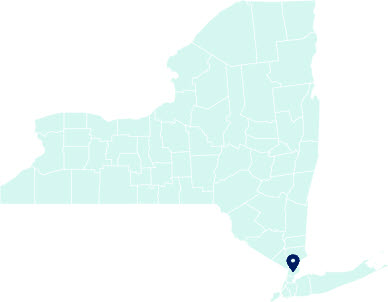

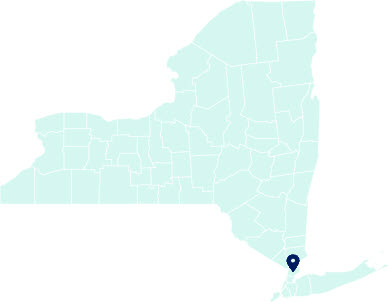

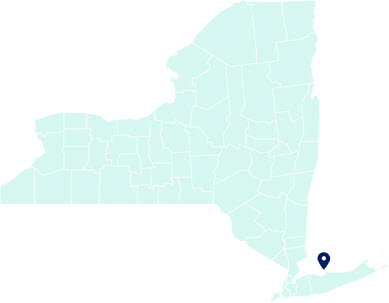

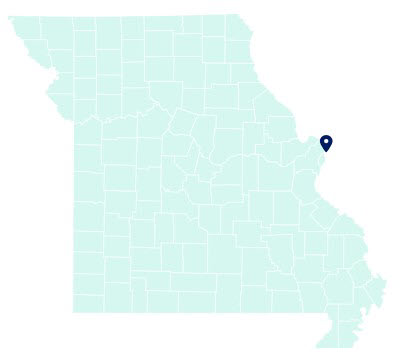

New York

In 2024, Wells Fargo committed $500,000 to Breaking Ground, a New York City-based organization that operates nearly 4,500 units of permanent housing. This funding supports the organization’s affordable housing facility in Harlem. Read More

In celebration of BNY’s 241st anniversary, employees across the globe dedicated their time to giving back to their communities. In New York, team members partnered with Good+Foundation to assemble gift sets for growing families, helping welcome new life with essential items. Read More

Morgan Stanley remains committed to giving back to the community. As part of the firm’s Global Volunteer Month, employees gathered in Times Square to partner with Food Bank For New York City, working together to make a meaningful impact on addressing food insecurity. Read More

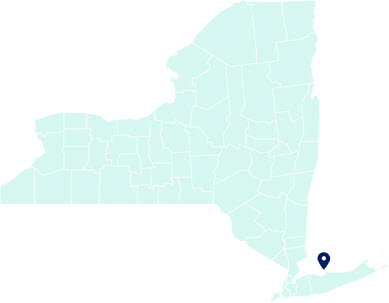

New York City

Bank of America announced plans to open more than 150 financial centers across 60 markets by the end of 2027. In 2025, the bank opened a flagship financial center in Bryant Park, designed to give clients direct access to financial specialists and personalized support.

Citi announced that it will donate over $6.6 million in support of education-focused non-profit organizations as part of its “e for education” campaign. The selected non-profit organizations focus on tackling childhood illiteracy and improving access to quality education. One New York-based recipient is Civic Builders, an organization that develops public school buildings in historically under-resourced communities. Read More

In 2023, State Street issued $1 billion of senior debt and $0.5 billion of senior subordinated debt with Siebert Williams Shank, a women- and minority-owned firm based in New York, as a joint book-running manager on the transaction. “State Street remains a leading partner in its commitment to broadening opportunities for minority and women-owned business enterprises,” said Suzanne Shank, President and CEO of Siebert Williams Shank. Read More

In 2023, the City of New York issued $965 million in municipal bonds, partially underwritten by Citi, Morgan Stanley, Bank of America, JPMorganChase, and Wells Fargo. The bonds will reimburse the city’s Department of Housing Preservation and Development for previous funds they spent on affordable housing for low-income, in-need, and senior citizen residents.

In 2023, the New York Transportation Development Corporation issued $2 billion in municipal bonds, partially underwritten by Citi, Bank of America, and JPMorganChase, to finance Phase A of a project at John F. Kennedy International Airport. The project includes the design, construction, and operation of the New Terminal One passenger terminal, which is anticipated to hold 23 gates across 2.4 million square feet. The project also involves demolishing a parking garage near the current Terminal 1, building new offsite facilities, utilities and roadways, and improving the AirTrain.

In 2024, Bank of America announced four New York City-based small business beneficiaries of its Small Business Spotlight program, which offers local entrepreneurs and businesses support to reach new customers. A Manhattan-based store that sells cooking kits from different countries and cultures, eat2explore, was selected to showcase its products at the Bank of America Winter Village at Bryant Park. Read More

In 2024, Bank of America announced four New York City-based small business beneficiaries of its Small Business Spotlight program, which offers local entrepreneurs and businesses support to reach new customers. A Queens-based South Asian snack store, Doosra, was selected to showcase its products at the Bank of America Winter Village at Bryant Park. Read More

In 2024, the New York State Environmental Facilities Corporation issued $717.3 million in municipal bonds, partially underwritten by Bank of America, Morgan Stanley, and Wells Fargo. The bonds will specifically be issued to assist the New York City Municipal Water Finance Authority in financing water pollution control projects and drinking water projects.

JPMorganChase announced $9.6 million in philanthropic commitments to organizations that help preserve homeownership by addressing heirs’ property issues, appraisal bias and the undervaluation of homes. Center for New York City Neighborhoods, a non-profit organization dedicated to supporting low- and moderate-income homeowners, received $889,000 in support of its free estate planning services and education for Black homeowners. Read More

State Street issued $1 billion of senior debt with Tigress Financial Partners, a disabled and women-owned firm based in New York, as co-manager on the transaction. Read More

The construction of JPMorganChase’s headquarters in Midtown Manhattan is expected to create 8,000 construction jobs, triggering additional economic activity of $3.6 billion for New York State, including $2.6 billion for New York City. Read More

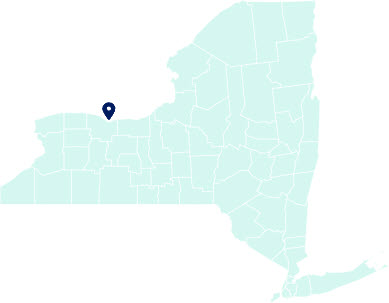

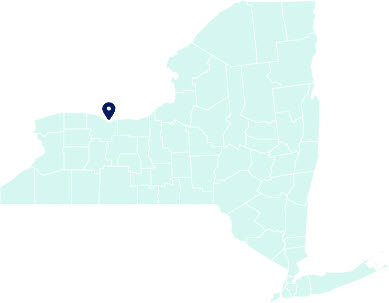

Rochester

Goldman Sachs’ Urban Investment Group partnered with KeyBank Community Development Lending and Investment and provided a $200 million construction loan for the planned renovation of affordable housing for seniors in Rochester, New York. The capital investment will have a significant impact within underserved communities living in downtown Rochester. Read More