Introduction

Large companies in the U.S. that compete all over the globe – companies that run that gamut from the likes of Boeing to Coca-Cola – require steady access to sophisticated financial services that can be tailored to the complex and global needs of their businesses. These services, such as foreign currency and derivative services, are critical to ensuring that U.S. companies operating overseas can compete effectively with their foreign counterparts. Even smaller companies that generate sales and operate overseas need such services to effectively function and compete abroad. Financial Services Forum members operate globally and offer a wide range of financial services that help U.S.-based firms compete effectively in a world that is increasingly characterized by less cross-border lending from large banks abroad as well as foreign “national champion” competitors that are actively supported by foreign government policy. Forum members, as global banks that have deep expertise in foreign markets, are uniquely positioned to support large, U.S. companies competing abroad and contribute to their success on the world stage.

The Decline in Cross-Border Lending

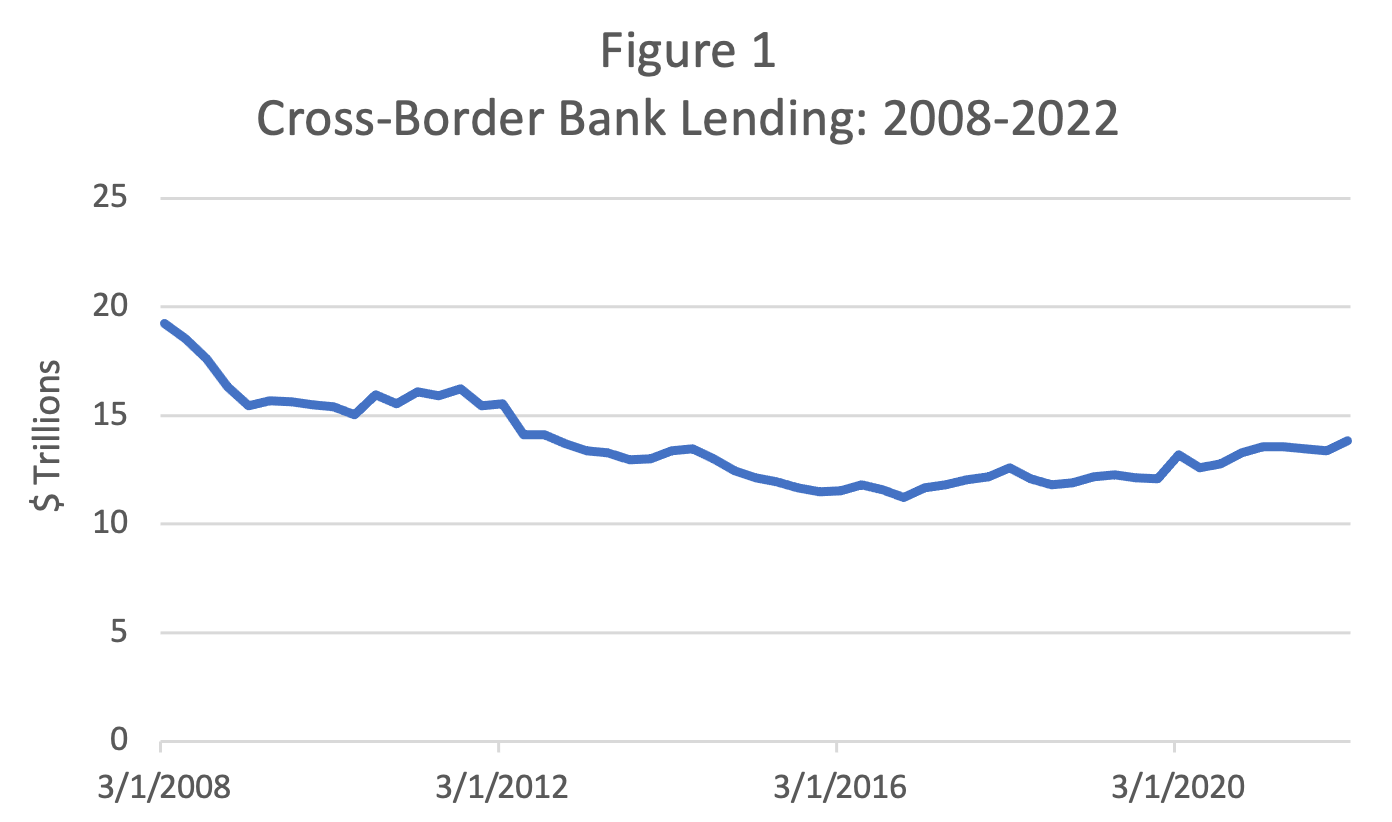

For more than a decade there has been a steady decline in cross-border lending and banking. More specifically, the amount of lending provided by banks in one country to companies in another country has steadily declined. Figure 1 depicts the total amount of outstanding cross-border loans made by banks from 2008-2022. As shown in the figure, the amount of cross-border lending has declined from roughly $20 trillion to $14 trillion since 2008. As a result, large U.S. companies operating overseas must look to U.S. banks to fulfill their financing needs as well as their needs for other financial services that are critical to their success in foreign markets.

Forum Leadership in Global Financial Services

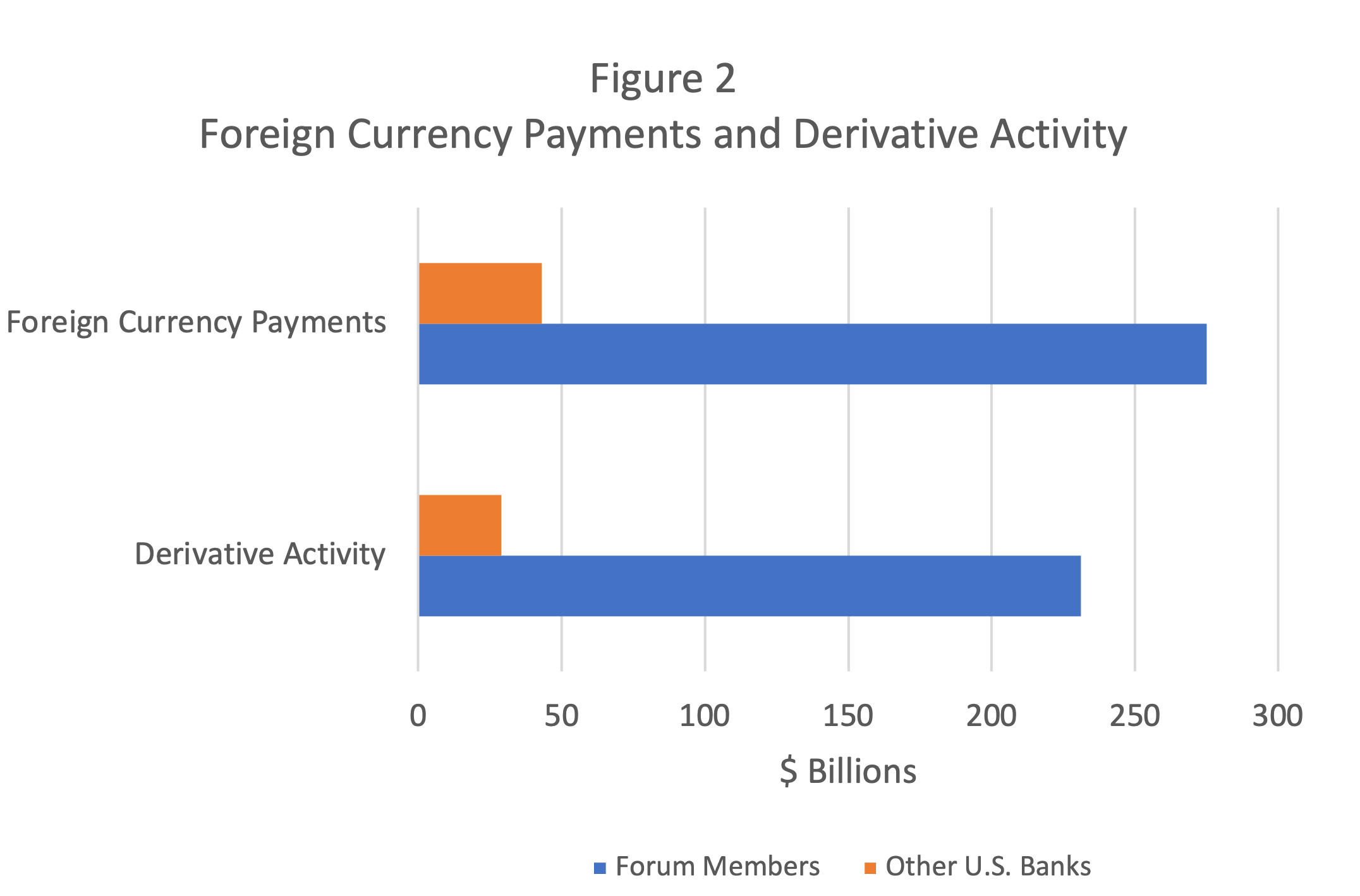

While large U.S. companies such as Boeing and Coca-Cola require bank loans, they also demand a range of additional, sophisticated financial services that are largely provided by large, global banks, such as Forum members. As an example, Coca-Cola may need to purchase goods in foreign countries to support its operations. To make those purchases, Coca-Cola will need to transact in a foreign currency and will need a bank that can make large volumes of foreign currency payments. Coca-Cola may also need to risk manage its exposure to foreign currency fluctuations by using foreign exchange derivatives and will need to work with a bank that has expertise in the complex field of derivative risk management.

In Figure 2 below, we show the amount of foreign currency payments and the amount of derivative activity conducted by Financial Services Forum members and all other large U.S. banks.

As can be clearly seen in the figure, Forum members are the dominant providers of foreign currency payments and derivative services. These services are critical to maintaining the competitive position of large U.S. firms operating overseas. In particular, a large U.S. company that is unable to competitively manage its foreign currency expenditures abroad would find it difficult — if not impossible — to compete with local firms that bear no foreign currency risk whatsoever.

Moreover, operating in foreign markets requires a degree of insight and expertise that can only be achieved by global firms that continuously operate in those foreign markets. Among U.S. banks, Forum members stand alone in their foreign market footprint and expertise.

Beyond Lending: Raising Capital from Public Markets

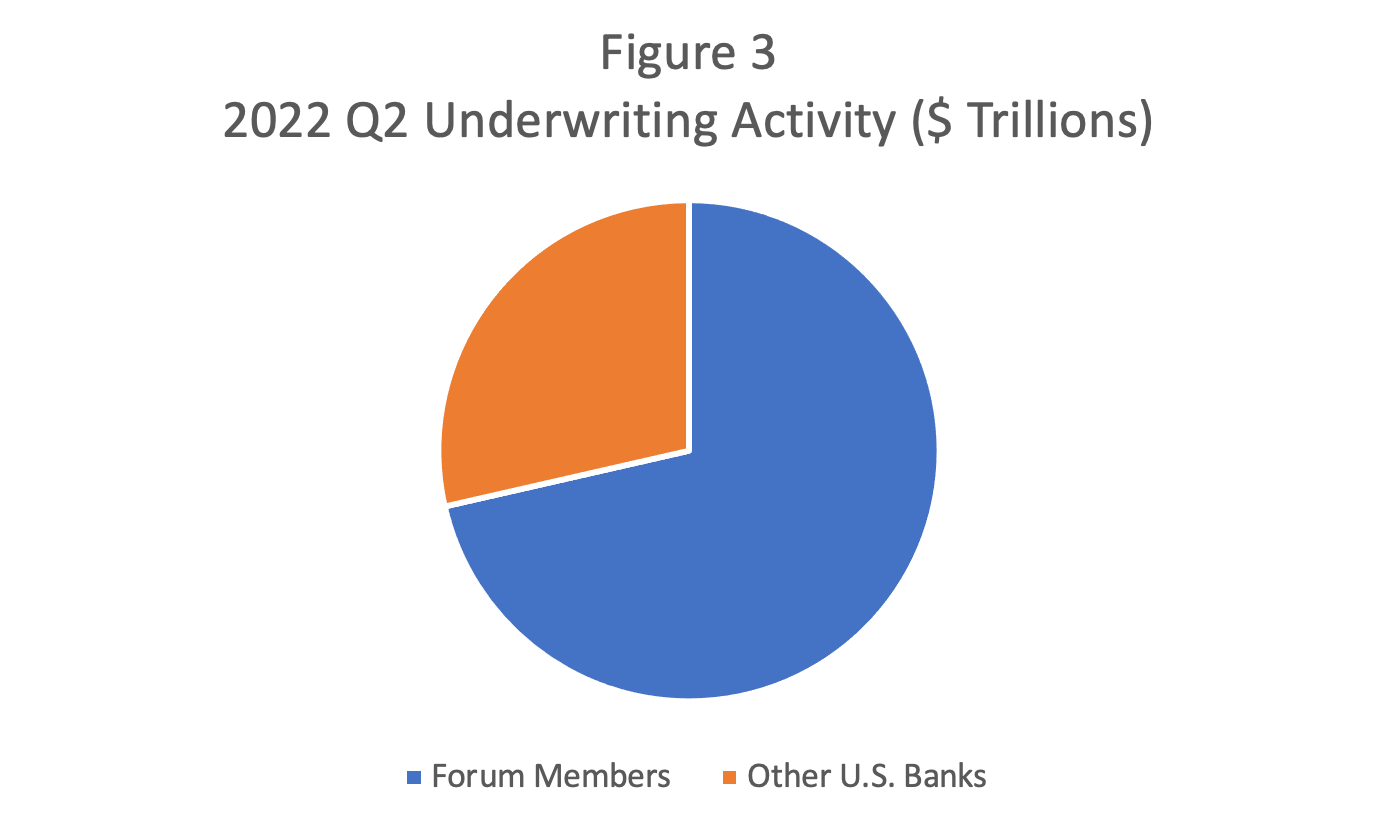

While large U.S. companies do need bank lending, a large amount of their financing comes from their own issuance of debt and equity securities in our public capital markets. This source of funding is critical to ensuring a steady flow of finance that can be used to make needed investments overseas to remain competitive with foreign competitors. In Figure 3, we show the combined amount of debt and equity underwriting provided by Forum members and other large, U.S. banks.

As shown in the figure, Forum members account for the lion’s share of underwriting activity among U.S. banks.

This form of support to large, U.S. companies operating overseas is important for maintaining international competitiveness as some foreign competitors may benefit from certain “national champion” policies that tilt the playing field in the direction of nationally supported foreign competitors. Accordingly, having ready access to global pools of capital puts large U.S. firms in the best position to compete head-to-head against their foreign competitors.

Conclusion

Maintaining the competitive position of U.S. firms internationally is critical to ensuring the success and vibrancy of the U.S. economy. Forum members support the international competitiveness of U.S. firms by lending and providing a range of other financial services that large firms operating overseas require. Forum members are themselves global firms that are uniquely positioned to provide the services, insight and perspective that comes from their day-to-day experience in markets all over the globe.Working together, Forum members and large U.S. companies bring the competitive spirit and productivity of the U.S. economy to the world stage.