Introduction

Recently, the Federal Reserve’s Vice Chair for Supervision gave a speech in which he stated that “current U.S. [capital] requirements are at the low end of the range described in most of the research literature.” This statement should be more closely scrutinized because “most of the research literature” does not explicitly account for all of the enhancements to the large bank regulatory regime that have been enacted since the financial crisis. Indeed, a number of the papers cited in the speech were written before the U.S. reforms were finalized and don’t explicitly account for these reforms in their analysis. It is inappropriate to assess the level of large bank capital without explicitly and holistically considering all of the post-crisis reforms that improve bank resiliency and resolvability. In this blog we focus on one single reform – Total Loss Absorbing Capacity, or “TLAC” requirements. We discuss a Bank of England (BoE) research study on the optimal level of bank capital showing that once TLAC is explicitly considered, the capital level of Financial Services Forum members is at the high end of the range provided in the BoE’s research paper.

Total Loss Absorbing Capacity (TLAC)

In 2015, the Financial Stability Board (FSB) issued the TLAC standard for global systemically important banks (GSIBs). The external TLAC standard was then finalized as a U.S. rule that applies only to Financial Services Forum members, though other non-U.S. GSIBs are covered by TLAC standards in their home jurisdictions.

The external TLAC standard in the U.S. requires that Forum members maintain a prescribed amount of long-term debt that can be converted to equity in the event of significant financial distress to absorb losses and ensure that the firm can continue operating. In this way, TLAC requirements directly support existing and highly rigorous capital requirements and materially enhance the ability of Forum members to absorb losses associated with a financial crisis. Accordingly, when assessing the capital level of U.S. GSIBs, it is critical to explicitly and quantitatively recognize the loss-absorbing capacity of TLAC.

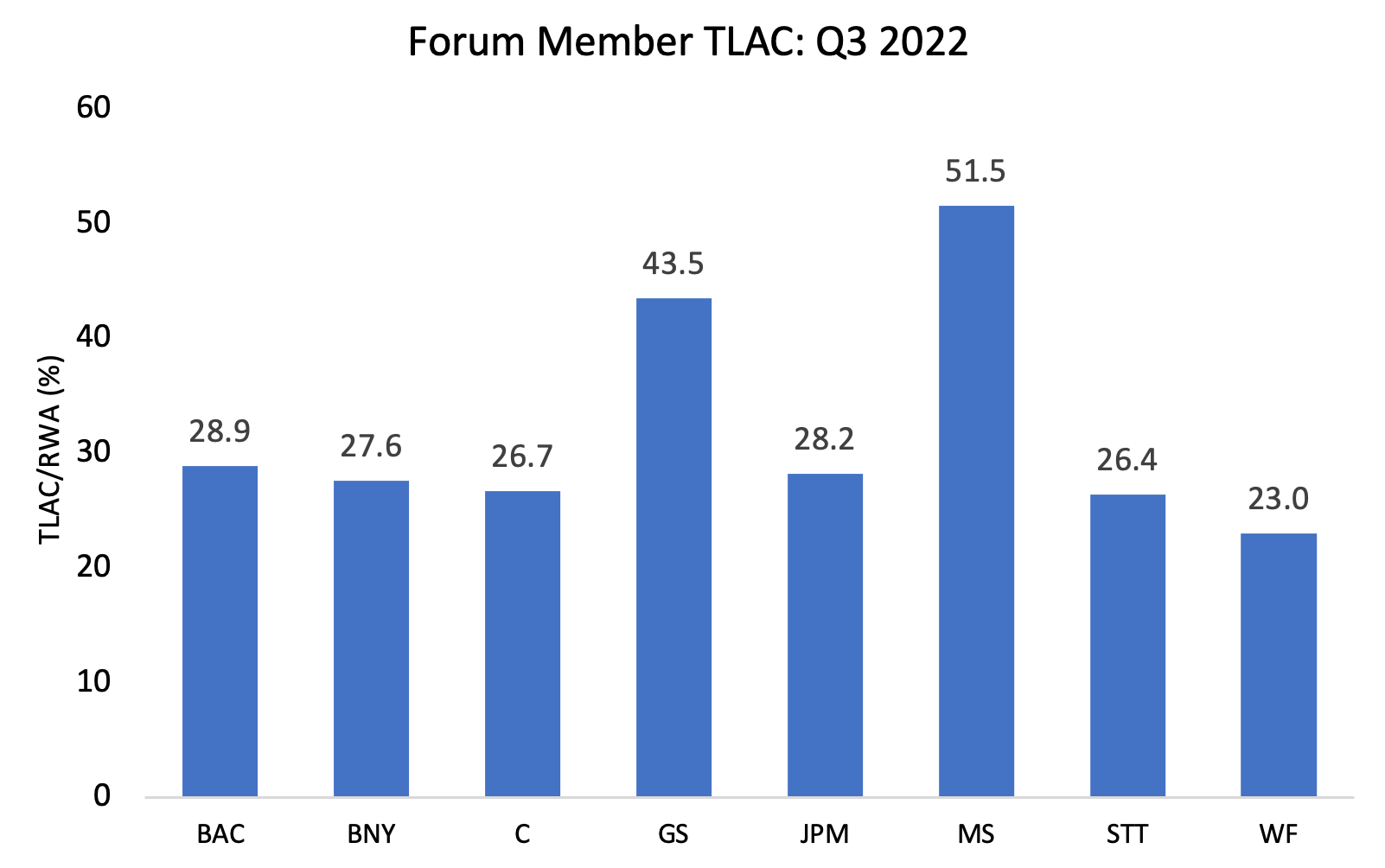

In the chart below, we document the level of TLAC for all Forum members as a proportion of their risk-weighted assets. The TLAC amounts reflect both the level of Tier 1 capital and the amount of long-term debt that is eligible to be converted to equity capital.

As shown in the chart, Forum members maintain TLAC levels that are well in excess of 20 percent. This amount of TLAC substantially buttresses existing capital requirements and provides for an additional layer of loss absorbency over and above existing capital requirements. As a result, when assessing the right level of capital for large banks, it is critical to factor in the large amount of TLAC that is maintained by Forum members.

TLAC and Optimal Capital Levels

So how do TLAC levels translate into resiliency and the optimal amount of bank capital? Economists at the Bank of England conducted a research study that directly and quantitatively addresses the impact of TLAC on optimal capital requirements.

The BoE researchers found that the existence of significant amounts of TLAC reduces the amount of capital that is required to achieve any desired amount of financial stability because the introduction of TLAC requirements would “reduce their probability of default by individual banks by around 30%.” The BOE estimates of the resiliency-enhancing effects of TLAC are research-based and draw on the same analysis that was used to support the FSB TLAC standard. Accordingly, the BoE’s assessment of the benefits of TLAC is appropriately holistic and internally consistent.

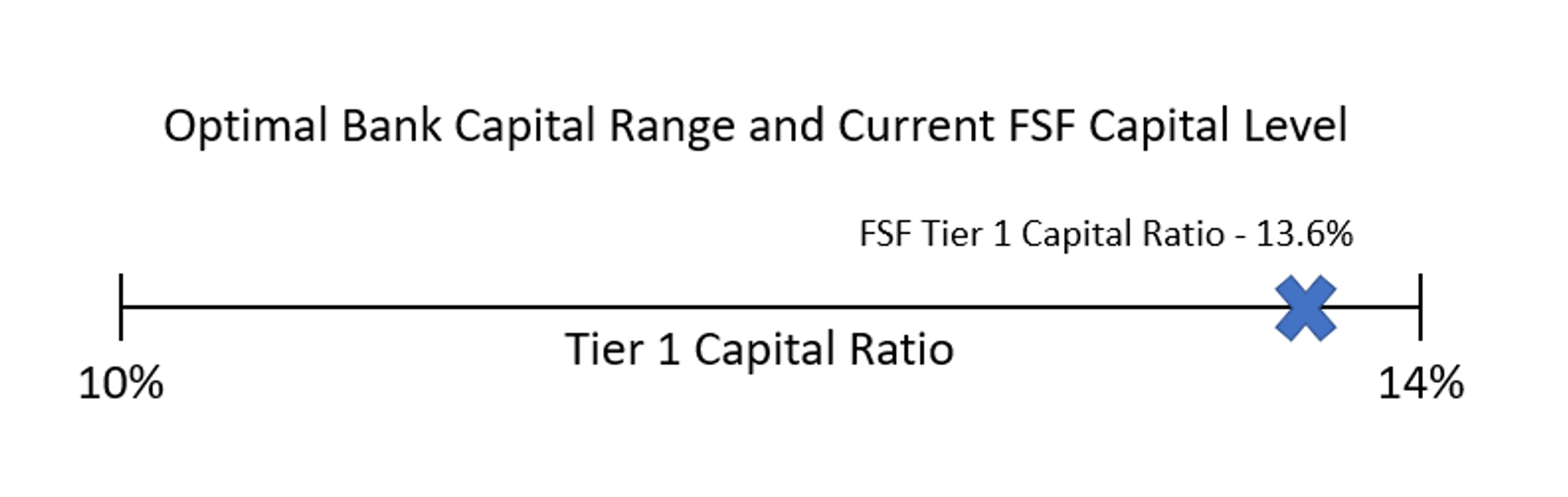

The BoE researchers then combine this information with other data on the relative costs and benefits of bank capital and conclude that the optimal level of bank capital ranges from 10 to 14 percent of risk-weighted assets (RWA). The graph below depicts this range as well as the current aggregate capital ratio of Forum members.

Source: Bank of England, Federal Reserve Y9-C

As shown in the graphic above, as of Q3 2022, FSF members maintain an aggregate Tier 1 capital ratio that is at the high end of the optimal range found in the BoE study.

The BoE research paper recognizes that the optimal range that the authors find is measurably lower than that found by other studies, but they directly attribute this difference to a failure of previous research to account for the resiliency benefits of TLAC: “An important caveat with these studies, however, is that none of them explicitly considered the effects of TLAC and improvements in the UK bank resolution regime. Hence, it is possible that the results from these studies may have overstated the optimum equity capital requirement.” Indeed, the BoE cites previous research papers ignoring the benefits of TLAC that were also included as citations in the Vice Chair’s speech.

The recognition that a failure to explicitly consider the benefits of TLAC renders the findings of previous research inapplicable to the current environment is a critical insight that must be reflected in any holistic review of large bank capital requirements. More still, any comprehensive review of current capital levels must explicitly consider the entire range of large bank regulatory requirements that enhance overall resiliency. Such requirements would include new and enhanced resolution requirements and new liquidity requirements, as well as enhanced risk-management standards that have been put in place as part of the Dodd-Frank Act’s enhanced prudential standards framework. An assessment of large bank capital that does not explicitly account for these improvements is conceptually incomplete and sells short the important and significant progress made by regulators and large banks for over a decade.

Conclusion

According to Federal Reserve Chair Jerome Powell, large bank capital levels are at “multi-decade highs.” The strong level of large bank capital that we have today is the result of over a decade of progress that has been made by large banks and regulators to improve their resiliency. The overall resiliency of large banks is supported by these strong capital levels as well as other important changes to the large bank regulatory regime that support bank safety and financial stability. Once additional enhancements are explicitly considered, a systematic and quantitatively rigorous economic analysis shows that Forum members maintain robust capital levels that appropriately support bank safety and financial stability.