Introduction

The recent and horrifying developments in Ukraine have created significant challenges in the oil and gas industry that have impacted consumers at the gas pump and the broader macroeconomy. At the same time, the U.S. economy is also on a transition path that will, over time, make increasing use of renewable energy resources. Large banks play a pivotal role in supporting the existing energy infrastructure and managing the transition to a less carbon-intensive energy industry. In this post we lay out some basic facts about large bank financing of the energy industry. The data clearly show that large banks have been consistently providing financing to this important industry, along with financing for the next energy boom.

Bank Funding of the Energy Sector

Energy companies routinely obtain significant amounts of credit from large U.S. banks. We can open a window into the amount of financing provided to energy companies by looking at the Shared National Credit Report. The Shared National Credit, or “SNC,” report provides an annual review of large loans that are shared, or “syndicated,” by three or more lenders. These are precisely the kinds of large and widely held bank loans that are used to fund large, capital-intensive industries such as the energy industry.

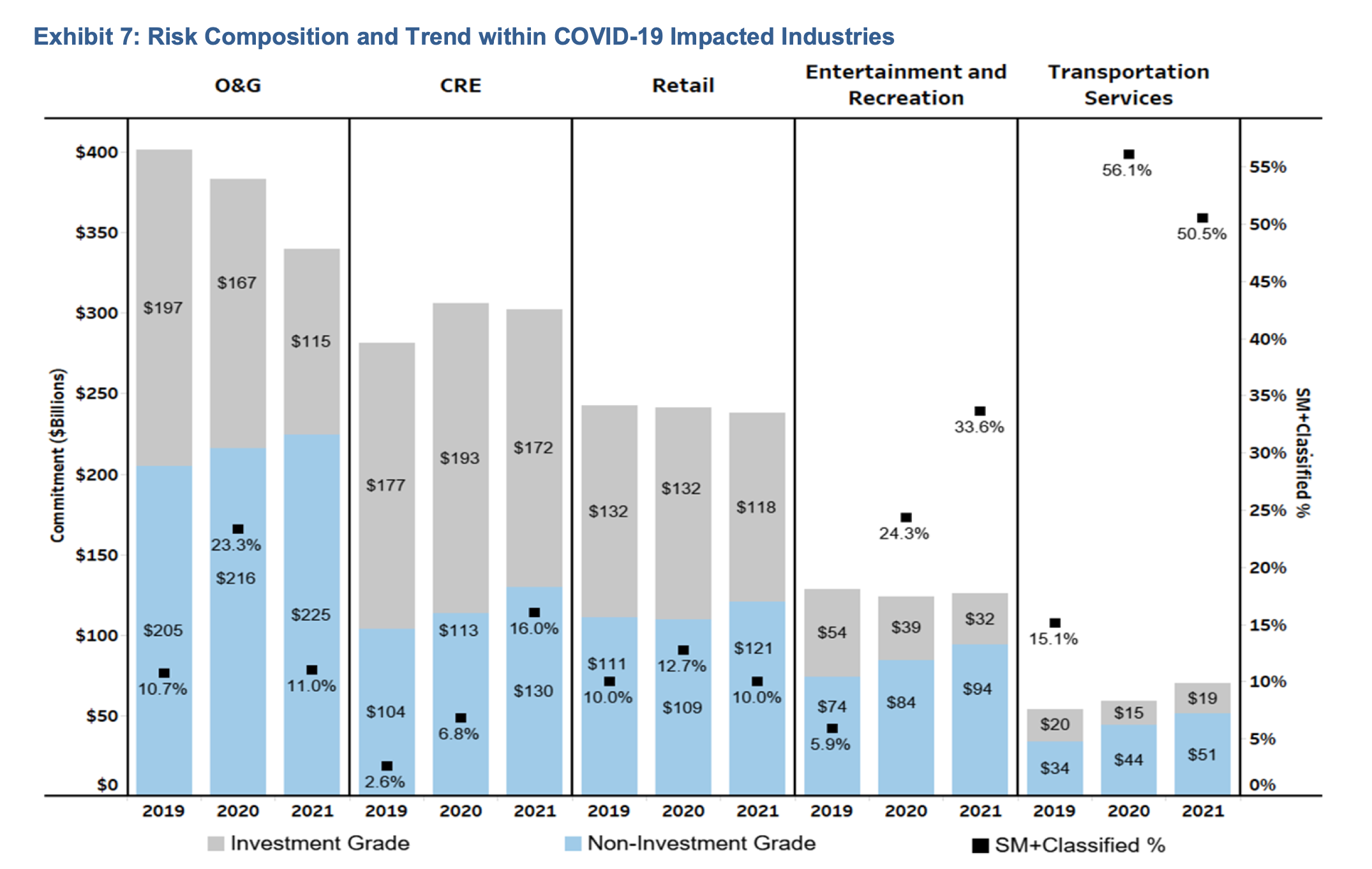

The 2021 SNC report is particularly instructive as it contains an analysis of the loan commitments provided to a range of COVID-impacted industries. The chart below shows the level of SNC loan commitments made to the oil and gas industry as well as other industries from 2019 through 2021.

As shown in the figure from 2019 through 2021, SNC lenders were providing between $350 billion -$400 billion in loan commitments to the oil and gas sector (O&G). It is further worth noting that among COVID-impacted industries analyzed in the report, the energy sector has received the greatest amount of bank funding. Of course, this is partly to be expected because the energy industry is a capital-intensive industry that typically requires more financing than less capital-intensive industries, such as the retail or entertainment sectors. Finally, it should be noted that large U.S. banks are generally the largest holders of SNC commitments. As detailed in the report, U.S. banks hold over 44 percent of all SNC commitments while foreign banks and non-banks account for 33 percent and 23 percent of all SNC commitments, respectively.

The Energy Industry and Market Funding

While large U.S. banks provide a significant amount of direct lending to the energy industry, direct bank lending is only one part of the credit story. Beyond direct financing, large banks underwrite significant amounts of security issuance, which allow large companies to obtain credit directly from public capital markets.

At the onset of the pandemic in 2020, after an initial freezing of credit markets, the Federal Reserve took a number of actions to increase the flow of credit to the economy, including through the increased issuance of debt securities by large companies. In 2020 and 2021, large companies across an array of industries raised significant amounts of funding from capital markets as total U.S. corporate bond issuance rose nearly 65 percent relative to 2019. And this trend towards greater capital markets issuance was not lost on the energy sector. In the table below we highlight the debt issuance of five large, established U.S. companies in the energy sector.

|

2020 Debt Issuance of Select Oil and Gas Companies |

|

| Oil and Gas Company | Issuance ($BN) |

| Chevron |

12 |

| Exxon Mobil |

23 |

| Marathon Oil |

3 |

| Phillips 66 |

2 |

| Valero |

1 |

| Source: SEC 10k | |

As shown in the above table, energy companies clearly have availed themselves of the opportunity to raise debt financing in the U.S. capital markets. And these markets are primarily intermediated by large U.S. banks. Indeed, Financial Services Forum members underwrite nearly three-fourths of all equity and debt issuance in the U.S. Accordingly, large banks have supported the energy industry by directly financing their investment needs and by facilitating their debt raising from the public through the U.S. capital markets.

Financing the Transition to a Less Carbon-Intensive Economy

Much of the financing of energy companies has been used to increase our nation’s capacity for traditional, carbon-based energy, such as oil and gas. Yet many of these traditional energy companies, and other companies as well, are actively pursuing opportunities for the more renewable, less carbon-intensive energy sources that will power our economy in the future. Forum members are committed to an “all of the above strategy” that finances our nation’s transition to a cleaner and more renewable energy future while also working to ensure that today’s energy’s needs can be met effectively and efficiently. Forum members regularly disclose and report on their varied and distinct investments in renewable energy projects in relevant reports. These investments represent high-value opportunities that are designed to spur innovation to support our economy’s longer-term needs for cleaner sources of energy.

Conclusion

The recent and unsettling events in Ukraine have shined a light on the need to balance our efforts to support our existing energy needs while supporting innovation towards a less carbon-intensive future. As we have demonstrated, large banks provide significant amounts of financing to the energy industry to meet today’s needs through direct lending and also through underwriting securities issuance in our capital markets, while also financing the energy needs of tomorrow. Both activities, coupled with a sensible and supportive regulatory framework, will continue to support this vital industry as the economy confronts the long-run transition to the less carbon-intensive economy of tomorrow.