Introduction

Recently, the Federal Reserve released its semi-annual Financial Stability Report. The report is chock full of important insights on the state of our economy and the nation’s largest banks. The report also provides data that clearly demonstrate the problematic nature of recent regulatory proposals, possible forthcoming proposals, as well as regulatory actions that have not been taken, but are having a clear impact on financial stability.

GSIB Capital Levels are at a Multi-Decade High and are Supporting a Strong Banking System

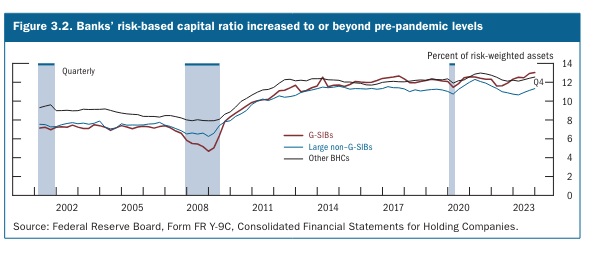

Right off the bat, the overview section of the report states that “the banking sector remained sound and resilient overall, and most banks continued to report capital levels well above regulatory requirements.” The report goes on to focus on the extremely well-capitalized nature of U.S. GSIBs (Forum members), focusing on the Common Equity Tier 1 (CET1) capital measurement, “CET1 ratios for global systemically important banks (G-SIBs) reached the highest levels recorded in the past decade, while CET1 ratios for large non–G-SIBs and other bank holding companies were close to pre-pandemic levels.” This statement is also reflected in the chart below taken directly from the report.

There are a few interesting observations to make about this chart. First, it clearly shows that U.S. GSIBs maintain capital levels that stand far above that of other U.S. banks. Indeed, judging by the chart, the gap between GSIB and non-GSIB capital ratios is as high now as it has ever been – at least since 2000 (the beginning time period for the chart). Second, while the report states that GSIB capital levels reached their highest level in the past decade, a review of the chart clearly shows a stronger statement applies. Specifically, the chart clearly shows that GSIB capital levels are now higher than they have been in over 20 years. This chart clearly confirms a previous statement by Federal Reserve Chair Jerome Powell that GSIB capital levels are at “multi-decade highs.”

And while the report clearly recognizes the strength and stability of America’s banking system, it does identify some potential risks. These risks, however, are largely confined to banks outside the U.S. GSIBs. Specifically, the report points to potential problems in commercial real estate (CRE) lending portfolios. As we have previously documented, and is well-recognized by key public sector officials such as U.S. Treasury Secretary Janet Yellen, U.S. GSIBs do not have significant exposures to CRE: “I hope and believe that this will not end up being a systemic risk to the banking system. The exposure of the largest banks is quite low, but there may be smaller banks that are stressed by these developments.”

Finally, the report points to the possibility of further bank stresses like the stress from last Spring that resulted in a significant reallocation of deposits within the banking system. On this point, too, U.S. GSIBs are not exposed to significant risk because U.S. GSIBs maintain the strongest capital and liquidity levels and are widely and rightly recognized as being a source of strength for the U.S. economy. Indeed, as research from the Federal Reserve Bank of New York has demonstrated, U.S. GSIBs were the recipients of significant deposit inflows during last year’s brief period of turmoil.

Overall, the Federal Reserve’s Financial Stability Report paints a clear picture of the strength, stability, and resiliency of Forum members. Forum members are stronger and more resilient now than they have been in decades and are supporting broad stability in the banking system. And while there are some areas of potential concern, Forum members are not significantly exposed to these risks. Rather, they are a bulwark against these risks that will help to promote a stable financial system in the economy if these risks materialize.

Financial Stability Report Clearly Demonstrates Wayward Regulatory Policy

While the report does not directly address current or expected future regulatory proposals, clear insights gleaned from the report speak volumes about the wisdom of current (and likely future) regulatory efforts.

First, the data on current risk-based capital levels speaks for itself and calls into obvious and serious question the current capital proposals that would increase Forum member risk-based capital levels by nearly 30 percent while having a significantly smaller impact on non-Forum member capital levels. When Forum member capital levels are at multi-decade highs and significantly higher than that of other banks, the zeal to disproportionately raise capital for Forum members is nothing less than a real head-scratcher.

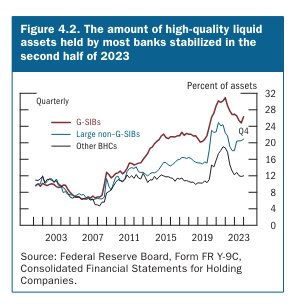

Second, while regulators have not issued any proposals regarding liquidity there is an expectation that a proposal will soon be released to revamp the large bank liquidity regime. The Financial Stability Report speaks directly to the wisdom of any such proposal in the following figure reproduced from the report.

As clearly shown, Forum members (“G-SIBs” on the chart) maintain the highest level of liquidity amongst U.S. banks. When one combines this fact with the fact that Forum members maintained ample liquidity during last year’s banking turmoil, were the recipients of deposit inflows, and supported one smaller failing bank to provide regulators with enough time to resolve it, the evidence is clear that the full suite of liquidity requirements for U.S. GSIBs is providing the resilience that was intended for those firms.

However, it is also important not to lose sight of the fact that liquidity regulations are not without cost. Requiring large banks to stockpile ever larger amounts of liquid assets on their balance sheets has the predictable effect of crowding out the provision of credit and lending to the real economy. Every dollar of bank reserves sitting on the asset side of a bank balance sheet crowds out a dollar of lending that might otherwise occur. Indeed, research by Rene Stulz of Ohio State University and others has clearly demonstrated that post-crisis liquidity rules have contributed to a decline in lending by our nation’s largest banks. So, while regulators may propose changes in response to the events of last year, there is no evidence to suggest that these efforts should be aimed at Forum members. Any adjustments should be aimed at addressing the specific problems that led to those failures, improving or utilizing existing regulatory tools, and avoiding steps that further depress large bank lending.

The report states: “Treasury market liquidity is important because of the key role these securities play in the financial system. Various measures of market liquidity, such as market depth, suggest that liquidity in the Treasury cash market remained low, although at levels that reflect elevated measures of interest rate volatility… conditions in the Treasury cash market appear challenged and could amplify shocks.”

A clear contributing factor driving low Treasury market liquidity is the application of the risk-insensitive leverage ratio to large banks. As we have discussed previously, a risk-insensitive leverage ratio penalizes the holding and intermediation of U.S. Treasuries, which is primarily intermediated by Forum members and a small number of other financial intermediaries.

The solution to this problem is clear and well understood. Bank regulators, including the Federal Reserve, should reform risk-insensitive leverage ratio requirements. A variety of external experts, including the Group of Thirty, have publicly called on regulators to take up reform of the leverage ratio. The Federal Reserve itself publicly committed in 2021 to take up leverage ratio reform but no action has been taken since this commitment was announced over three years ago. Given the Federal Reserve’s assertion that U.S. Treasury market liquidity is a clear and present financial stability risk, there is no excuse to continue to delay a reconsideration of the leverage ratio.

Conclusion

The Federal Reserve’s recent Financial Stability Report provides an important and well-supported view on the state of U.S. Financial Stability. The report clearly shows that Forum members are supporting financial stability through their strong levels of capital and liquidity. Equally as important, the report also demonstrates the many problems with recent regulatory proposals, expected future regulatory proposals, and proposals that have been promised but not yet made. The Federal Reserve and other regulators should take stock of its own financial stability assessment as they chart the course for regulatory reform.