Last week the Federal Reserve released this year’s stress test results. The results showed that large banks were resilient and robustly capitalized. Indeed, all 23 large banks were shown to maintain sufficient capital to warrant a return to shareholder distributions consistent with the Federal Reserve’s risk-based capital requirements.

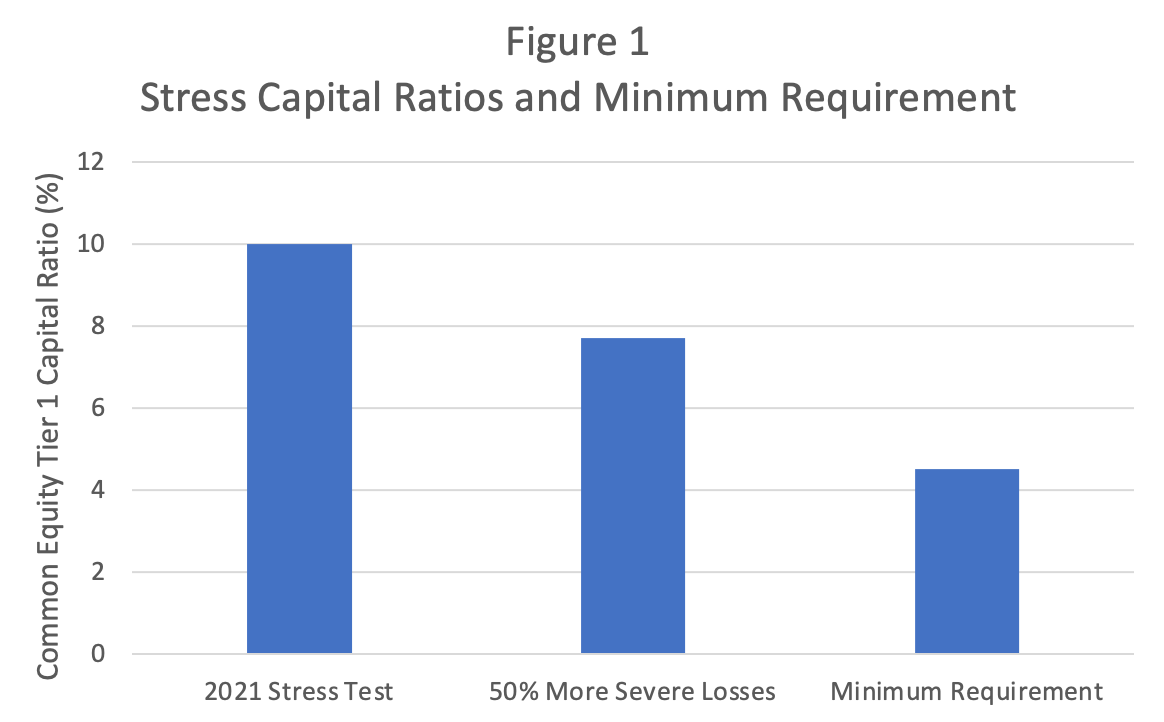

Figure 1 below shows how Financial Services Forum members fared in this year’s stress tests. As shown in the first bar in the chart, after absorbing a total of $297 billion in hypothetical losses in the severely adverse scenario, Forum members collectively maintained a capital ratio of 10 percent, which is more than double the regulatory minimum of 4.5 percent (the third bar in the chart).

Some have argued that this year the stress tests were “too easy” and that the banks are only being permitted to return capital to shareholders because the test was too lenient. This simply doesn’t measure up with the facts. As shown in Figure 1, Forum members would maintain a capital ratio in excess of the minimum requirement even if the stress test losses were significantly larger than those hypothesized by this year’s test. More specifically, as shown in the middle bar of Figure 1, even if stress losses were increased by fifty percent to $445 billion, Forum members would still maintain a capital ratio well in excess of the regulatory minimum. Indeed, not only would Forum members maintain sufficient capital in the aggregate, each individual member would maintain a capital ratio in excess of the regulatory minimum if losses were fifty percent larger than those hypothesized by this year’s test.

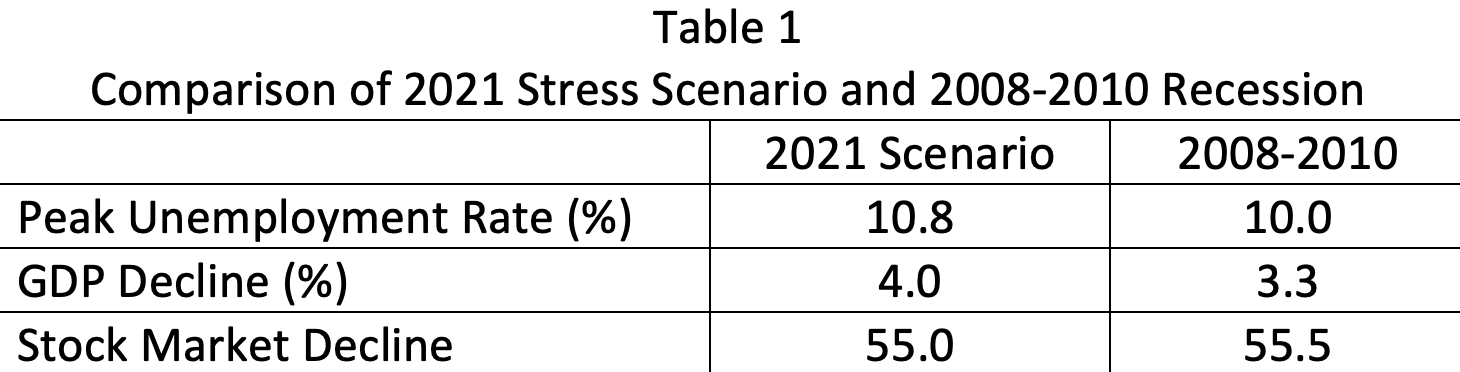

Finally, the idea that this year’s scenario is somehow too easy doesn’t hold up. In Table 1 below, we compare the value of three key variables in the stress test – the peak unemployment rate, the decline in GDP, and the decline in the stock market – across the 2021 stress scenario and the 2008-2010 recession.

As shown in Table 1, these key variables in the 2021 stress scenario are either more severe or on par with the experience of the 2008-2010 recession.

And of course, it goes without saying that there would be some level of scenario severity at which large banks would not have sufficient capital. That statement, however, is simply a matter of arithmetic that itself says nothing about either the proper severity of the stress tests or the capital adequacy of Forum members and other large banks. One can always envision a scarier, and more extreme doom-and-gloom scenario. The mere fact that one can hypothesize more extreme events does not mean that those events are relevant for measuring the capital adequacy of large banks.

Indeed, this kind of thinking has also prompted some to argue that the only reason large banks are healthy and strong is because “the government bailed them out” during the pandemic and absent this infusion of funds, the situation would be far worse. This argument is fallacious for two reasons. First, as already shown, Forum members would be resilient to a stress scenario significantly more severe than the 2021 scenario. Second, as a matter of course over the past year, our government engaged in macroeconomic stabilization policy. In other words, the Federal Reserve and the Congress acted swiftly and forcefully to protect the American economy. Those actions benefitted all industries and households. The fact that the government took steps to address an external macroeconomic shock emanating from outside the financial sector to support all businesses and households should not be used as a rationale to penalize the shareholders of large banks. Rather, we should applaud these efforts and recognize the strength and resiliency of our financial system in the face of an unprecedented economic and social shock.