Today, we are all dealing with a global economic slowdown, the likes of which we have not seen for over a decade. One important difference between then and now is the position which Financial Services Forum members are in. Over the past decade, Forum members have bolstered their safety and soundness, raised capital and liquidity, and positioned themselves to serve the economy. In this post, we review the facts on large bank resilience and demonstrate one key way in which large banks are serving households and businesses – the provision of safe, secure deposit accounts. Forum members remain resilient with capital levels in excess of regulatory requirements and supported the economy during the first quarter through a $818 billion increase in deposit accounts used as a safe store of value by households and businesses during these uncertain times.

Robust Capital and Liquidity

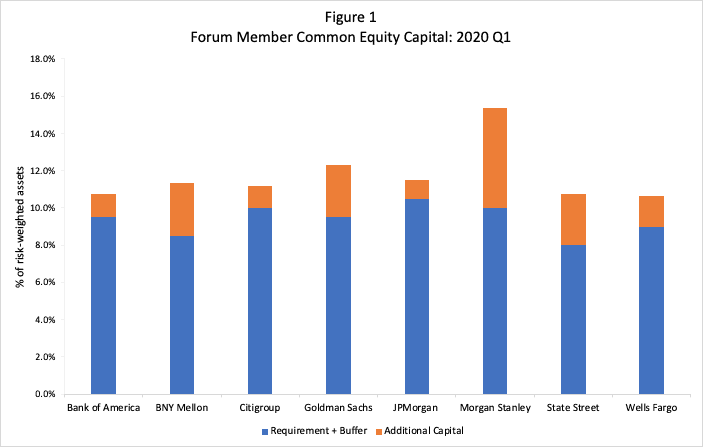

Large banks have significantly increased their capital and liquidity over the past decade. As we have detailed in previous posts and research, Forum member capital has increased by more than 40 percent while liquid asset levels have doubled. Moreover, the strength and resilience of Forum members continues even as the economy deals with the fallout from the COVID-19 pandemic. Figure 1 below provides a recent assessment of capital levels at Forum members from their first quarter earnings releases. The figure shows, for each Forum member, their Q1 2020 common equity capital ratio alongside the regulatory requirement that includes the minimum required capital level and associated regulatory buffer.

Source: Forum Members’ Earnings Releases, OFR Bank Systemic Risk Monitor

As shown in the Figure, all Forum members maintain capital levels in excess of all requirements and regulatory buffers. The precise amount of additional capital maintained by each member depends on various factors such as the mix of business lines and activities at each firm. This strong capital position puts Forum members in a unique position to support the economy during the pandemic. Moreover, as we have referenced in previous posts on market-based finance and business lending, Forum members are using their resilience to serve the economy through increased lending and helping other companies to raise much-needed funds from public markets.

Provision of Deposits for Households and Businesses

While lending and capital raising are important to the economy, it is also important to recognize the role that Forum members play in providing a critical, but too often neglected, financial service – deposit accounts. People everywhere use deposit accounts as a safe store of value during uncertain times. Recently, financial market volatility has risen dramatically, leading people to rely more on safe, liquid, bank deposits as they manage a variety of near-term risks.

Table 1 uses data from the Federal Reserve and shows the quarterly percent change in deposits of large commercial banks for a number of different time periods. The final row of the table shows the percentage increase in deposits for Forum members during the first quarter of 2020.

|

Table 1 |

|

| Quarterly Change (%) | |

| 1986 – 2019 Average Large U.S. Commercial Bank | 1.3 |

| 2020 Q1 Large U.S. Commercial Banks | 8.8 |

| 2020 Q1 Forum Members | 13.2 |

Conclusion

The COVID-19 pandemic has led to a substantial increase in economic, financial, and health-related risks. A natural reaction to an increase in risk is a move towards safer assets that can be relied upon when the rent is due or when someone needs to draw on their savings while out of work. Forum members have recently provided businesses and households with access to an additional $818 billion in safe, secure, and remotely accessible deposits. The significant strength and resilience of Forum members further bolsters the safety and security of these deposits.