Introduction

More than half of all Americans work at small businesses, making these companies vital to the growth and success of the American economy. Though small businesses are generally profitable and vibrant in a healthy economic environment, economic downturns or periods of uncertainty bring challenges that can force them to shut their doors forever. Unlike larger businesses, small business owners simply do not have pockets deep enough to withstand extended periods of adversity. In these circumstances, healthy, well-capitalized banks support entrepreneurs through lending. In this post, we review how the events of the past few years have showcased the substantial contributions of Forum members in supporting small businesses, and the economy.

Forum Members’ Steady and Growing Support for Small Businesses

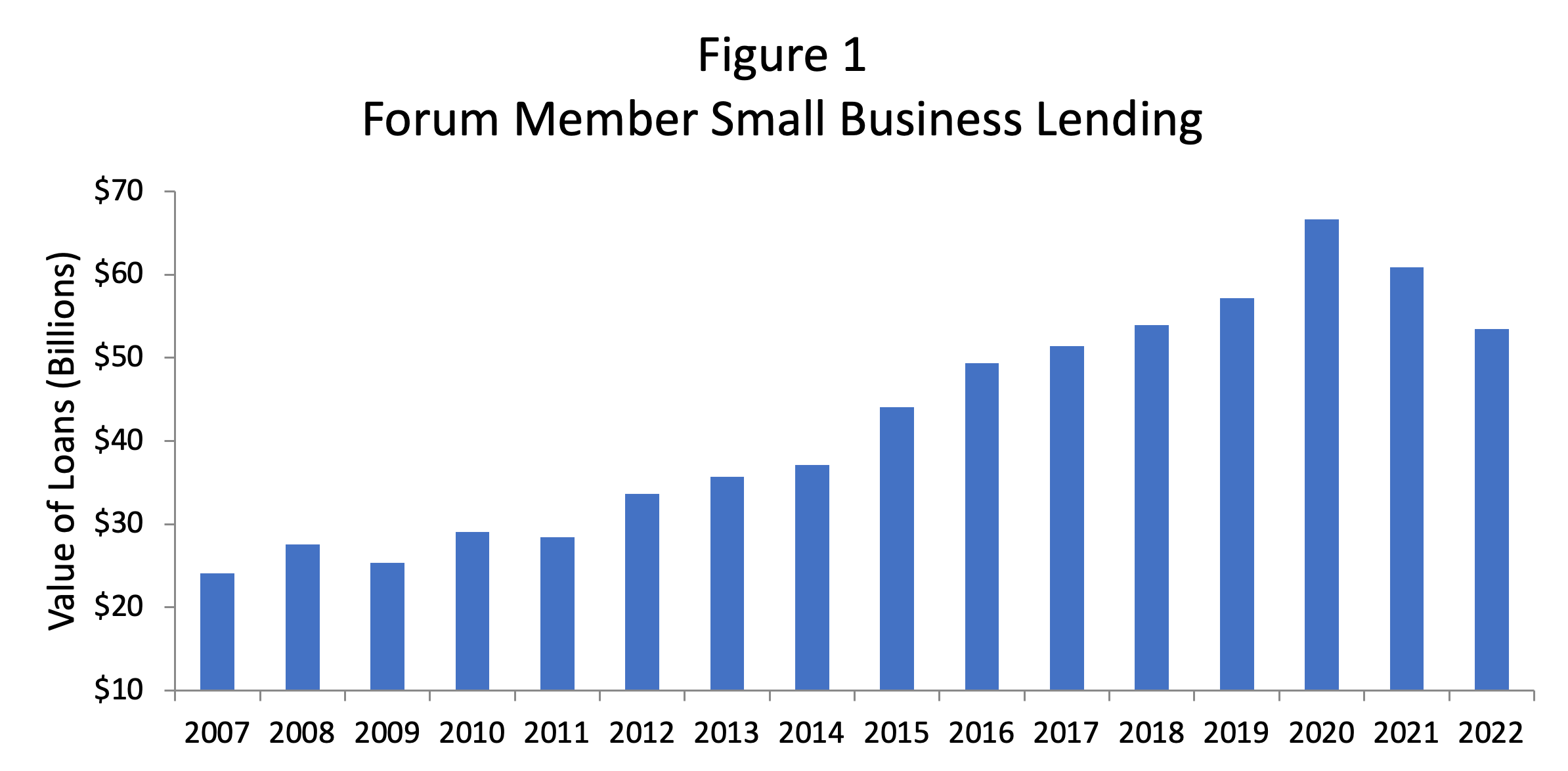

Figure 1 reports the total amount of outstanding small business loans in each year – small business loans are defined as those loans less than $1 million. As the figure clearly shows, Forum member loans to small businesses have grown steadily over time. Importantly, at the onset of the pandemic, lending to small businesses increased dramatically – in part due to their participation in the government’s Paycheck Protection Program (PPP) – to meet the rapidly growing needs of small businesses across the country. Forum members helped these businesses through a time of economic uncertainty and lockdowns, increasing their small business lending between 2019 and 2020 by 38 percent.In 2021, as some of the uncertainty passed and the economy began opening up again, small businesses repaid previously borrowed funds, and small business PPP loans were forgiven. As a result, the outstanding amount of small business loans fell relative to the 2020 pandemic year, but have remained elevated.

Forum Members Strongly Supported the Paycheck Protection Program (PPP)

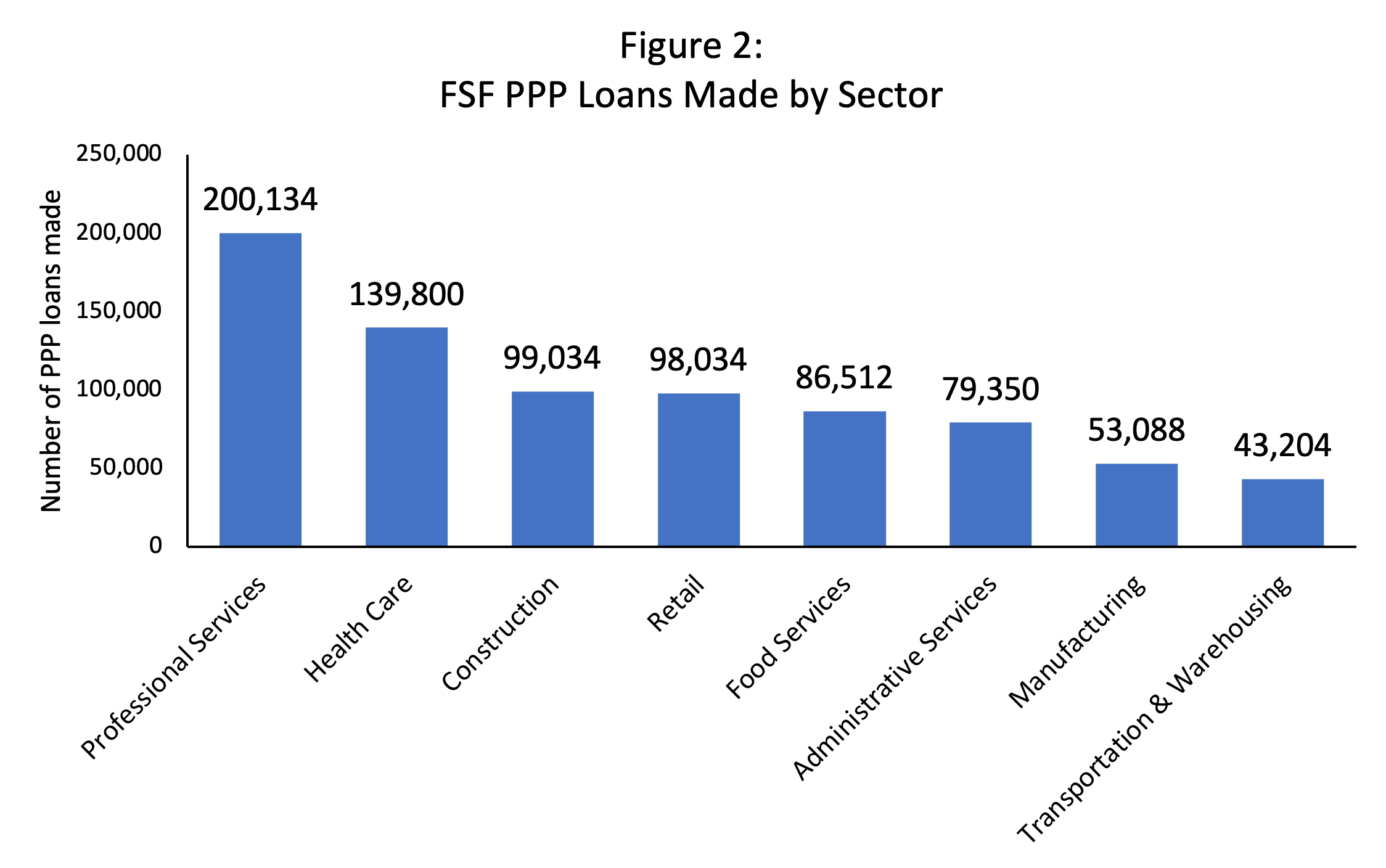

As discussed, Financial Services Forum members also played an instrumental role in the government’s Paycheck Protection Program (PPP). The PPP program was a key element of the government’s pandemic response that was aimed at providing forgivable loans to small business in need of emergency funding during the pandemic. Over the course of the program,Forum members facilitated over $94 billion in loans to well over 1 million recipients andmore than half of Forum member loans were for less than $25,000. In addition, on average, each loan supported roughly 10 jobs, demonstrating the extent to which these loans supported small businesses throughout the country.The PPP program was also a success in supporting a wide array of industries. Figure 2 below shows the number of Forum PPP loans made to different industry sectors. As the chart shows, Forum members channeled small business loans to a wide array of industries, many of which were crucial to addressing the pandemic, such as health care and transportation services.

Small Business Lending All Across the USA

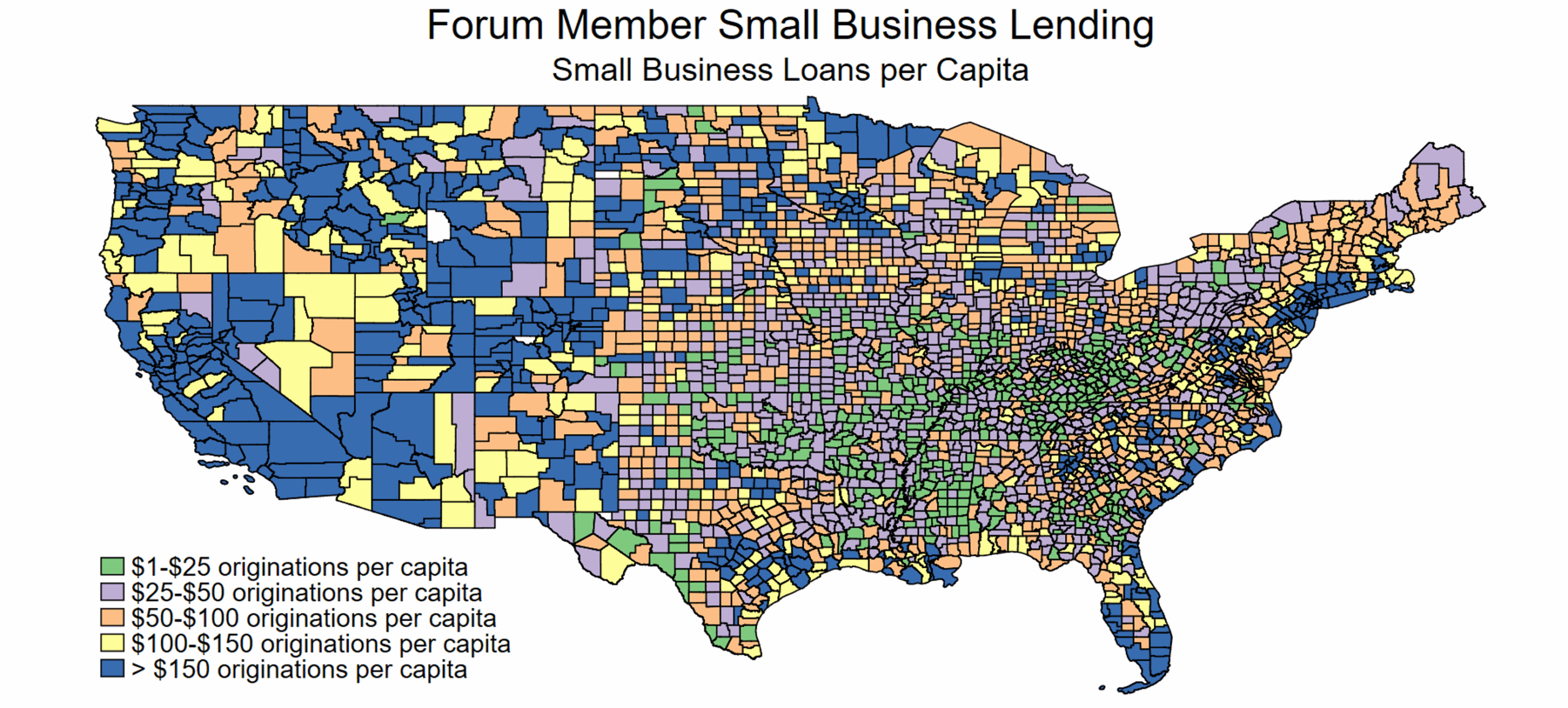

Figure 3 provides even more granular data on Forum member small business lending, showing exactly where these loans are going. The figure shows per capita small business lending by Forum members across the United States through 2020. This geographic look at the data highlights that Forum member small business lending is making a difference all across the country, not only in a few areas. In particular, significant amounts of small business lending can be seen in all regions of the country.

Sources: FFIEC Community Reinvestment Act, available at https://www.ffiec.gov/cra/default.htm, U.S. Census Bureau County Population Totals, available at https://www.census.gov/programs-surveys/popest/data/data-sets.html

Beyond the Numbers: How Forum Members are Supporting Small Businesses

The data we have shown are impressive, but it is also helpful to look at some specific and clear examples of how Forum members are making a difference to small businesses. Below, we detail a handful of specific examples that provide greater context for the broader trends we have discussed.

At the start of the COVID-19 pandemic, Bank of America partnered with State Street and several other organizations to create Small Business Strong, a non-profit that provides online resources and personalized consulting services to Massachusetts small businesses (particularly women and minority owned), free of charge. Since its creation, Small Business Strong has helped nearly 2,000 Massachusetts small businesses.

In July 2021, the Citi Foundation’s Small Business Technical Assistance Initiative provided $25 million in unrestricted funding to 50 community organizations, supporting each group in their missions of helping small businesses owned by people of color through lending, training programs, pro bono legal and marketing services, and technical assistance.

pro bono legal and marketing services, and technical assistance.

From March 2020 to June 2020, Goldman Sachs committed $750 million to fund PPP loans through Community Development Financial Institutions (CDFIs), and launched partnerships with the National Urban League and the U.S. Hispanic Chamber of Commerce to “ensure that both capital and information reach minority-owned businesses.” Goldman’s 10,000 Small Businesses Program continues to provide training and coaching to small business owners, who see significantly increased rates of hiring, expansion, and business success after graduation.

In February 2021, JPMorgan Chase pledged $350 million over five years to aid Black, Latino, women-owned, and other small businesses in their recovery from the COVID-19 pandemic, and to grow these businesses with the aim of addressing the racial wealth divide. As a part of this commitment, JPMorgan Chase is expanding the Entrepreneurs of Color Fund in collaboration with the Local Initiatives Support Corporation and a nationwide network of CDFIs.

Conclusion

Small businesses are vitally important to the American economy and American small businesses have deftly navigated a number of significant challenges in the past few years. In that time, Forum members have supported small businesses across the country by ramping up their small business lending, initiating specific and purposeful financial programs aimed at benefitting small businesses, and facilitating the government’s PPP program. While there is still work to do in improving the economy for the future, Forum members have been vital to the recent success of America’s small businesses and look forward to supporting them in the future.