Introduction

Large banks contribute to our economy in a variety of ways. Importantly, breadth and scale make it possible for large banks to extend their reach and help consumers, communities and business throughout the country while also driving efficiencies that reduce costs for the whole economy.

In this post, we briefly outline some of the ways in which large banks provide significant benefits to the economy.

Matching Savings with Investment All Across the USA

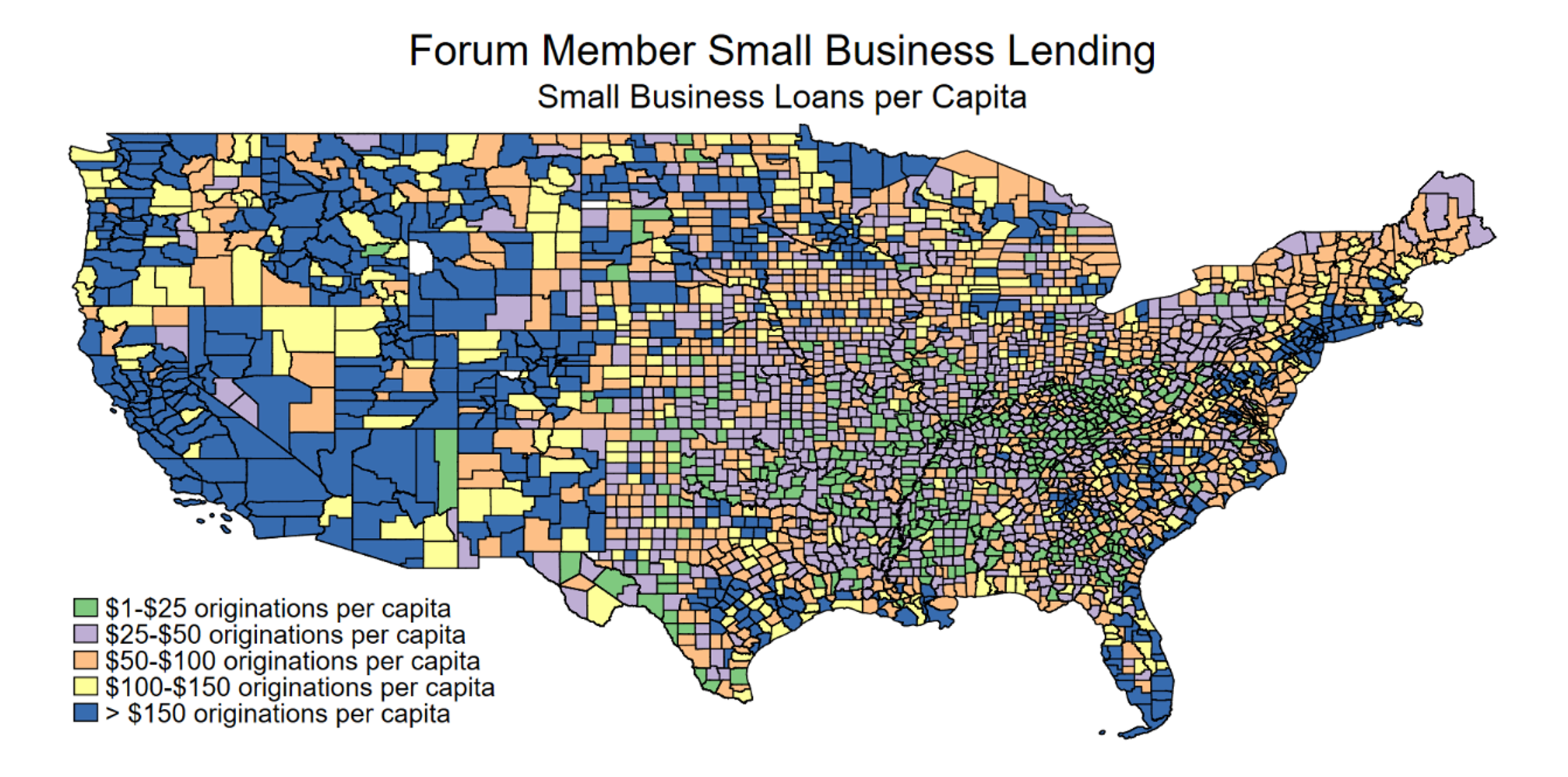

One key benefit of large banks is that they operate on a national scale, which provides them with the opportunity to benefit consumers, communities and businesses across our economy. One tangible example of the wide reach of large banks is their small business lending activities. The chart below shows small business loans that were originated by Financial Services Forum members in the continental United States in 2021 (Forum members also originate small business loans in Alaska, Hawaii and U.S. territories, but these are not displayed to conserve space). As shown in the chart, Forum members are working with small businesses in every part of our country.

The breadth of small business lending by Forum members displayed in the chart is important because it speaks to a primary function of the banking system: connecting savers and borrowers.

The central goal of banking is to match savers with excess savings with borrowers who have productive investment opportunities and need funding. This basic matching function between savers and borrowers is the primary role fulfilled by banks in our economy. A key advantage of large banks is that they have a geographically diverse reach that allows them to find good matches between savers and borrowers even if they aren’t nearby.

As an example, a local area in California may have a sharp need for investment because of the emergence of a thriving new industry. At the same time, that specific area may not have significant amount of excess savings among its households to finance the needed new investments. A large bank, however, can source that financing from deposits sourced from New England, or the South, or the Midwest. By leveraging their scale, large banks can connect those that have the greatest need for investment dollars with those households that have the greatest abundance of savings to invest. And as shown above, Forum members productively match small business borrowers with savers all across the country to finance the important needs of small businesses.

Driving Efficiencies to Reduce Economywide Costs

Another key benefit of large banks is their well-documented ability to reduce costs. A raft of empirical research convincingly shows that large banks benefit from scale economies. Specifically, a large bank can produce the same amount of banking services, such as lending, at lower cost than a smaller bank.One reason for these scale economies is that a large bank can spread its fixed overhead costs out over a larger number of customers, thereby reducing total costs. As a simplified example, imagine that every bank needs a building to serve as its headquarters. A small bank with 100 customers would need to amortize that cost over 100 customers while a large bank could amortize the same cost over several thousand customers, thereby reducing the total cost of producing banking services.

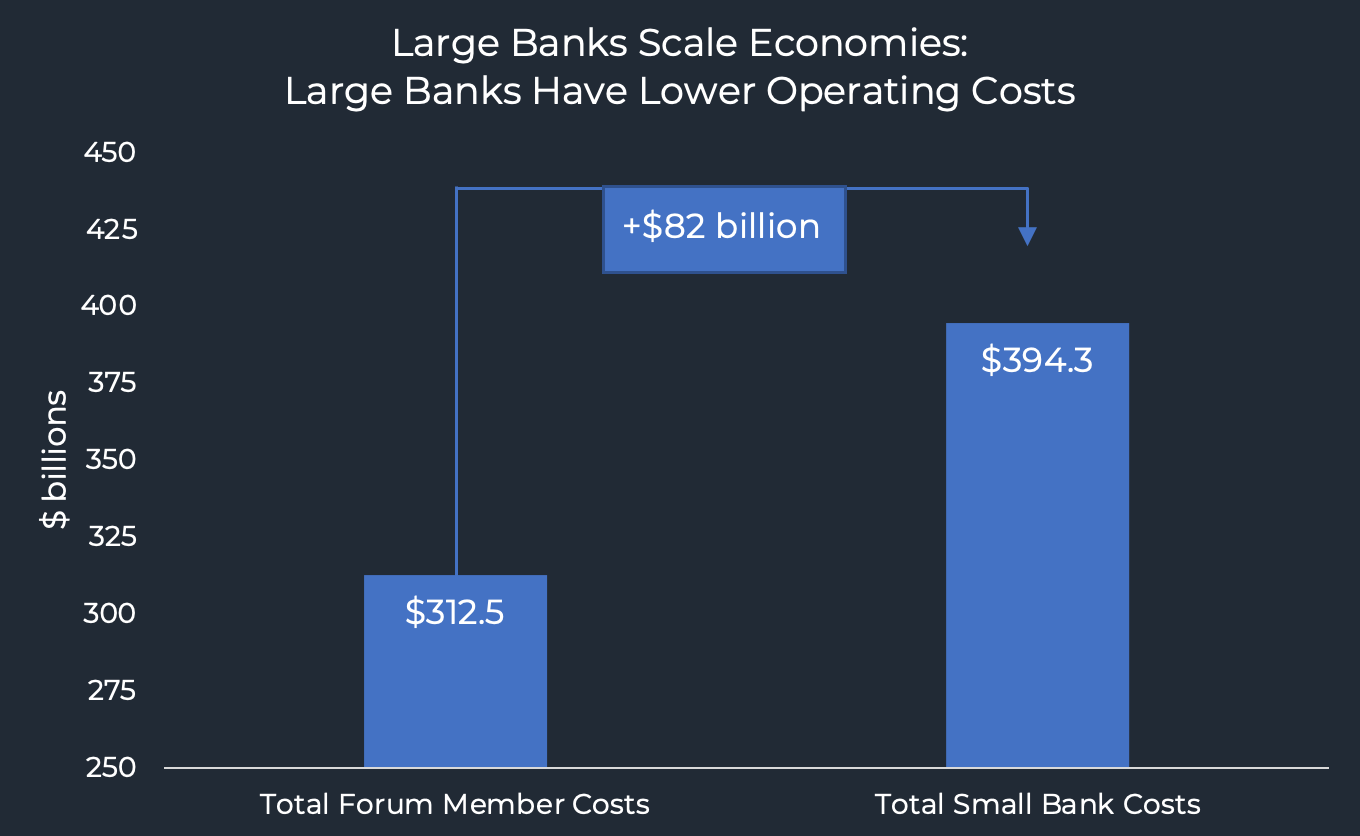

Several academic researchers have quantified the scale economies in the banking industry. In the chart below we use this research to compare the operating costs of Forum members – the cost of wages, IT, real estate, legal services, and so on – with the cost that would be expected to result if each Forum member was replaced by a large number of small banks with total assets of $10 billion, such that the total assets of all the small banks equated to the total assets of Forum members.

As shown in the chart above, replacing Forum members with a large number of small banks would result in a significant increase in costs. The increase in costs results directly from the empirically documented scale economies that accrue to large banks such as Forum members, but not to smaller banks. Overall, the research suggests that banking costs would increase by roughly 25 percent if large banks were replaced by an equivalent number of small banks. These increased costs would be borne by the economy. The increased costs could be passed onto borrowers through higher loan rates or through increased prices for other services. Alternatively, increased costs could result in lower wages for bank employees or lower dividends to bank shareholders. Regardless of who pays, some in the economy would bear higher costs for the same banking services, which would reduce economic efficiency for everyone. Accordingly, the scale economies provided by large banks are an important source of economic efficiency that benefits our entire economy.

Conclusion

Large banks play an important role in our economy. Their size and scope help them to efficiently achieve the primary function of the banking sector – connecting savers and borrowers. In addition, large banks benefit from significant scale economies that drive efficiencies that reduces costs to benefit the whole economy. Forum members are committed to leveraging these strengths to serve households, communities, and businesses across the country.