Introduction

Financial Services Forum members are among the most highly capitalized and liquid banks in the United States. Forum members’ strong capital and liquidity position has allowed them to support the U.S. economy while also demonstrating leadership in resiliency. In this blog, we provide an update on the robust capital and liquidity levels of Forum members and discuss the implications of current capital levels for current and future economic growth.

Forum Members Are Robustly Capitalized

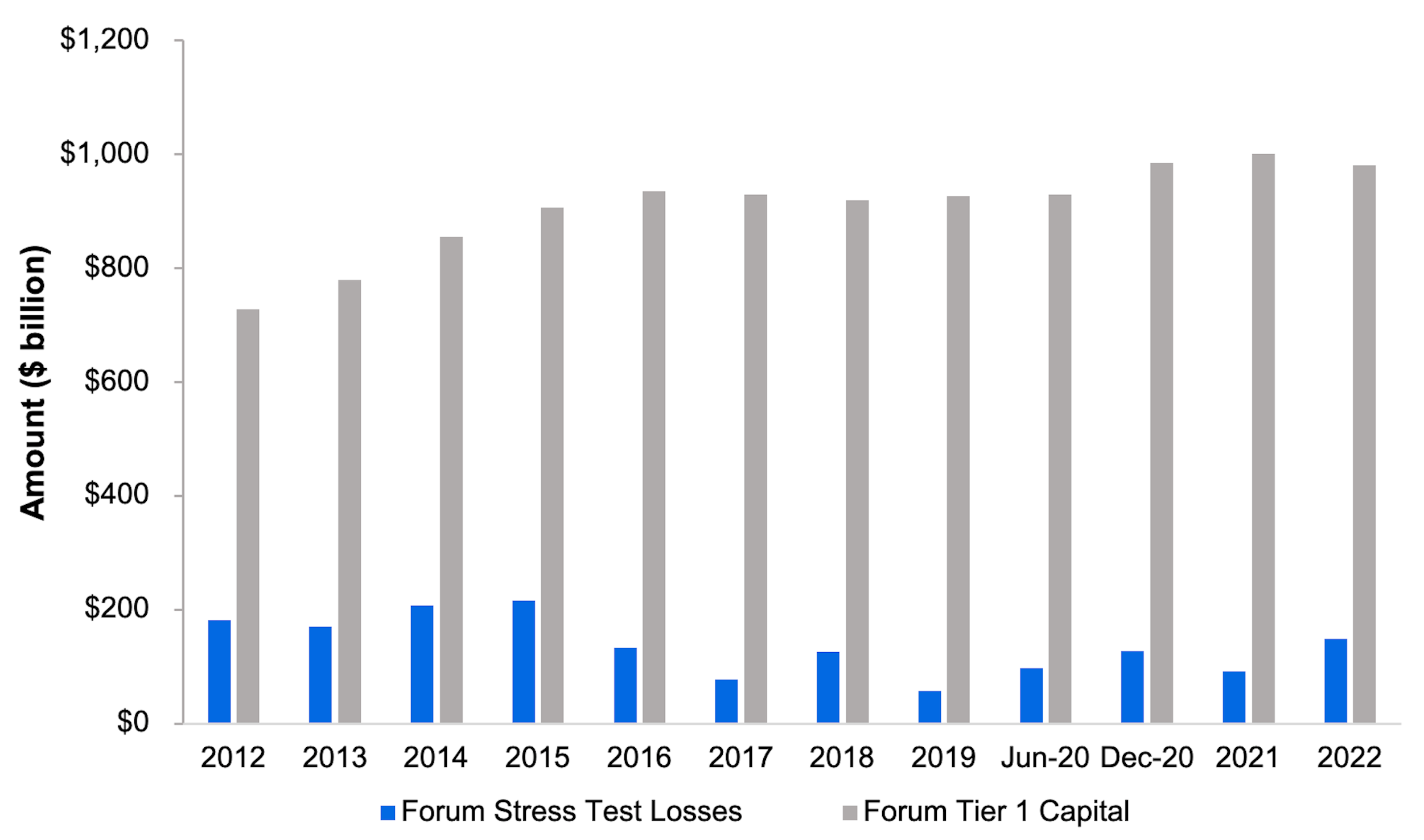

Forum members are subject to rigorous capital requirements that are more stringent than those that apply to other banking organizations, including their international peers. Specifically, Forum members are subject to an additional capital requirement that applies only to a Global Systemically Important Bank (GSIB): the GSIB capital surcharge. Moreover, the GSIB requirement levied in the United States is far more stringent than the requirement that applies internationally. Figure 1 below demonstrates the significant capital adequacy of Forum members by plotting the total amount of losses that are assumed to occur under the Federal Reserve’s stress test and the amount of Tier 1 capital maintained by Forum members to absorb losses in each year since 2012.

As the figure clearly demonstrates, Forum members maintain a level of capital that is many multiples in excess of the amount required to absorb the Federal Reserve’s hypothetical stress losses. This finding is itself all the more compelling in light of the extreme nature of the Federal Reserve stress tests, which routinely envision a period of financial stress more extreme than that experienced during the financial crisis. Finally, just considering the 2022 exercise, total credit, market and counterparty losses for the entire banking industry, before the recognition of revenue, were estimated by the Federal Reserve to be roughly $600 billion, which is still dwarfed by the Forum’s Tier 1 capital, which stood at over $980 billion.

Finally, it is important to understand Forum member capital in the context of the stringent requirements to which they are held. Not only do Forum members maintain capital in line with the most stringent standards, they regularly exceed these standards. More specifically, Forum members currently maintain common equity capital that is roughly $88 billion above all required amounts. Forum members maintain excess capital above requirements to ensure that unexpected market movements don’t meaningfully compromise their already strong capital position. Accordingly, Forum member capital and resilience stands well above the stringent standards to which they are held.

Forum Members Maintain Ample Liquidity

Beyond a strong capital position, Forum members maintain ample amounts of liquidity, which support financial stability by ensuring that a large bank can deal with substantial cash needs without disrupting its ability to extend credit to the economy.

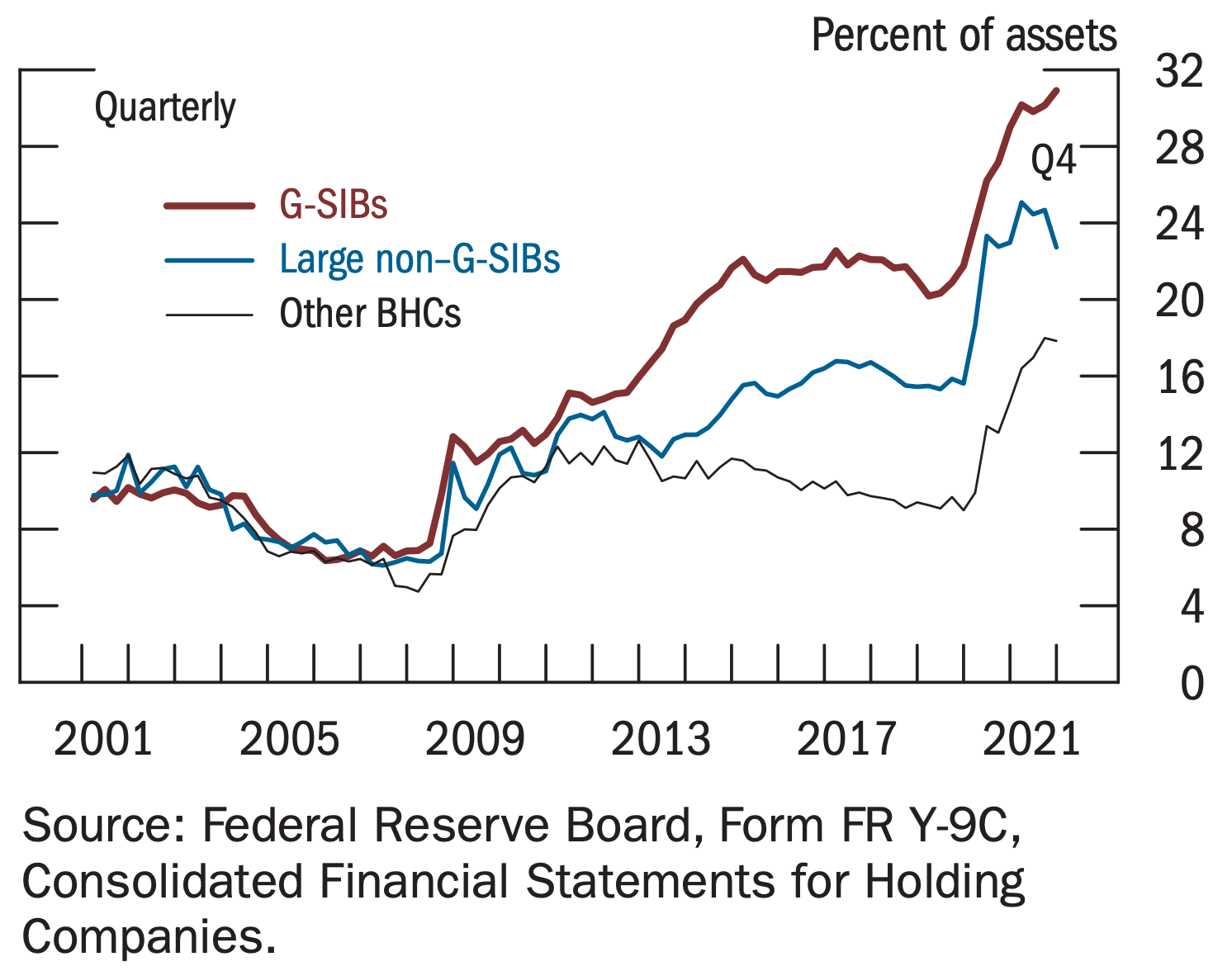

Recently, the Federal Reserve Board’s Financial Stability Report called attention to the significant level of liquid resources held by Forum members. Figure 2 below reproduces the Figure from the report.

As shown in the Figure, Forum members (“G-SIBs”) maintain liquid assets far in excess of other banking institutions and have maintained considerably more liquidity relative to their peers for well over a decade. The industry-leading liquidity levels at Forum members are not accidents, but represent Forum members’ strong liquidity risk management as well as more stringent liquidity requirements that are not applied to other banks. The fact that the liquidity levels of large banks, and Forum members in particular, are profiled in the Federal Reserve’s Financial Stability Report speaks directly to their importance as sources of stability to the financial sector and our economy.

Resilience vs. Growth: Getting the Balance Right

The data clearly demonstrate that Forum members maintain a clear leadership position in supporting the economy with robust capital and liquidity levels that not only meet but exceed the most stringent standards. Against this backdrop, it is worth considering whether current capital and liquidity levels are lacking. As shown during the pandemic, Forum members maintained sufficient capital and liquidity to support the economy and help absorb the shock created by the unprecedented public health crisis. But this is not a case of more is better. That is because capital and liquidity come at a real cost to the economy. As a specific example, a dollar of assets held as cash to satisfy a liquidity requirement simply can’t be deployed to make a loan to a small business. A rainy-day fund of liquid assets is one thing, but hoarding liquidity to the detriment of the economy is quite another.

On the capital front, mainstream economists agree that increasing capital requirements reduces economic growth. As an example, a research paper from the Peterson Institute for International Economics estimates that raising capital requirements by two percentage points would result in a cost to the U.S. economy of roughly $1 trillion. Importantly, this cost arises from increasing the cost of bank lending to businesses, households, and communities. The high level of Forum member capital and liquidity is a testament to GSIBs’ resiliency and their ability to support the economy in difficult times. At the same time, policy makers and the public should be thoughtful about the impact that further increases could have on reducing opportunity and growth in our economy. Quite to the contrary, available data provide no evidence to support the view that resilience is lacking.

Conclusion

Financial Services Forum members are among the most highly capitalized and liquid banks in the United States. Collectively, Forum members maintain $88 billion in capital that is above and beyond all requirements. The strong capital and liquidity positions of Forum members continue to support the U.S. economy while demonstrating leadership in resiliency. At the same time, increasing the amount of required capital and liquidity has significant downside risks in terms of stunted economic growth. Academic studies show that even a modest increase in capital could cost the U.S. economy as much as $1 trillion. Going forward, the public and policymakers should be deliberate and thoughtful about striking an appropriate balance between resilience and growth.