Introduction

The market for U.S. Treasury securities is the world’s most important financial market. Many if not all financial assets are priced relative to the interest rate that the U.S. government pays to borrow money from the public. What’s more, the health and liquidity of the U.S. Treasury market directly affects the cost of financing the U.S. government’s borrowings, which has become increasingly important as both interest rates and U.S. debt levels have risen substantially over the past few years. At the same time, a mounting body of evidence clearly demonstrates that the health and liquidity of the U.S. Treasury market has deteriorated sharply. In particular, economists at the Federal Reserve Bank of New York in a recent blog post explain that Treasury market liquidity and functioning has “been challenged in recent years.” A key factor contributing to the decline in market liquidity is the risk-insensitive leverage ratio that requires banks to maintain the same amount of capital for low-risk Treasury securities as they would for riskier securities such as equities, disincentivizing banks from engaging in the U.S. Treasury market. Others, including prominent economists such as Former Federal Reserve Governor Dr. Jeremy Stein have concluded that a risk-insensitive leverage ratio has contributed to deteriorating Treasury market liquidity, “U.S. Treasury markets is a prime example of a low-risk activity to which banks have been allocating less capital since the SLR [supplementary leverage ratio] was put in place.”

Despite these concerns, Federal Reserve Vice Chair for Supervision Michael Barr in a recent speech indicated that he was not recommending any changes to the leverage ratio. More specifically, he characterized the evidence that a binding leverage ratio reduces Treasury market intermediation as “inconclusive.” In this post, we briefly review the recent evidence on Treasury market illiquidity, relate these findings to the existing leverage ratio regime, and discuss how regulators can and should adjust policy to improve the functioning and stability of the world’s most important financial market.

Market Depth Signals a Significant Decline in U.S. Treasury Market Liquidity

A market’s liquidity reflects the ability to buy or sell significant quantities with relative ease. A liquid market is one in which a significant buy or sell order does not have an outsized impact on market prices. Moreover, a liquid market is one that facilitates trade, price discovery, and overall market health and stability. One measure of a market’s liquidity is its depth. Market depth refers to the amount of an asset that can be bought or sold at the prevailing price. As an example, if you go to the supermarket to buy bananas that have been advertised as being on sale only to find that there are only a few bunches out on display, the market is not “deep” because your ability to buy bananas is limited by the fact that the store only has a small quantity available. Conversely, if the market had a display case brimming with bananas at the sale price, we would say the market is deep because lots of folks could purchase bananas without any difficulty.

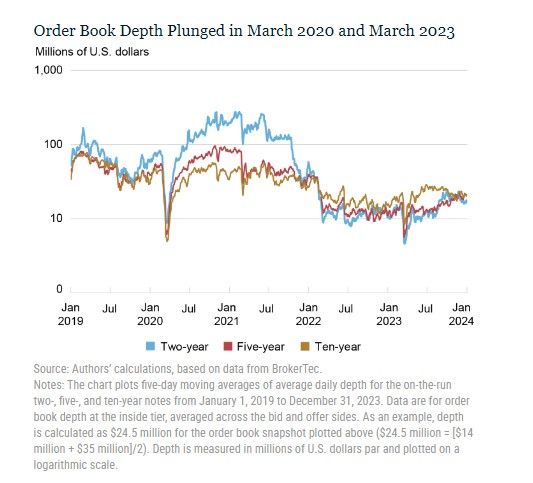

Just like the market for bananas, we can measure the depth of a financial market by measuring the amount of an asset that is available to be bought or sold at the best available price. A recent blog post by economists at the Federal Reserve Bank of New York constructed a measure of market depth in the U.S. Treasury market between January 2019 and January 2024. A plot of their findings is reproduced below.

The first thing to note about this chart is its scale. The scale is logarithmic so that each horizontal line represents an increase of a factor of 10. The chart plots the estimated market depth for three common Treasury bond maturities: two-, five-, and ten-years. As shown in the chart, in January 2019 market depth stood at roughly $100 million. By January 2024, market depth was considerably lower at roughly $25 million. Moreover, the chart shows a clear and steady decline in market depth that is quite consistent and dramatic. Accordingly, this research further underscores a clear and conclusive trend towards deteriorating liquidity and health in the market for U.S. Treasuries.

Large Bank Leverage Requirements Are a Key Factor in Deteriorating Treasury Market Liquidity

The data clearly demonstrate a significant deterioration in Treasury market functioning and liquidity. And while it is surely the case that, like any phenomenon, there are multiple factors at play, the restrictive nature of risk-insensitive leverage ratios is clearly one key factor that has been identified as a source of worsening liquidity conditions. As we have discussed, the Group of Thirty’s 2021 report on the U.S. Treasury market specifically identified large bank leverage requirements as a key factor leading to diminished liquidity. More recently, economists from the Federal Reserve Board published a research paper indicating that “these finding[s] support the hypothesis that banks’ ability to participate in markets for safe assets may be curtailed by leverage regulations.” More recently still, Darrell Duffie of Stanford University presented a research paper at the 2023 Federal Reserve Jackson Hole Conference that found that: “Since 2007, the total size of primary dealer [large bank] balance sheets per dollar of Treasuries outstanding has shrunk by a factor of nearly four. This trend continues because of large US fiscal deficits and regulatory capital constraints.”

As in the case of the data demonstrating lower Treasury market liquidity, the evidence suggesting that leverage requirements are a key factor driving this deterioration is both clear and convincing. While one can credibly claim that there are additional factors helping to determine Treasury market liquidity, it is not defensible to simply state that evidence of leverage as proximate cause is “inconclusive.”

Making Good on Past Promises: The Path to Leverage Ratio Reform

Back in 2021, the Federal Reserve Board announced that it would “shortly seek comment on measures to adjust the SLR [large bank leverage ratio requirement].” In light of the mounting evidence that Treasury market liquidity is continuing to worsen, now is the time for the Federal Reserve to maintain its institutional credibility and make good on its promise to seek comment on adjustments to large bank leverage requirements. To be clear, the stakes are now higher than they have been in the past. As recently disclosed by the Congressional Budget Office, at current interest rates, the U.S. Government will spend more on interest payments on U.S. Treasury securities than national defense or Medicaid in 2024. The importance of a liquid and well-functioning Treasury market is critical to our nation’s future success now more than ever.

Finally, one common objection to leverage ratio reform is the argument that recently proposed changes to risk-based capital requirements, ala “Basel 3 Endgame,” will obviate the need for any leverage ratio reform. This argument is deeply flawed on many levels. First, as a pure process matter, the Federal Reserve Board had full knowledge that it would implement Basel 3 Endgame back in 2021 when it committed to seek comment on adjustments to the SLR. Second, the key argument for risk-insensitive leverage ratio requirements is that internal, model-based capital requirements are too easily “gamed” by banks, thus requiring a “rough and ready,” but “un-gameable” leverage ratio as a backstop. As the U.S. Basel 3 Endgame proposal does away with nearly all internal models, if implemented, the basic argument motivating a leverage requirement would no longer exist, suggesting that regulators should take a very hard look indeed as to whether any leverage requirement at all is necessary.

Conclusion

The U.S. Treasury market is the world’s most important financial market. The last few years have seen a steady and clear deterioration in the liquidity and overall health of this market. At the same time, the evidence that risk-insensitive leverage ratios are playing a key role in this troubling trend is clear and conclusive. Rising U.S. debt levels and interest rates heighten the need for regulators to take active steps in the near term to ensure the health, vibrancy and liquidity of the Treasury market. Regulators should quickly seek public comment on adjustments to leverage ratio requirements as they committed to do in 2021.