Introduction

Since the onset of the pandemic in the U.S. in 2020, U.S.-based Global Systemically Important Banks (GSIBs) have supported businesses, households and communities through expanded lending, increased deposits, and robust securities underwriting for public companies seeking private capital. While all of this has been occurring, the Federal Reserve and the rest of the U.S. government have engaged in a massive fiscal and monetary stimulus that has directly and mechanically increased the size of the banking sector. The increased size of the banking sector has resulted in increased GSIB scores of all Forum members and will result in increased GSIB surcharges and capital requirements in 2023. Rising capital requirements will raise the cost of bank lending and depress economic activity at a time that the economy is facing headwinds. The scheduled increases to the GSIB surcharge are the result of government policy, are unrelated to any reasonable notion of systemic risk, do not signal any need for increased capital requirements, and should be arrested before they take effect in 2023.

The Federal Reserve’s Balance Sheet and the GSIB Surcharge

The Federal Reserve supplies the economy with two forms of money: currency and bank reserves. As the Federal Reserve expands its balance sheet by buying more government securities, it increases the amount of bank reserves in the system. During the pandemic, the Federal Reserve engaged in an unprecedented expansion of its balance sheet from roughly $4 trillion to $9 trillion to support the economy. For some perspective, during the financial crisis from 2008 to2009, the Federal Reserve expanded its balance sheet from $1 trillion to $2 trillion. By any standard, the balance sheet expansion we have witnessed recently is without precedent.

When the Federal Reserve increases bank reserves, bank assets must rise because only banks can hold bank reserves. Banks have no choice in the matter because the Federal Reserve fully and solely controls the supply of bank reserves. The GSIB surcharge is a capital charge that only applies in the United States to the eight Forum members. According to regulators, the GSIB surcharge is intended to measure the “systemic risk” of a large bank and banks with higher GSIB scores face a higher capital requirement. The GSIB score is based on a complex amalgamation of balance sheet variables such as the size of a bank’s total assets, the amount of securities on its balance sheet, and the amount of certain deposits. As the Federal Reserve’s balance sheet has risen, so too have the total assets and other balance sheet variables of all Forum members. The concomitant rise in Forum member balance sheets is a largely mechanical and unavoidable consequence of the Federal Reserve’s balance sheet policy that has impacted all banks throughout the country.

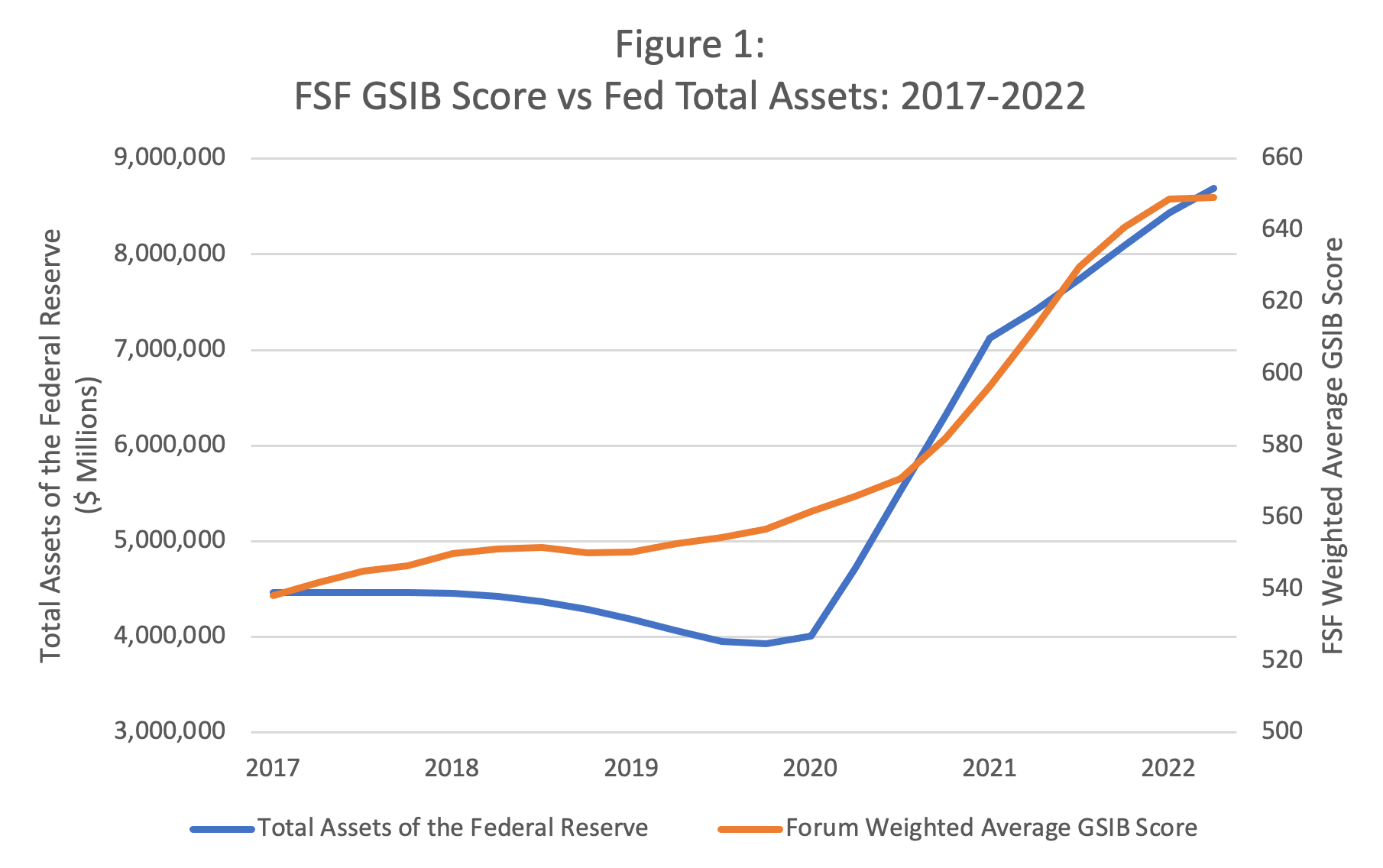

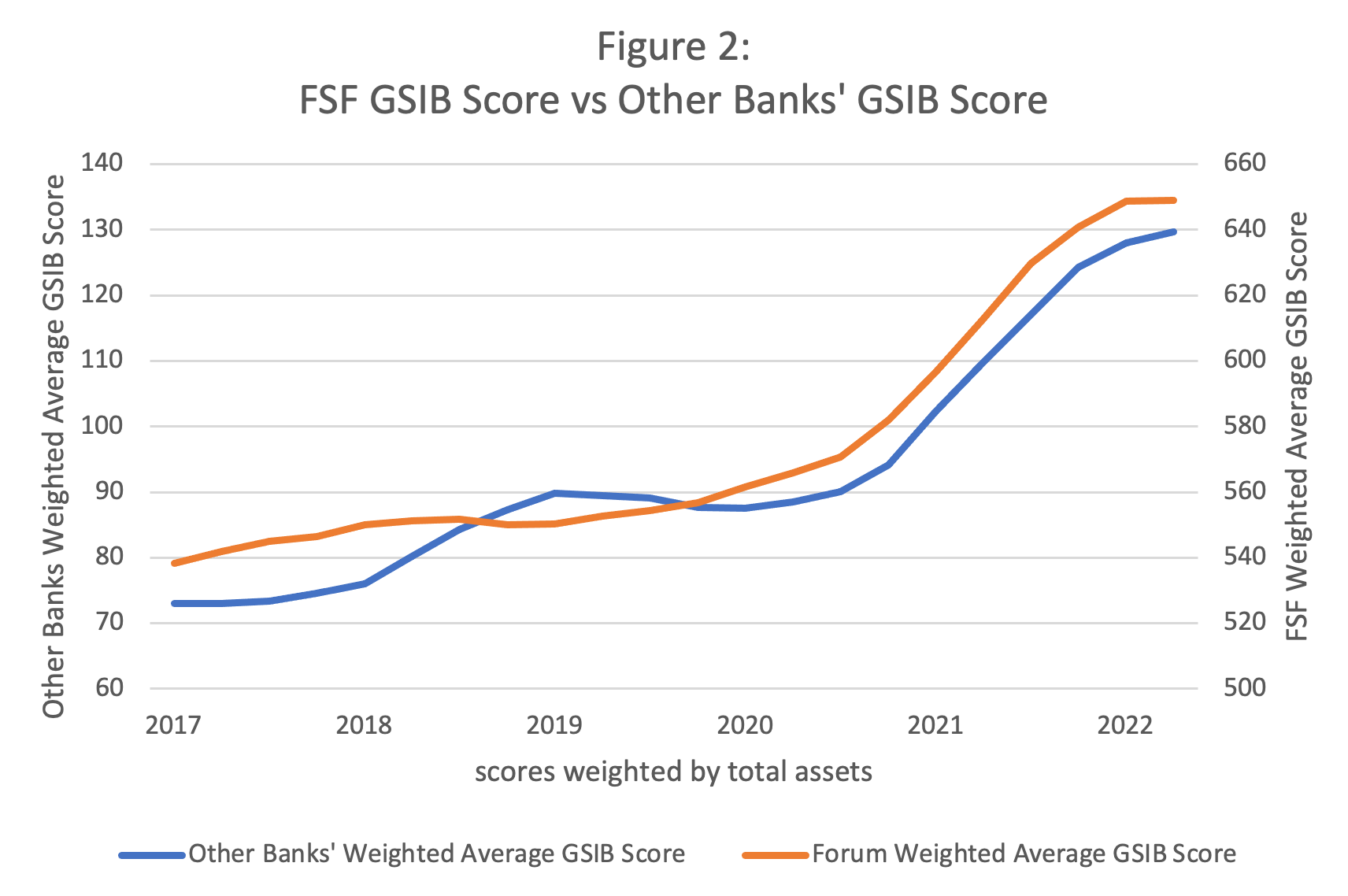

Below, we show two figures demonstrating the pervasive impact of the Federal Reserve’s balance sheet policy on Forum members and the entire banking sector. First, we show a plot of the Federal Reserve’s balance sheet and the aggregate GSIB score of Forum members. This chart clearly shows that starting in 2020 as the Federal Reserve balance sheet began to rise, so too did the GSIB score of Forum members. In the second chart, we show the aggregate GSIB score of all Forum members and that of all other large banks that are required to report their GSIB scores. None of these other large banks are subject to the GSIB surcharge, but are required to report the score for monitoring purposes. This chart also clearly shows that the behavior of Forum GSIB scores is directly in line with developments in the rest of the banking industry. As bank reserves have increased, so too have the total assets and other balance sheet variables of all banks. There is nothing unusual or unique about the recent experience of Forum members.

Increased GSIB Scores Despite Reduced Systemic Risk

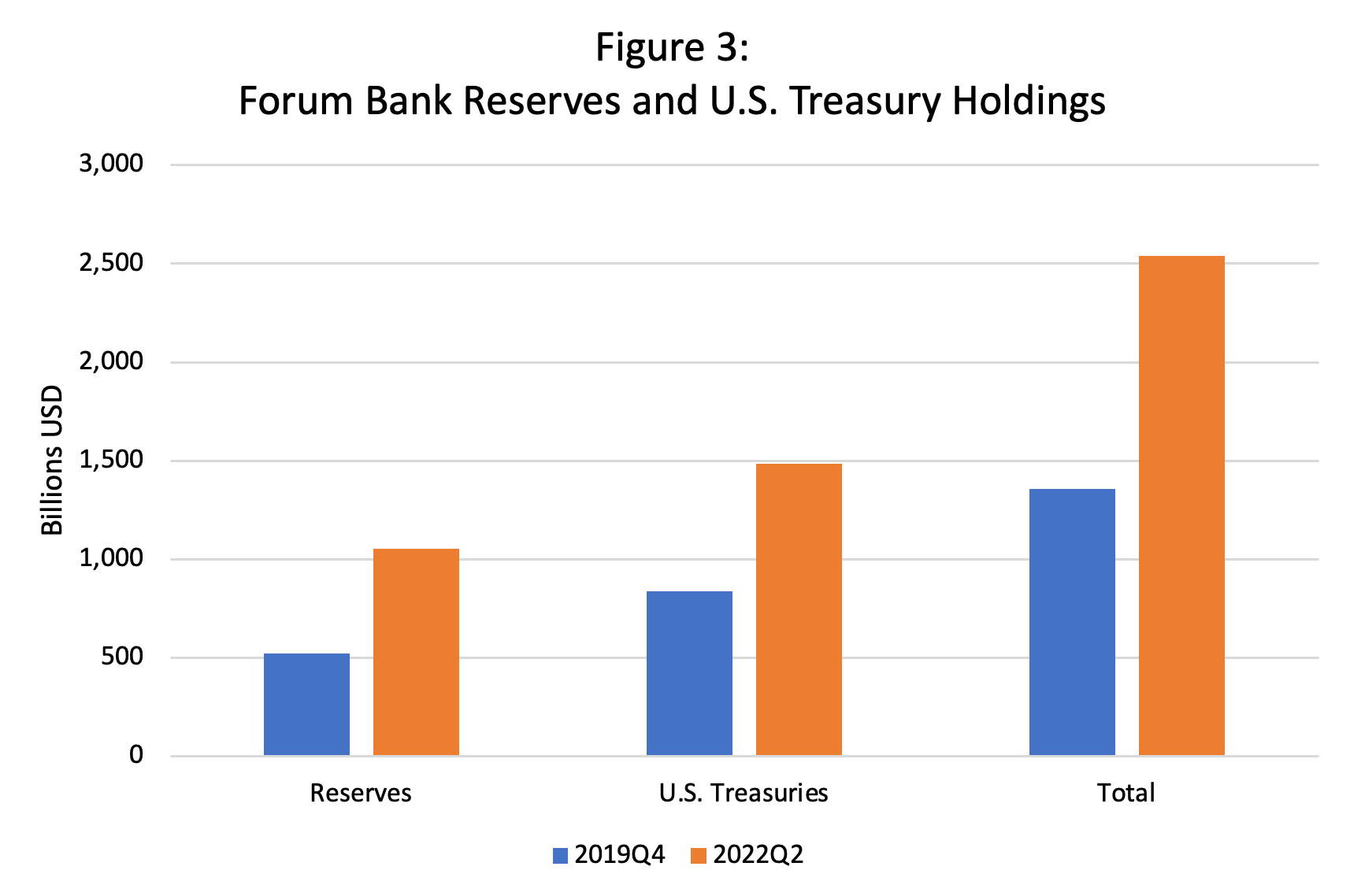

We have established that GSIB scores and surcharges are rising for reasons that are well beyond the control of the affected banks. In addition, however, GSIB scores are rising while systemic risk is declining. Said another way, the heightened scores paradoxically signal lower systemic risk. This is because large banks have significantly increased their holdings of cash and U.S. Treasury securities due to the unprecedented increase in bank reserves. Cash and Treasurys are among the safest financial assets in the world. Cash bears zero default risk while the full faith and credit of the U.S. government stands behind all U.S. Treasurys. A bank with significantly more safe cash and U.S. Treasurys surely presents less, not more, systemic risk to the economy. The figure below shows the increase in cash and U.S. Treasury holdings. Since 2019, cash and U.S. Treasury holdings of Forum members have increased by over $1.2 trillion. Increasing a bank’s GSIB surcharge because it holds “too much” cash and Treasury securities is simply nonsensical. But that is how the GSIB formula is working.

Increased GSIB Surcharges Will Unnecessarily Raise Borrowing Costs

Some may argue that the Federal Reserve is now engaged in a reduction of its balance sheet and that GSIB scores and surcharges will recede on their own. This argument ignores that current estimates suggest that it will take several years for the Federal Reserve’s balance sheet to normalize. The economy should not be saddled with incoherent and unhelpful capital policy for a period of years while it waits for “things to run their course.” Rather, the Federal Reserve should act now to arrest the oncoming changes and commit to a fuller reevaluation of the GSIB surcharge as part of the announced holistic review of the capital regime that was described by the Federal Reserve’s Vice Chair for Supervision.

Capital is not a free resource. Capital requirements should reflect real, well-founded risk-based considerations and should not rise as an unnecessary consequence of government policy. The oncoming increases in GSIB surcharges will result in higher borrowing costs that will put downward pressure on economic activity in the near term. As capital requirements rise, so too will borrowing costs, which will reduce lending and economic growth.

In light of current economic headwinds, it is all the more important to ensure that banks can proactively support lending and the economy. Unnecessary and counterproductive increases in capital requirements are never good, but are all the more damaging in the present circumstances.

Conclusion

A willingness to change one’s mind in light of new facts is a hallmark of good decision making. The period of the past few years has, if nothing else, presented the world with a whole new set of facts that demand consideration. The underlying motivations for the GSIB surcharge have been completely upended, and indeed, reversed, by the pandemic and the Federal Reserve’s unprecedented balance sheet policy response. We should not blindly follow a formulaic approach to increasing capital requirements without carefully taking stock of where we are and whether such an increase is warranted. Any reasonable analysis of the facts shows that increasing GSIB capital surcharges at this point in time is unwarranted, unhelpful, and will only serve to weaken our economy. The Federal Reserve should act swiftly to halt these increases before they take effect in January.