Home » Essential to the U.S. Economy

Essential to the U.S. Economy

Large, diversified U.S. financial institutions make unique and vital contributions to the American economy.

America’s leading banks support Main Street by deploying nearly $5 trillion in loans to businesses and families across the country, in addition to helping people save for the future. Forum members play a critical role in the growth and success of the U.S. economy by serving consumers, partnering with small businesses, and lending to other financial institutions. We are also uniquely positioned to support states and localities raise the funds they need to build and upgrade vital infrastructure, like hospitals, schools, roads, and bridges.

The Value and Strength of America’s Largest Financial Institutions

We support economic growth by lending to consumers, businesses, and other financial institutions, and foster deep and liquid capital markets that allow the U.S. government and private institutions to finance public spending and investment. Our financial institutions provide a wide range of products and services that supports the ability of consumers, governments, and businesses of all sizes to grow and create jobs in the United States.

Credit

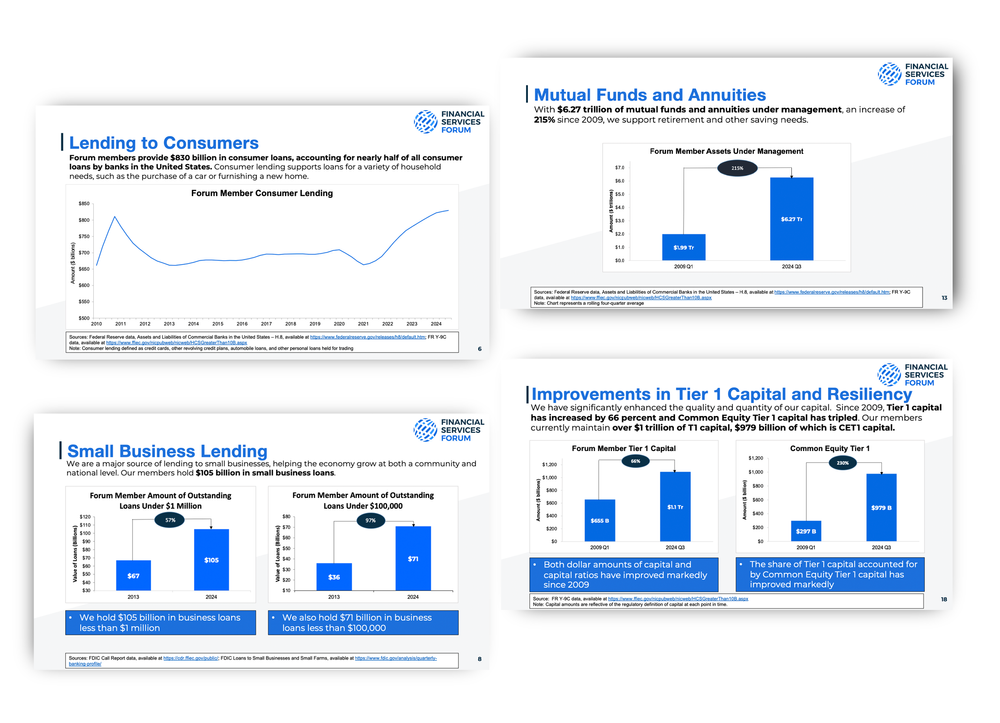

We promote savings and investment through lending. Forum members hold $5.08 trillion in loans, accounting for 39 percent of total lending by banks to businesses and households. Forum members provide nearly half of all consumer loans by banks in the United States. Consumer lending supports loans for a variety of household needs, such as the purchase of a new car or furnishing a new home.

Forum members provide $855 billion in consumer loans.

U.S. Consumer Lending

Forum Member Amount of Outstanding Business Loans Less Than $100,000

Holding $108 billion in small business loans, our members are a major source of lending to small businesses, helping the economy grow at both a community and national level.

Liquid Capital Markets

Our underwriting activities foster deep and liquid capital markets and support corporate investment in America. We underwrite three-quarters of debt and equity transactions–such as initial public offerings–among large institutions in the United States, providing a critical service that that other U.S. institutions cannot offer.

Underwriting Four-Quarter Average for Periods Ending Q3 2024 and Q3 2025

Our members underwrite three-quarters of debt and equity transactions.

Capital & Liquidity

Our institutions help foster deep and liquid capital markets, ensuring the U.S. government and private institutions are able to effectively finance public spending and investments in the real economy.

Forum members have significantly enhanced the quality and quantity of their capital.

Forum Member Common Equity Tier 1 Capital

Forum Member Stress Test Losses to Tier 1 Capital

Forum members maintain substantial capital to sustain losses as severe as those contemplated in the stress tests.

Regulation & Supervision

In addition to significant annual increases in capital and liquidity levels, several post-crisis regulatory and supervisory reforms have greatly increased the safety and resilience of the U.S. financial system. These include enhanced supervision at member institutions, improved resolvability, and new requirements to issue long-term debt, among others..

Total subsidiaries at U.S. GSIBs have declined by 27% since 2009, which suggests a significant decrease in organizational complexity.

Forum Member Unique Subsidiaries

We provide nearly half of all consumer loans by banks in the United States and meet close to three-quarters of the bank funding needs of other financial institutions across the country. We underwrite nearly three-quarters of debt and equity transactions – such as initial public offerings – among large institutions in the United States. We are vital to a vibrant U.S. economy that is competitive worldwide.