Dear reader,

Welcome to the latest edition of The Forum File. In this edition, we are highlighting one bank’s work to support mental health in local communities, Forum members’ vital role in making small businesses stronger, and a look at our contributions to communities across the country.

We hope you enjoy reading this edition and please do not hesitate to share your feedback.

Kevin Fromer, President and CEO, Financial Services Forum

Penny for Your Thoughts

Joan Steinberg is Morgan Stanley’s Global Head of Philanthropy and President of the Morgan Stanley Foundation.

What is the Morgan Stanley Alliance for Children’s Mental Health and what drives this work?

For more than 60 years, the Morgan Stanley Foundation has been dedicated to giving children a healthy start to life, supporting diverse communities, and harnessing the time and skills of our employees to make an impact. In February 2020, we launched the Morgan Stanley Alliance for Children’s Mental Health in response to the mental health crisis facing our youth.

We recognized that while anxiety and depression in young people have risen at alarming rates, children’s mental health remains substantially underfunded. Approximately 20% of youth experience a mental, emotional, developmental or behavioral disorder, but only around 1% of philanthropic funding is earmarked for these issues. Through the Alliance, we are combining the resources and reach of Morgan Stanley with the knowledge and experience of leading nonprofits in the mental health space. Our aim is to help deliver positive, tangible impact on the critical challenges of stress, anxiety and depression in young people.

The Alliance supports organizations through growth capital, nonprofit capacity building, seed funding and thought leadership. So far, Alliance programs have reached 25 million students, families and educators globally, many of whom are from diverse and underserved groups.

Tell us about the Alliance’s Innovation Awards program and the solutions it is advancing.

In 2021, the Alliance launched the Innovation Awards program as a way to identify and fund mental healthcare solutions for youth across the U.S. – seeking to address the lack of both private and public investment in this issue.

To date, the Alliance has provided $1 million in grants to ten groundbreaking nonprofits across the United States, and is currently reviewing applications for the next cohort of five organizations working on mental health solutions for youth in their local communities and beyond. Each award winner will receive a grant of $100,000, as well as additional support through publicity, fundraising opportunities and consultation and training with industry professionals.

In response to the high volume of applications, we will be expanding the program to support more charities and hopefully effect greater change in this space. Through a capacity building platform, we will offer expert-led and peer learning sessions and networking events aimed to benefit small- to mid-sized organizations. We are encouraged by the growth of the awards program over the past few years, including the $6 million in additional funds raised by our first cohort, and hope to inspire others to join us in our mission to fund transformative solutions to the children’s mental health crisis.

How else is Morgan Stanley working to support local communities?

“Give Back” is one of five core values at Morgan Stanley and is very ingrained in our culture. Our employees engage in the Firm’s philanthropic programs year-round by volunteering, donating funds and collaborating with their colleagues to increase our collective impact. In 2022, our Firm, foundations and employees collectively donated more than $160 million to nonprofit organizations around the world throughout the year.

We also leverage the talents and passions of our employees to strengthen our impact. A cornerstone of this work each year is Global Volunteer Month, when we come together across the world to kick up our efforts to volunteer in the communities where we live and work.

Since our first Global Volunteer Month 17 years ago, our employees have provided over 2.8 million hours to local charities during the campaign. We just concluded our 2023 program, and over 60K employees—nearly 75% of our Firm—devoted over 295K volunteer hours to their communities. Senior management is highly invested in the program, serving as role models by participating themselves and actively encouraging our employees to volunteer.

Value Add

Morgan Stanley Strategy Challenge

The Morgan Stanley Strategy Challenge, our flagship pro-bono program, combines our employees’ business acumen with our value of giving back in an especially deep and substantial way. Launched in 2009, the Strategy Challenge gives Morgan Stanley employees the opportunity to consult for nonprofits and help them solve strategic, mission-critical challenges. Over an eight-to-ten-week engagement, employees from different levels and with varied skill sets leverage their expertise to provide customized analysis and implementable action plans, along with tools for future assessments and decision-making.

Through the program, Morgan Stanley employees have served a total of 183 nonprofits and volunteered over 131,000 hours. Team recommendations have led to more effective business models, expanded services, productivity improvements and more—all in service of each nonprofit’s mission. This year’s teams collaborated with nonprofits to tackle pressing societal issues, including in education, healthcare, children’s wellbeing, mental health and food insecurity.

Capital Gains

What we’re doing in Washington

The Forum released its latest Policy Cents video featuring Forum President and CEO Kevin Fromer on the vital role played by the nation’s largest banks in supporting small businesses through lending. Watch the latest video and the rest of our series here.

In response to the release of a proposal on capital requirements, Forum President and CEO Kevin Fromer issued a statement. “The U.S. government is poised to increase the cost and reduce the availability of a wide array of services that directly support our economy,” Fromer said. “There is no justification for significant increases in capital at the largest U.S. banks and no other jurisdiction is likely to adopt the approach proposed today, which will only increase the significant disparity that already exists between U.S. and foreign bank capital requirements.”

Fromer also joined Bloomberg TV to highlight the costs of higher bank capital to U.S. businesses and households. Read more and watch the full interview.

The Forum responded to a proposal by the FDIC that seeks to recover losses to the Deposit Insurance Fund resulting from use of the Systemic Risk Exception in connection with the closures of Silicon Valley Bank and Signature Bank. The proposed special assessment on insured depository institutions neither reflects the entities that benefitted from the systemic exception determination nor differentiates between stable and unstable deposits, the Financial Services Forum said.

The Forum, with the American Bankers Association, Bank Policy Institute, Institute of International Bankers, and Securities Industry and Financial Markets Association, submitted a letter to Federal Reserve Chair Jerome Powell to carefully consider the costs of higher capital requirements.

Our Two Cents

Research from the Forum

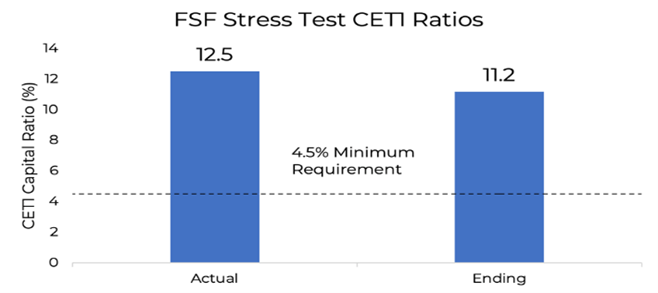

This year’s stress test demonstrates the robustness and resilience of our nation’s largest banks. The chart below shows Forum firms’ common equity tier 1 capital (CET1) ratio at the beginning of the stress test and at the point the CET1 reaches its minimum value of 4.5 percent.

Even though the stress test subjects large banks to an economic scenario more severe than the financial crisis, the chart shows that Forum member capital levels only dip modestly, which indicates sound and resilient balance sheets. Additionally, even at their lowest points, Forum members maintain a level of capital that is three times as high as the regulatory minimum of 4.5 percent.

To learn more about capital at the nation’s largest banks, go to smartbankcapital.com.

Checking the Balance

Members in the news

Bank of America announced it will expand its financial center network into nine new markets over the next four years, bringing banking, investing, retirement, lending and small business services and solutions to more clients and communities. Through this expansion, the company will now operate financial centers in more than 200 markets across 39 states.

BNY Mellon Investment Management announced the launch of two new thematic Exchange-traded funds for investors, BNY Mellon Women’s Opportunities ETF and BNY Mellon Innovators ETF. “These ETFs will enable investors to potentially benefit from themes we believe will drive economic and societal growth and progression,” said David DiPetrillo, Head of North America Distribution at BNY Mellon Investment Management.

Citi and American Airlines announced the refresh of the Citi/AAdvantage Executive World Elite Mastercard with new benefits. The new card benefits will enhance cardmembers’ travel experiences and will offer more opportunities to earn AAdvantage miles and loyalty points, as well as greater rewards for everyday travel and spending.

Goldman Sachs announced the expansion of Visual Structuring, a tool for options price discovery and trade idea generation, available through Goldman Sachs Marquee. The bank expanded capabilities for the tool into equities, crypto and precious metals, and also launched web and Android versions in addition to the original iOS mobile application for FX launched in September.

JPMorgan Chase announced new philanthropic and expanded business commitments as part of its firmwide approach to addressing the housing affordability gap. The announcement marked two years into JPMorgan Chase’s $400 million, five-year commitment to improve housing affordability and stability for underserved households.

Morgan Stanley’s E*TRADE earned 5.0 out of 5.0 stars and took the #1 spot for Best Mobile Investor App and Web Trading Platform from StockBrokers.com’s 2023 Online Broker Review. E*TRADE aims to enhance the financial independence of traders and investors through a powerful digital offering and professional guidance.

State Street announced that its Alpha servicing platform for institutional investment and wealth managers now supports the entire ETF (exchange traded funds) lifecycle with front, middle and back-office capabilities, with everything bolstered by The State Street Alpha Data Platform.

Wells Fargo announced a $7.5 million grant to Habitat for Humanity International to help make housing more affordable and accessible. Through the 2023 Wells Fargo Builds program, the grant funding will enable local Habitat for Humanity affiliates to build and repair more than 360 homes nationwide, including accessibility modifications to meet the needs of low-income older adults and people with disabilities.