Hello!

I’m thrilled to introduce myself as the Financial Services Forum’s new President and CEO. It’s an honor to lead this incredible organization to advance our mission of promoting policies that support a sound and vibrant financial system.

I’m eager to get to work driving positive change and ensuring our banks can continue to serve consumers, businesses, and communities. This month, we’re spotlighting one firm’s role in transforming the digital asset landscape by delivering real-time solutions that power seamless global commerce.

I look forward to collaborating with our members, policymakers, and partners in the months ahead. You can follow me on LinkedIn and now on X.

Amanda Eversole, President and CEO, Financial Services Forum

Penny for Your Thoughts

Ryan Rugg, Global Head of Digital Assets, Citi Services

Can you walk us through Citi’s strategy with Citi Token Services and how it’s transforming payments and liquidity for institutional clients?

Citi’s network and large global footprint are among our greatest strengths – we serve 19,000 clients including 85% of the Fortune 500 companies and move $5 trillion every day. In an increasingly digital world, Citi is continually innovating to provide borderless, always-on, and real-time solutions to enable frictionless commerce on a global scale.

24/7 clearing capabilities and tokenized deposits remain central to our digitization strategy. Our digital asset strategy is consistent with our innovation strategy to research emerging technologies, collaborate with partners, build new solutions and implement new capabilities that support our clients. We continue to evolve our footprint and capabilities to support our clients by connecting them to new digital networks and enabling them to execute their strategies.

Any milestones you can share?

We launched Citi Token Services for Cash last year, which leverages a private permissioned blockchain that is facilitating billions of transactions for institutional clients in U.S. Dollars. This enables clients to move money around our network – across borders – instantaneously on a 24/7 basis. Citi Token Services for Cash is live in the United States, United Kingdom, Singapore, and Hong Kong; with additional markets and currencies on the roadmap. As of June 2025, we have processed billions of dollars globally on CTS, achieving a significant milestone on our innovation journey since commercial launch.

What does “responsible innovation” look like at Citi when working with emerging tech like tokenization? What role do you see traditional financial institutions playing in accelerating mainstream digital asset adoption?

We believe the future of networks will be borderless, always-on and real-time to enable frictionless commerce on a 24/7 global scale. The adoption of digital assets and blockchain technologies have progressed, and it is clear they will play a crucial role in future financial markets and in enabling real-time treasuries. Our strategy involves two key approaches: enhancing existing traditional financial rails with our solutions including 24/7, Real Time Liquidity, and Spring by Citi, and strategically investing in new technologies and platforms like our award-winning Citi Token Services. This dual approach allows us to meet our clients’ evolving needs and enables them to scale in a safe and sound manner.

What advice would you give to emerging leaders navigating the intersection of legacy finance and emerging tech?

- Lead with use cases not hype: focus on practical benefits and adding client value

- Ecosystem: unlike legacy finance, blockchain thrives on networks and interoperability

- Treat clients, compliance, regulators and risk as design partners

Value Add

Investing in innovative solutions for pressing community challenges.

This year marks the five-year anniversary of the Citi Impact Fund, which puts Citi’s balance sheet to work by investing in “double-bottom line” companies building innovative solutions for pressing community challenges. The $500 million Citi Impact Fund looks to bring all of Citi to its portfolio companies, leveraging the breadth of the firm’s capabilities and expertise to help companies scale and advance economic opportunity for underserved communities. To date, we have invested over $190 million in over 50 companies and funds.

The Citi Impact Fund’s investments focus on solutions to community needs, and many of our partners are using new and emerging technology to help address these needs. One example is Clerkie, an AI company helping millions of Americans ease their debt burden with a dedicated financial assistant, automated debt negotiations, and access to responsible financial solutions for urgent money needs. Fueled by investments from the Citi Impact Fund and others, Clerkie helped consumers cut over $1 billion in debt last year.

Capital Gains

What we’re doing in Washington

The Forum voiced strong support for proposed revisions to leverage-based capital requirements for U.S. GSIBs in a letter to the Federal Reserve, the Office of the Comptroller of the Currency, and the FDIC. We emphasized the changes are not expected to materially impact GSIB capital levels and would help ensure the nation’s largest banks remain resilient and better positioned to support the economy.

The Forum joined BPI, ABA, and CBA in applauding President Trump’s Executive Order to promote access to financial services across America. “Today’s Executive Order helps ensure all consumers and businesses are treated fairly, a goal the nation’s banks share with the Administration,” the associations stated.

To further support consumers and the broader economy, the Forum submitted a comment letter urging the Federal Reserve to promptly adopt its proposal to improve large bank supervisory ratings. Our recommendations include targeted supervisory enhancements to further improve oversight and resilience.

Finally, to protect the safety and stability of the financial system, we joined ABA, BPI, CBA, and ICBA in calling for a regulatory fix to prevent stablecoin issuers from paying interest, a move that could introduce systemic risk into the financial system.

Our Two Cents

Research from the Forum

Continuing our discussion on leverage capital reform, arguments that easing bank-level requirements could weaken banks’ resilience confuse broad, institution-level requirements with narrower, bank subsidiary-level rules.

In our latest BankNotes blog, the Forum’s Chief Economist explains that the proposed adjustment is not expected to materially impact GSIB capital levels and would ensure these banks remain well capitalized.

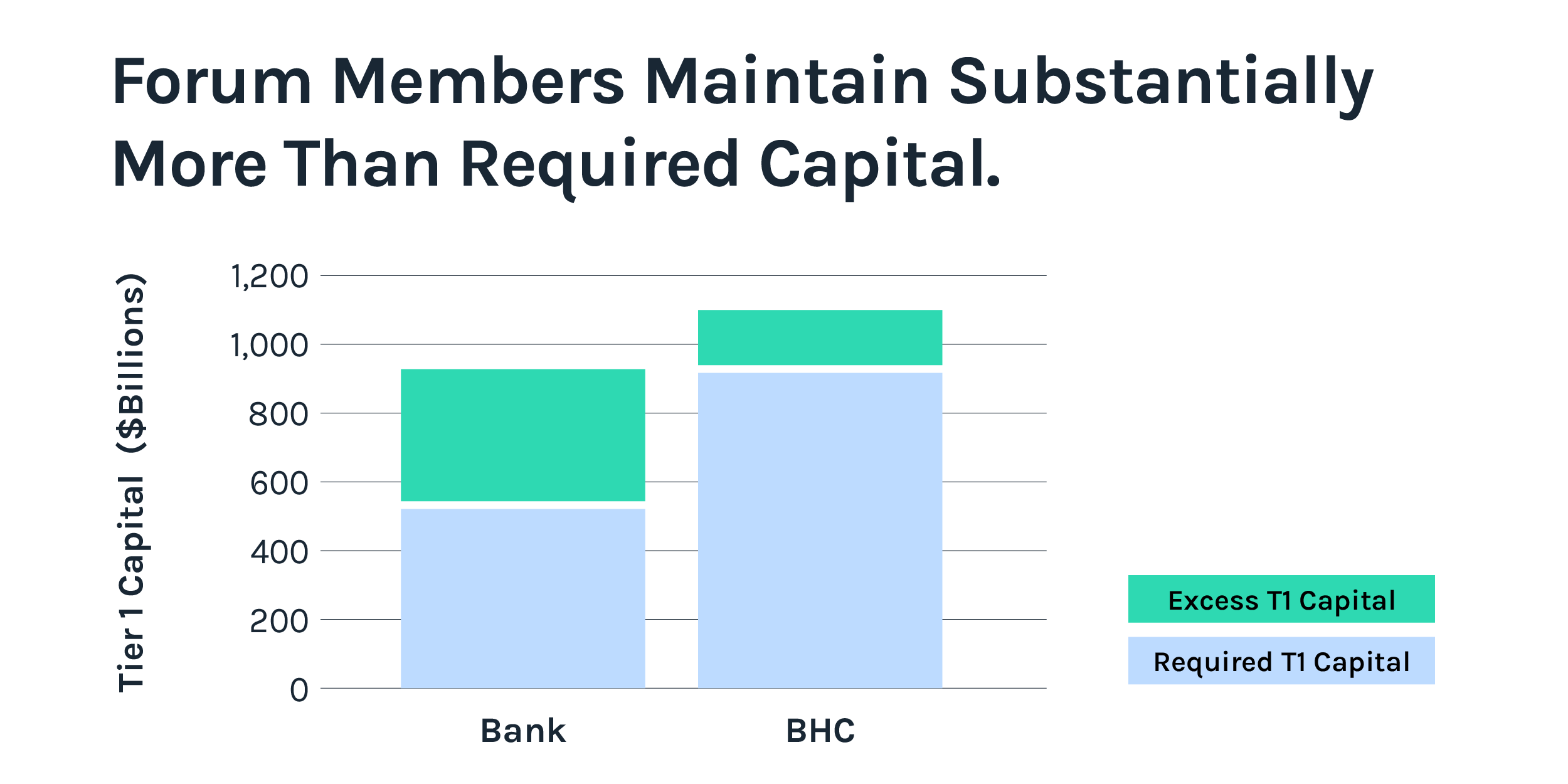

The chart below makes this clear: The Federal Reserve’s capital requirements at the holding company (BHC) level are significantly more stringent than those for bank subsidiaries, and Forum members already hold hundreds of billions more than required at both levels.

As a result, any changes at the subsidiary-level would not have a material impact on bank capital.

Checking the Balance

Members in the News

Bank of America announced a new initiative to expand access to soccer by investing in six soccer parks across the U.S., in partnership with Street Soccer USA and Visa. The first two opened this summer in San Francisco and Denver, with parks in Kansas City, New York City, Nashville, and Atlanta set to open over the next few months.

BNY was selected by OpenEden, a leading platform for the tokenization of Real-World Assets, to provide investment management and custody services for its Tokenized U.S. Treasury Bills Fund.

In the latest episode of the Citi Institute Podcast, Hon. Caroline Pham, Acting Chairman of the CFTC, and Ronit Ghose, Global Head of Future of Finance at Citi Institute, explore how the digital financial ecosystem is evolving.

As part of Goldman Sachs’ efforts to deploy capital to help unlock economic growth across New York City, the firm committed nearly $170 million to finance an affordable housing development in Brooklyn that will serve low-income and formerly homeless New Yorkers. Goldman Sachs also broke ground on the second phase of an affordable housing development in Coney Island, New York, which is expected to deliver 420 new residences.

JPMorganChase wrapped up its Southern Swing bus tour, covering vibrant communities in Mississippi, Alabama, Georgia, South Carolina, and North Carolina.

Morgan Stanley opened applications for its Finance Academy, a virtual five-month career development program for current high school seniors across the United States. Through skill-building sessions, mentorship, and exposure to professionals across Morgan Stanley, students will gain insight into finance careers and how to prepare for success in the industry.

State Street partnered with UC Investments to launch a “super app” that gives students, alumni, and retirement participants access to professional investment tools and new opportunities to build wealth.

The Wells Fargo Foundation announced a $1 million philanthropic investment for entrepreneurs in rural and tribal communities in South Dakota, which will be shared equally by Akiptan, a Native-led Community Development Financial Institution, and GROW South Dakota, a statewide economic development organization.